- The Bitwise XRP ETF is buying and selling nicely under its launch worth

- SEC approval didn’t translate into sustained crypto upside

- Analysts now flag the ETF as a higher-risk institutional product

Bitwise Asset Administration, which oversees roughly $15 billion in belongings, grew to become the second institutional agency accredited by the US Securities and Trade Fee to launch an XRP ETF in November 2025. The milestone adopted Canary Capital’s debut earlier that month, which noticed about $58 million in first-day buying and selling quantity and set optimistic expectations for XRP-linked merchandise.

On the time, approval was framed as a possible turning level for XRP, with many anticipating institutional inflows to push costs greater. Greater than two months later, that optimism has cooled. As an alternative of strengthening in 2026, XRP has trended decrease, dragging the Bitwise ETF down with it.

Early Good points Gave Strategy to Losses

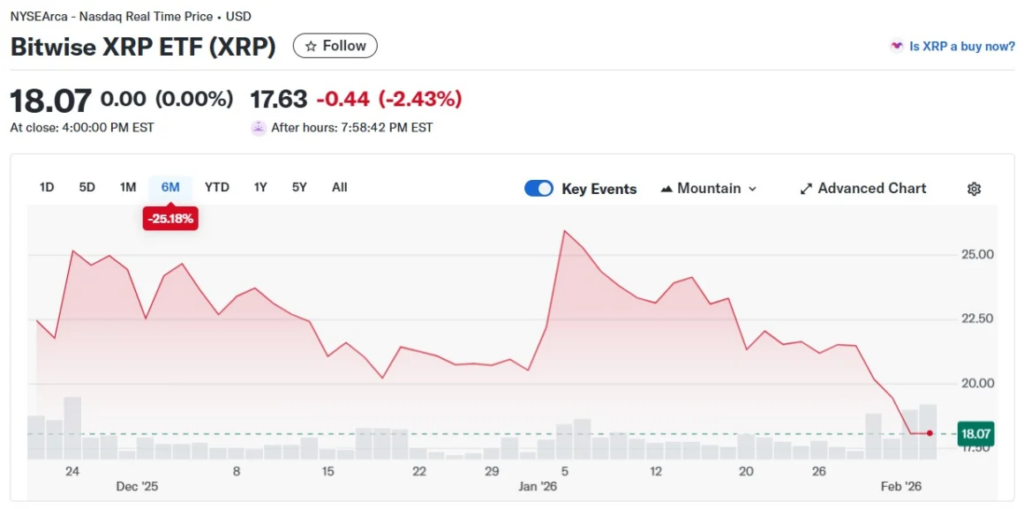

The Bitwise XRP ETF launched at $24.15 and climbed to a excessive of $26.88 shortly after going stay. Momentum didn’t final. As broader crypto sentiment weakened heading into 2026, the ETF started sliding alongside the underlying asset. Market uncertainty, rising commerce tensions, and tariff-related considerations added stress throughout danger belongings.

As of this week, the ETF is buying and selling close to $18.07, after briefly touching lows round $17.63. That decline has erased early positive factors and left buyers sitting on losses for the 12 months. The downturn mirrors wider stress in crypto ETFs, particularly after Bitcoin fell under the $75,000 stage and briefly pushed main funds, together with BlackRock-linked merchandise, into the purple.

ETF Publicity Isn’t the Similar as Holding XRP

Analysts have more and more described the Bitwise XRP ETF as a higher-risk instrument suited just for buyers with sturdy danger tolerance. In contrast to holding XRP instantly, ETF publicity introduces further volatility pushed by giant capital flows, fund mechanics, and institutional rebalancing.

That construction can amplify draw back in periods of weak sentiment. Giant inflows and outflows don’t at all times align with spot market conduct, which might result in sharper swings than many retail buyers count on. For some, that distinction solely turns into clear after losses seem.

A Reminder That Approval Isn’t a Worth Assure

The Bitwise XRP ETF serves as a reminder that regulatory approval alone doesn’t assure constructive worth motion. Whereas SEC clearance provides legitimacy, it doesn’t override macro stress, weak demand, or shifting danger urge for food.

For buyers, the lesson is pretty blunt. Crypto ETFs can provide entry and comfort, however in addition they include structural dangers that don’t exist when holding the asset instantly. As XRP struggles to regain momentum, warning, not hype, is doing a lot of the speaking.

Disclaimer: BlockNews offers unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.