- Over 30% of Ethereum’s provide is now staked, lowering liquid ETH accessible for buying and selling

- Trade reserves have fallen to round 16.2 million ETH, easing fast promote strain

- Tightening liquidity can amplify future value strikes, however it could additionally improve volatility

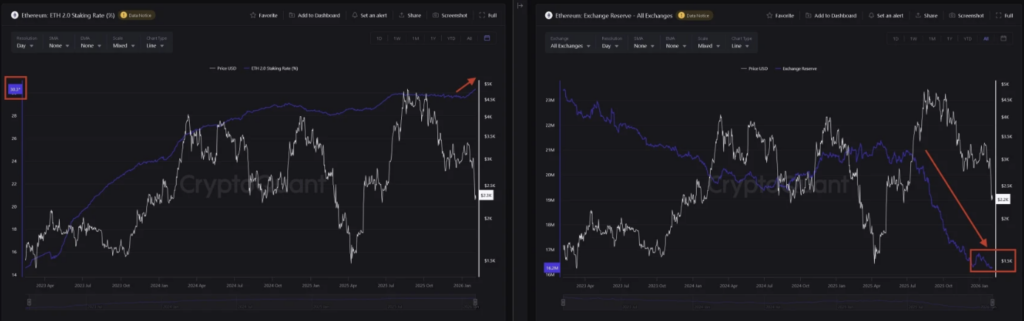

Liquidity motion on Ethereum is beginning to look totally different, and it’s not a small change both. Current blockchain analytics present that extra ETH is being staked whereas much less is being held on centralized exchanges, tightening the accessible provide that may be simply traded. Present estimates counsel over 30% of Ethereum’s complete provide is now staked, whereas change balances proceed to slip decrease.

This issues as a result of staking and change reserves often replicate how persons are positioned. When extra ETH is locked up in staking contracts, it turns into much less liquid, and when fewer cash sit on exchanges, there’s much less “ready-to-sell” stock. It doesn’t mechanically imply value will moon tomorrow, but it surely does change the market’s construction in a method merchants can’t actually ignore.

Staked ETH hits report ranges as conviction grows

On-chain information reveals roughly 30.3% of Ethereum’s provide is at the moment locked in staking contracts, marking an all-time excessive. That’s an enormous portion of ETH that’s successfully faraway from day-to-day buying and selling movement. Staked ETH isn’t freely tradable, and even when holders resolve to unstake, they nonetheless must undergo withdrawal and activation queue mechanics, which provides friction and time.

Analysts usually interpret rising staking participation as an indication of long-term conviction. It suggests holders are keen to commit ETH to the community and earn yield moderately than preserve it liquid for fast buying and selling. It additionally matches the broader development of buyers displaying extra curiosity in income-generating crypto property, particularly because the market matures and “yield” turns into an even bigger a part of the dialog once more.

Trade balances preserve falling, lowering sell-side strain

On the similar time staking has climbed, ETH held on centralized exchanges has dropped meaningfully. Present figures put change reserves round 16.2 million ETH, a degree decrease than what was seen over the previous few months. That decline is usually seen as constructive as a result of fewer cash sitting on exchanges sometimes means much less fast promoting strain.

When change balances fall, the tradable provide turns into tighter. In easy phrases, there’s much less ETH accessible for consumers and sellers to hit immediately, and that may make costs extra delicate when quantity picks up. Merchants usually watch change reserves as a liquidity indicator, as a result of they’ll trace at whether or not the market is gearing up for distribution or quietly shifting into longer-term holding conduct.

Tighter liquidity can amplify strikes, each up and down

The mix of rising staking and declining change balances factors to at least one factor: liquidity is tightening. When a bigger share of an asset is locked and the liquid float shrinks, the market can behave in a different way than it did when provide was extra freely accessible. For this reason analysts generally deal with these metrics as a part of an total “well being examine” for Ethereum.

Tight liquidity doesn’t assure greater costs, and anybody claiming it does is overselling the sign. However it might probably amplify value motion when demand returns. With fewer readily tradable tokens, even reasonable shopping for curiosity can have an even bigger impression, pushing value greater sooner than anticipated. The draw back is that the identical construction may also improve volatility throughout sharp sell-offs, as a result of liquidity dries up on either side.

What this development means for ETH buyers

For long-term Ethereum holders, this shift could also be seen as a basic optimistic. Excessive staking participation suggests confidence in Ethereum’s proof-of-stake mannequin and the long-term attraction of incomes yield. In the meantime, declining change inventories suggest that holders usually are not speeding to promote, which may help the concept provide is shifting into stronger arms.

That stated, liquidity construction is just one a part of the puzzle. Markets can keep irrational longer than metrics can keep bullish, and tight liquidity can generally create messy value swings in both route. Nonetheless, as Ethereum continues to lock up extra provide and scale back change stock, it’s constructing a market setup that would grow to be very reactive as soon as demand meaningfully returns.

Disclaimer: BlockNews supplies unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.