Bhutan moved $22.4 million in Bitcoin out of sovereign wallets this week, together with a direct transaction to institutional market maker QCP Capital. The Himalayan nation’s crypto portfolio has dropped from a $1.4 billion peak to about $412 million.

The outflows proceed a sample of periodic liquidations by the Royal Authorities of Bhutan, which started mining and holding Bitcoin in 2019. These current transactions spotlight questions dealing with sovereign crypto methods amid ongoing market pressures.

Sponsored

Sponsored

Latest Bitcoin Gross sales and Transaction Patterns

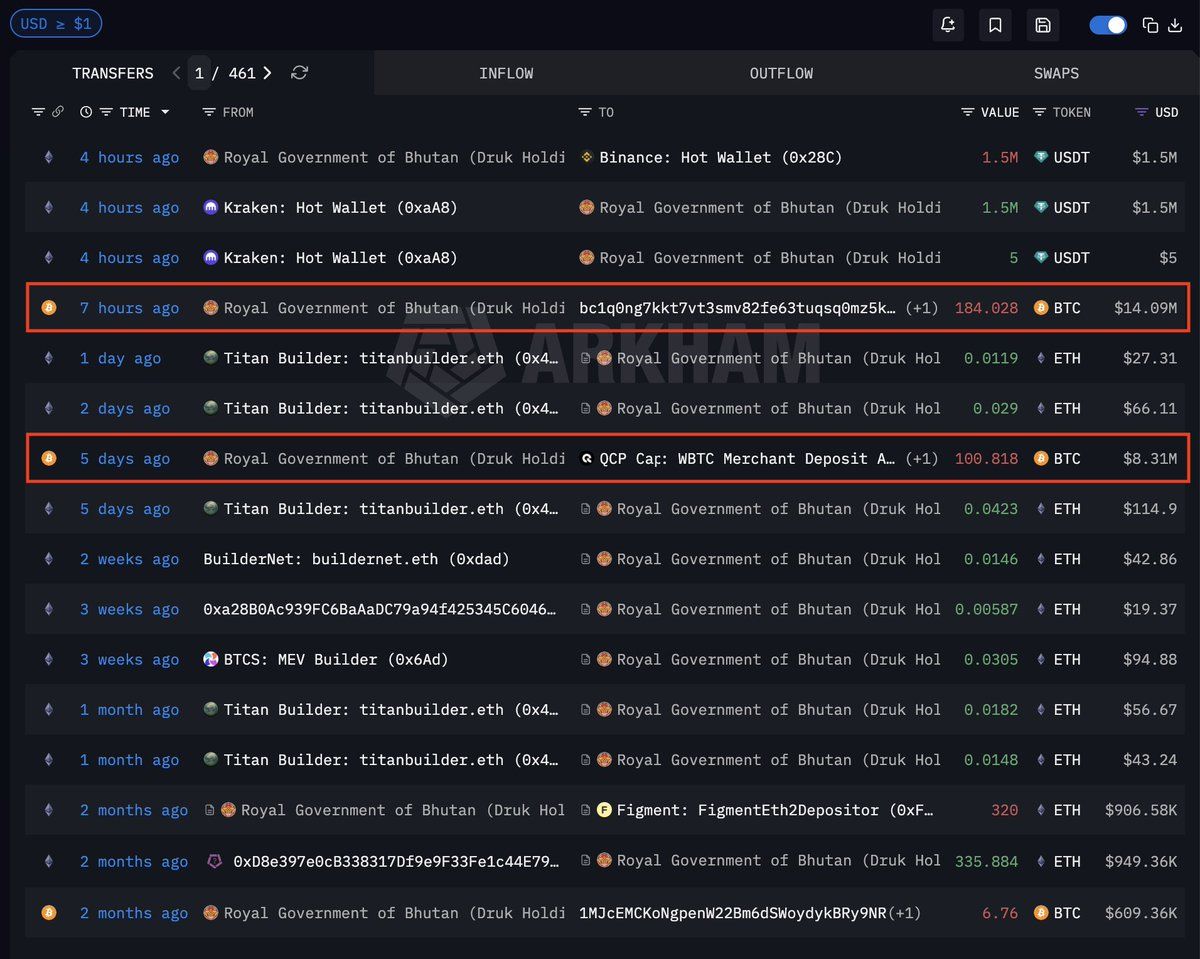

Blockchain analytics platform Arkham confirmed the Bitcoin gross sales. Two main outflows got here from Druk Holding Investments (DHI), Bhutan’s sovereign funding arm. The transactions included 184.03 BTC, price $14.09 million, and 100.82 BTC, valued at $8.31 million, 5 days earlier. The latter went on to labeled addresses tied to QCP Capital, a Singapore-based institutional market maker energetic in derivatives and spot markets.

In keeping with Arkham’s evaluation, Bhutan often sells Bitcoin in roughly $50 million tranches. Historic knowledge exhibits particularly heavy gross sales between mid and late September 2025, with a number of transactions surpassing $50 million every. The present $22.4 million in weekly outflows is smaller than previous gross sales, suggesting both extra measured liquidation or lowered holdings.

The QCP Capital transaction indicators a strategic liquidation fairly than distressed promoting. Market makers comparable to QCP allow massive block trades with out main market disruption. This enables sovereigns to exit positions whereas minimizing value impression, in contrast to direct alternate deposits which will set off sharper reactions.

Sponsored

Sponsored

Bhutan’s Bitcoin Mining Operation and Profitability

Bhutan’s Bitcoin technique started in 2019, with DHI launching a mining operation powered by the nation’s considerable hydroelectric sources. Arkham estimates that Bhutan has generated over $765 million in Bitcoin income since its inception, whereas whole power prices had been about $120 million. Hydropower has stored prices low in contrast with rivals that depend on fossil fuels.

The 2024 Bitcoin halving basically modified mining economics. This occasion, which happens about each 4 years, halves block rewards. The halving basically doubled the associated fee to mine one Bitcoin, making operations much less environment friendly. Information point out that Bhutan mined most of its holdings earlier than April 2024 after which sharply reduce manufacturing.

Pre-halving revenue margins enabled Bhutan to amass substantial holdings at favorable prices. Nonetheless, lowered effectivity after halving doubtless pushed the nation to monetize its reserves fairly than proceed energy-intensive mining at decrease returns. This strategic shift from accumulation to selective promoting mirrors a wider trade pattern as sector profitability compresses.

Portfolio Decline and Present Holdings

Bhutan’s cryptocurrency portfolio has skilled a dramatic contraction. Arkham Intelligence knowledge present DHI’s on-chain belongings at present whole about $412 million, down over 70% from the $1.4 billion peak. The portfolio consists largely of 5,700 BTC, with negligible holdings in Ethereum and different tokens.

The portfolio decline is because of ongoing gross sales and depreciation within the Bitcoin value. Some worth erosion got here from strategic liquidations for revenue or fiscal wants, however broader market situations throughout 2025 and early 2026 additionally contributed. Bhutan’s peak holdings aligned with Bitcoin’s value highs, amplifying the share drop as costs corrected.

Transaction historical past exhibits DHI’s fundamental alternate companions are Binance—which has $261 million in transferred worth, or 68% of exercise—and Celsius Community, with $118 million (31%). Smaller quantities moved by Kraken. These alternate interactions, mixed with direct transactions with market makers, present a classy strategy to treasury administration by Bhutan.

The Druk Holding and Investments entity manages these digital belongings together with conventional investments as a part of Bhutan’s broader diversification technique. The mixing of cryptocurrency into the sovereign treasury positions Bhutan amongst a choose group of countries concerned instantly in digital asset markets. Whether or not Bhutan’s continued liquidations point out a full exit or simply portfolio rebalancing stays an open query as observers monitor sovereign crypto adoption tendencies.