Bitcoin provide information: cost-basis bands, miner stress, and ETF move alerts

Bitcoin is at the moment buying and selling outdoors a $93,000–$110,000 cost-basis band that Glassnode frames as an “overhead provide” zone.

That setup places the subsequent quarter’s provide story on miner money move and holder habits somewhat than the issuance schedule. Based on Glassnode’s Week On-chain W02 2026, the Quick-Time period Holder (STH) value foundation sits close to $98,300.

That stage usually turns into a reference level for whether or not latest consumers add publicity or distribute into rebounds.

On the identical time, mining markets are pricing a lean profitability regime.

The Hashrate Index roundup dated Jan. 26, 2026 put the six-month hashprice ahead curve at about $33.25 per PH/s per day (about 0.00041 BTC), under the zone it has described as breakeven for a lot of miners ($39.50) relying on working prices and machine varieties.

Associated CryptoSlate context: miner-stress narratives usually hinge on the identical profitability/issue loop described in Bitcoin’s hashrate continues to fall as the value spike doesn’t persuade miners to show machines again on.

This quarter’s extra variable is whether or not ETF flows act as a sink for tradable provide or a launch valve.

SoSoValue information recorded $681 million in internet outflows from spot Bitcoin ETFs within the first full buying and selling week of 2026, in a risk-off setup tied to charge expectations and macro headlines. Final week, internet flows reached -$1.3 billion, the worst week since Could 2025.

For extra CryptoSlate reporting context on that very same early-2026 move regime, see Bitcoin breaking $126,000 has clear 3 yr pathway however a brutal $1.3 billion exodus adjustments all the pieces in the present day.

Key takeaways

- Bitcoin’s issuance schedule is mounted by the protocol, with a 21 million cap and reward halvings each 210,000 blocks. Close to-term “provide shocks” have a tendency to come back from tradable float and incentives, in accordance with Blockchain.com’s provide chart.

- Glassnode locations present overhead provide between $93,000 and $110,000, with the STH value foundation round $98,300. That vary turns into a demand-absorption check for the quarter, in accordance with Glassnode W02 2026.

- Hashrate and issue already adjusted to emphasize, with the 7-day SMA hashrate transferring from 1,003 EH/s to 966 EH/s and issue falling 3.28% to 141.67T on Jan. 22, in accordance with Hashrate Index (Jan. 26, 2026). For background, see Bitcoin hashrate hits new excessive of 943 EH/s as issue adjusted down 0.45%.

- Mining forwards implying roughly $39.50/PH/s/day over six months retains consideration on miner treasury administration and shutdown threat. “Breakeven” depends upon opex and fleet effectivity, in accordance with Hashrate Index.

- ETF move route stays a swing issue after such a horrible month to start out the yr, with $1 billion in internet outflows.

Who that is for

- Lengthy-term allocators monitoring cohort provide, cost-basis bands, and maturation dynamics

- Swing merchants targeted on the STH value foundation and overhead provide reactions

- Institutional desks monitoring ETF move regimes and miner-driven liquidity

- Mining and infra operators managing hashprice publicity and issue timing

What to look at this quarter

- Worth habits across the STH value foundation close to $98,300 and regaining its place contained in the $93,000–$110,000 overhead band (Glassnode W02 2026)

- Six-month hashprice expectations recovering to close $39.50/PH/s/day and spot hashprice divergence from the curve (Hashrate Index)

- Issue adjustment cadence following the Jan. 22, 3.28% drop to 141.67T (Hashrate Index).

- Venue move combine, together with Glassnode’s observe that Binance and mixture change flows shifted into buy-dominant regimes whereas Coinbase promote stress eased (Glassnode W02 2026)

- Weekly spot Bitcoin ETF internet flows after $1.3 billion outflows final week.

Issuance fundamentals + halving (what’s mounted vs what’s variable)

Bitcoin’s whole provide path is deterministic on the protocol layer, with a most of 21 million BTC and block-subsidy halvings each 210,000 blocks.

That constraint issues for long-horizon valuation and for quarter-to-quarter issuance math. New provide enters on a schedule the market can mannequin.

The extra fast query for the subsequent quarter is market-available provide.

Meaning the stock that may attain spot venues by means of miner gross sales, holder distribution, and ETF creations or redemptions. That is the place “provide shocks” usually kind, because the issuance curve is understood whereas liquidity selections are conditional.

Most quarter-scale volatility maps to the second.

Miner economics & promote stress (why hashprice is the stay provide lever)

Mining acts as an elastic provide lever as a result of miner BTC gross sales are one of many few structural sources of recurring distribution.

That elasticity was seen in late January. Hashrate Index reported the 7-day SMA hashrate fell from 1,003 EH/s to 966 EH/s, and community issue adjusted down 3.28% to 141.67T on Jan. 22.

Ahead markets additionally suggest constrained miner margins.

The identical roundup reported the hashprice ahead curve pricing a mean of about $33.25 per PH/s per day over the subsequent six months. Hashrate Index has individually described $39–$40/PH/s/day as close to breakeven for a lot of miners, whereas stressing it varies by working prices and machine mannequin.

A forward-looking body for this quarter makes use of three conditional paths grounded in these information factors:

- Close to-breakeven grind: If hashprice recovers close to the forward-implied ~$33.25/PH/s/day, higher-cost fleets face tighter treasury circumstances.

- That may translate into periodic hashrate dips and episodic spot promoting to fund operations, in accordance with Hashrate Index.

- Issue-driven aid: If hashrate weakens additional, subsequent issue reductions can elevate income per unit hash even with flat BTC value.

- That reduces compelled promoting on the margin, because the Jan. 22 adjustment illustrates.

- Macro-driven compression: If a broader risk-off transfer pressures BTC value whereas hashprice sits close to breakeven, shutdowns can speed up.

- That feeds the identical difficulty-relief loop with unsure timing.

Miner stability sheet coverage can shift realized promote stress inside 1 / 4.

Associated CryptoSlate miner-stress framing: Bitcoin faces potential miner capitulation as hash charge continues to drop.

Lengthy-term vs short-term holders (the place overhead provide really comes from)

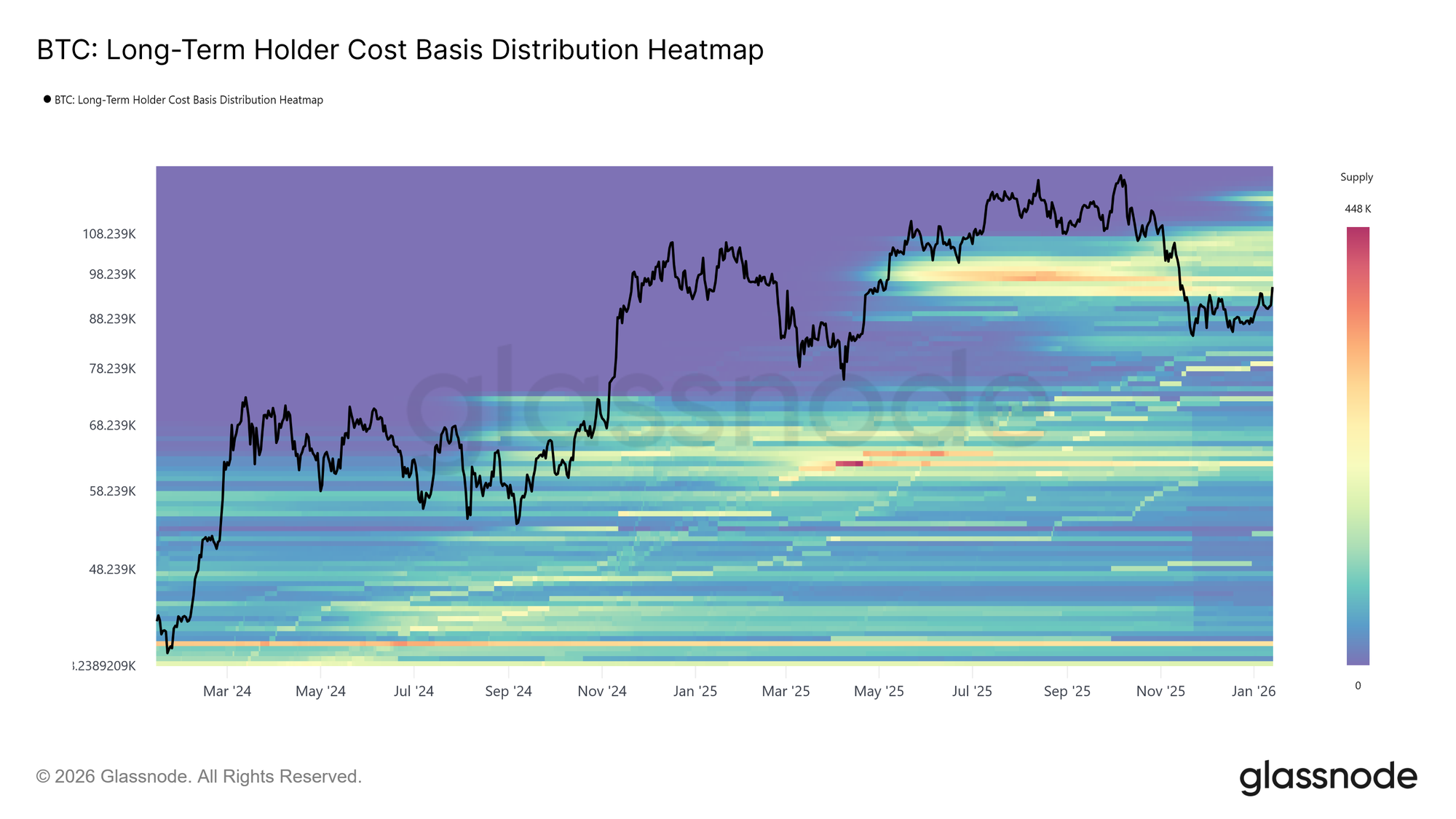

Glassnode’s present map frames the availability overhang as a cost-basis band somewhat than a single value.

In Week On-chain W02 2026, it described the market as testing provide spanning roughly $93,000–$110,000, whereas putting the STH value foundation at $98,300.

For this quarter, that framing issues as a result of it defines the place prior consumers could use rallies to exit.

It additionally defines the place new demand should soak up stock to keep away from renewed distribution.

Holder habits has softened versus late 2025 with out flipping into accumulation.

Glassnode mentioned Lengthy-Time period Holder (LTH) provide continues to development decrease, whereas the speed of decline slowed materially in contrast with the distribution seen all through Q3 and This fall 2025. It additionally put LTH internet realized revenue close to 12.8k BTC per week, down from cycle peaks above 100k BTC per week.

The regime-change situation Glassnode identifies for a extra sturdy rally is a shift the place maturation provide outpaces LTH spending.

That might push LTH provide greater. In quarter phrases, the overhead band can clear provided that promoting stress decelerates sooner than new and returning demand.

One technical caveat issues when readers examine dashboards.

Glassnode’s provide endpoints don’t deal with 155 days as a tough cutoff. Its cohorts use a logistic weighting centered at 155 days with a 10-day transition width.

Frequent myths (provide narratives that fail below measurement)

- Delusion: The halving creates fast shortage in tradable provide. Issuance adjustments are block-based and recognized, whereas quarter-scale provide stress is usually pushed by miner profitability and holder distribution selections.

- Delusion: 155 days is a strict boundary for LTH classification. Glassnode’s provide cohorts use a logistic weighting centered at 155 days with a 10-day transition width, which impacts interpretation close to inflection factors.

- Delusion: Miner capitulation is a single occasion. The hashrate and issue system can ratchet down after which normalize profitability per unit hash, as seen within the Jan. 22 issue discount following a hashrate decline.

Metrics dashboard (the minimal set to observe for the subsequent 6 months)

| Space | Metric | Present reference from sources | Why it issues this quarter | Supply |

|---|---|---|---|---|

| Protocol | Provide cap and halving cadence | 21M max provide, halving each 210,000 blocks | Anchors issuance math, shifts focus to tradable float | Blockchain.com |

| Mining | Hashrate (7-day SMA) | 1,003 EH/s to 966 EH/s (late Jan. 2026) | Shutdown threat and miner income stress proxy | Hashrate Index (Jan. 26, 2026) |

| Mining | Issue changes | -3.28% to 141.67T on Jan. 22, 2026 | Mechanical aid valve for miner margins | Hashrate Index (Jan. 26, 2026) |

| Mining | Hashprice ahead curve (6 months) | ~$33.25/PH/s/day | Frames treasury stress and forced-sell likelihood | Hashrate Index (Feb. 3, 2026) |

| Holders | Overhead provide band | ~$93k to $110k | Defines the place prior value foundation can convert rallies into promote move | Glassnode W02 2026 |

| Holders | STH value foundation | ~$98.3k | Confidence threshold for latest consumers close to overhead provide | Glassnode W02 2026 |

| Holders | LTH distribution pacing | ~12.8k BTC per week internet realized revenue, slower than prior peaks | Tracks whether or not distribution is fading or resuming into power | Glassnode W02 2026 |

| Liquidity | Venue move dominance | Binance and mixture flows buy-dominant, Coinbase promote stress eased | Absorption capability at overhead provide depends upon routing | Glassnode W02 2026 |

| ETFs | Weekly internet flows | -$1B in first month of 2026 | Internet outflows can return stock to the market by way of redemptions | SoSoValue by way of reporting |

Crimson flags & invalidation

- Any declare that change balances are “down X% lately” and not using a current-dated dataset needs to be handled as invalid.

- “Breakeven hashprice” ought to stay conditional on opex and {hardware}, since Hashrate Index frames $39–$40/PH/s/day as close to breakeven for a lot of miners relying on these inputs.

Motion guidelines, monitoring routine

- Weekly: Report ETF internet move signal and magnitude after the -$681 million outflow week, utilizing SoSoValue-linked reporting for comparability.

- Every issue epoch: Monitor whether or not issue continues to fall after Jan. 22’s 3.28% discount, and examine with hashrate route for miner stress context.

- Each day/rolling: Evaluate spot hashprice to the six-month ahead common close to $33.25/PH/s/day to gauge whether or not miners face tightening or aid.

- Regime examine: Monitor whether or not LTH provide stays internet declining or turns up below Glassnode’s “maturation exceeds spending” situation.

- Worth context: Observe market reactions round $98,300 and inside $93,000–$110,000, since these ranges map to STH and overhead provide value foundation within the present Glassnode framing.

These inputs needs to be tied again to the mounted Bitcoin issuance schedule.