- Kazakhstan now permits crypto change top-ups by way of financial institution QR funds

- The U.S. remains to be caught debating frameworks as a substitute of constructing rails

- Sooner integration overseas is popping warning into aggressive drag

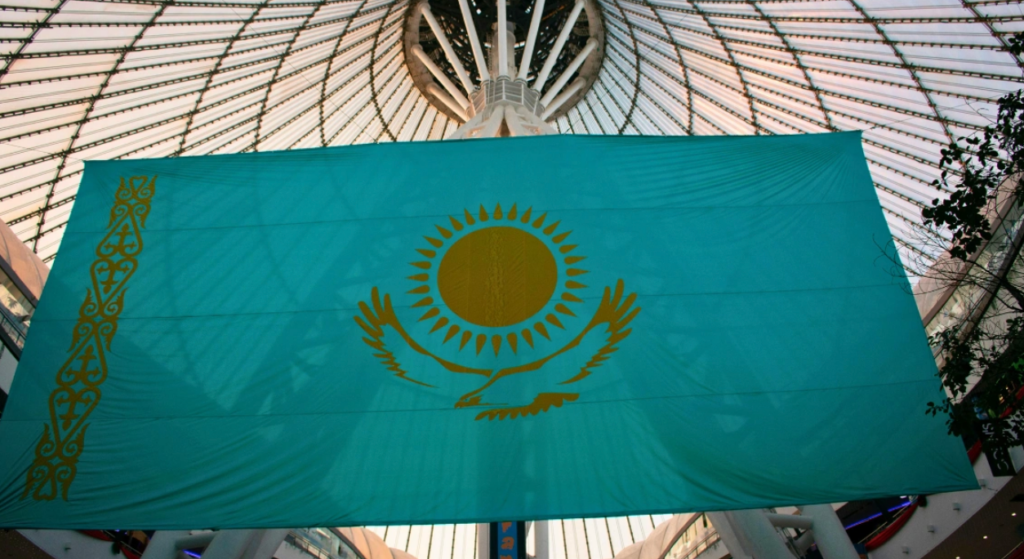

Kazakhstan has taken a quietly necessary step by permitting customers to high up crypto change accounts instantly via financial institution POS terminals utilizing QR codes. This isn’t a workaround or a loophole. It’s a regulated connection between banks, licensed exchanges, and monitored cost flows. Crypto buying and selling is being handled as an actual exercise that wants correct rails, not one thing to be tolerated on the edges.

The central financial institution’s place is pragmatic. Individuals already use crypto. The function of regulation is to convey that exercise into programs regulators can see, supervise, and progressively enhance. That is infrastructure-first considering, not ideology.

Regulation as an Enabler, Not a Freeze

Kazakhstan shouldn’t be opening the floodgates. Crypto funds stay restricted. Asset lists are curated. Limits and compliance checks apply. However the path is obvious. Entry is increasing whereas oversight tightens. Banks, cost corporations, and exchanges are all concerned in constructing one thing usable now, not ready for excellent legal guidelines later.

That is what regulated adoption appears like when execution issues greater than rhetoric. The rails get constructed whereas the rulebook continues to evolve.

Why the U.S. Is Falling Behind

The distinction with the USA is uncomfortable. Within the U.S., crypto integration via banks nonetheless feels defensive. Companies argue over jurisdiction. Banks hesitate. Lawmakers debate construction whereas customers depend on fragmented onramps. Management is mentioned endlessly, however implementation lags.

Kazakhstan isn’t attempting to win narratives. It’s fixing plumbing. And that distinction issues.

What This Alerts Going Ahead

Capital and customers don’t wait endlessly. Jurisdictions that combine crypto into on a regular basis banking will appeal to liquidity, builders, and relevance. People who stall will finally undertake options constructed elsewhere, on phrases they didn’t set.

Conclusion

Kazakhstan’s transfer isn’t flashy, nevertheless it’s significant. Whereas the U.S. debates management and principle, smaller markets are embedding crypto into day by day finance. If America desires to steer, it might want to shift from arguing to constructing. In any other case, catching up turns into the plan.

Disclaimer: BlockNews gives impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.