A extensively adopted crypto analyst believes the macroeconomic surroundings is beginning to shift in Bitcoin’s (BTC) favor.

Crypto dealer Michaël Van De Poppe tells his 818,600 followers on X that the enterprise cycle is choosing up pace.

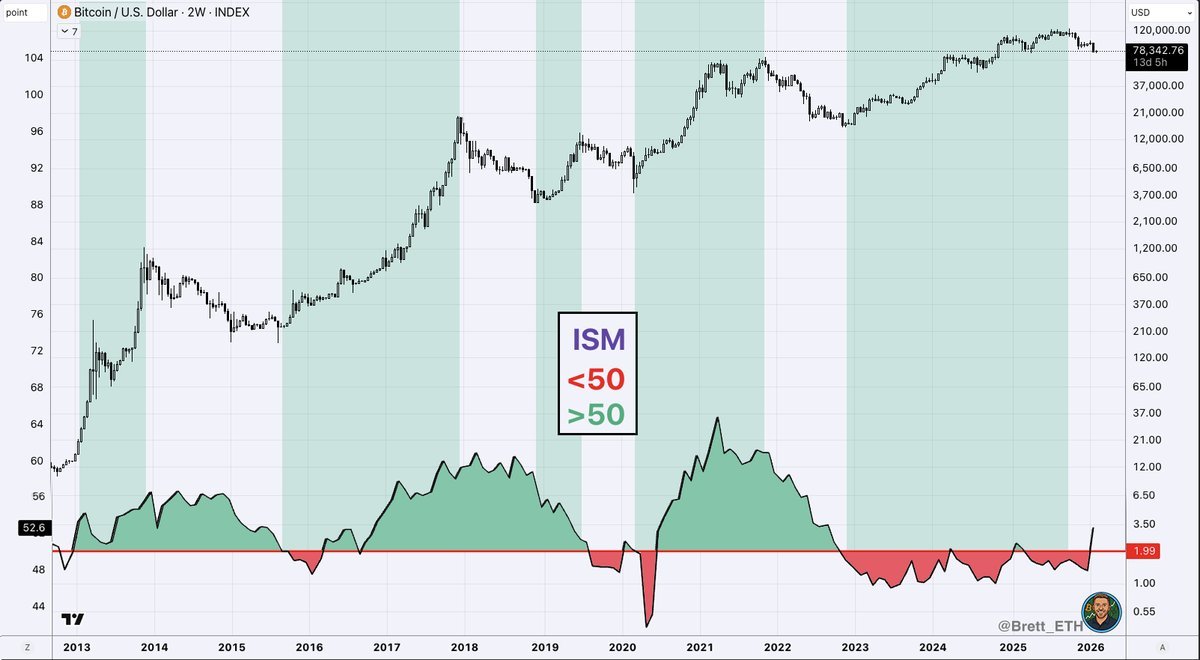

“It’s essential to be realizing that issues should be put into perspective. The ISM Manufacturing PMI [Purchasing Managers’ Index] is heading into the primary 50+ learn in additional than three years. It’s been one of many longest ‘bear’ markets on that regard. Not nice for the enterprise cycle, and never nice for Bitcoin. The truth that Bitcoin rallied is solely and solely as a result of launch and liquidity of the ETF [exchange-traded fund]. However now, simply now, is the second that the markets begin to get up.”

The query is whether or not the enterprise cycle is actually linked to Bitcoin’s worth.

“Now, there’s loads of debate on the truth that PMI stayed optimistic in earlier occasions and Bitcoin went right into a bear market. Sure, for positive, as a result of macroeconomic circumstances completely modified.

Final cycle: finish of 2021 the Fed determined to start out QT [quantitative tightening] and closely enhance rates of interest.

This time: QE [quantitative easing] has began as economic system is barely getting weaker and reduce of rate of interest.

There’s a purpose why gold and silver peaked final week and that’s as a result of truth of the top of this macroeconomic time frame. Within the coming one to a few years, we’ll see a powerful, and remaining bull on Bitcoin and crypto.”

When requested to make clear what he means by “remaining,” Poppe stated he means the final bull run earlier than a depression-level financial calamity descends.

In the meantime, extensively adopted crypto analyst and dealer Benjamin Cowen tells his 1.1 million followers on X that the ISM shouldn’t be a dependable indicator for Bitcoin’s efficiency.

“One other instance of the ISM not being the perfect indicator for predicting BTC worth motion:

January 2019:

June 2019:

So on this case the ISM dropped over six months and the worth of BTC went up 4x.”

Bitcoin is buying and selling at $75,469 at time of writing, down 3.7% on the day.

Comply with us on X, Fb and Telegram

Do not Miss a Beat – Subscribe to get electronic mail alerts delivered on to your inbox

Test Worth Motion

Surf The Every day Hodl Combine

[adinserter block=”5″]

Disclaimer: Opinions expressed at The Every day Hodl will not be funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your individual threat, and any losses you could incur are your accountability. The Every day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Every day Hodl an funding advisor. Please be aware that The Every day Hodl participates in affiliate marketing online.

Generated Picture: Midjourney