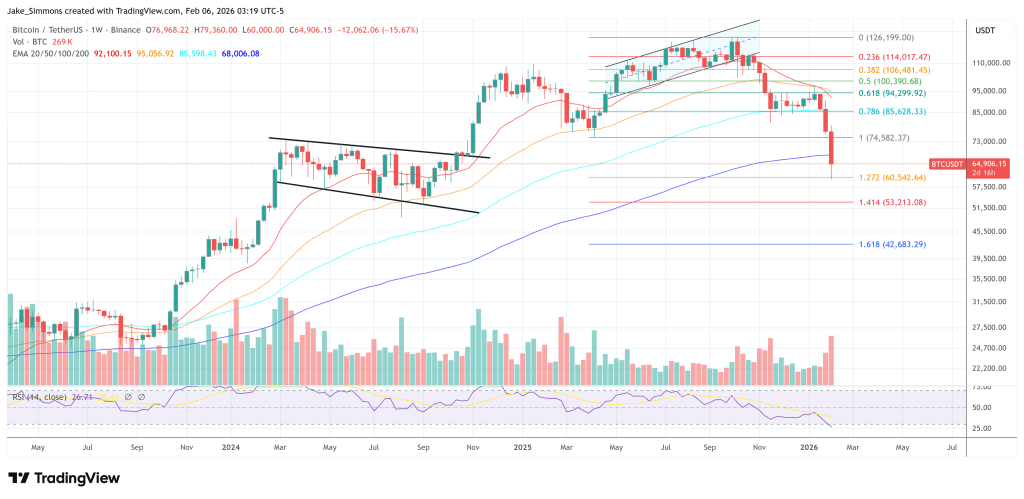

Bitcoin printed one of many largest ever day by day candles to the draw back on Thursday, sliding greater than 15%, roughly $10,800, in a transfer that rippled by means of derivatives, spot venues, and the US Bitcoin ETF advanced.

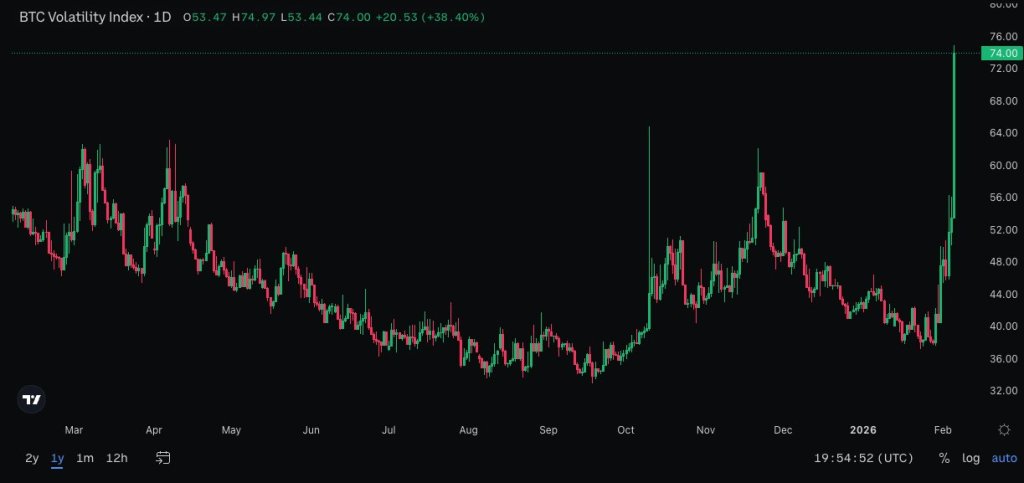

The dimensions of the drop is what made it stand out. Not simply the proportion drawdown, however the mixture of stress alerts hitting without delay: implied volatility spiking, volumes exploding, and momentum gauges collapsing into ranges usually related to compelled promoting fairly than discretionary danger discount.

Bitcoin Crash Sparks Capitulation Indicators

Actual Imaginative and prescient’s Jamie Coutts framed the session as a “capitulation watch,” pointing to a cluster of metrics hardly ever seen collectively. He highlighted Bitcoin implied volatility through BVIV at 88.55, “closing in on the FTX-collapse peak of 105,” and famous Coinbase logged its eighth-largest buying and selling day ever by USD worth, with $3.34 billion altering arms—roughly 54,000 BTC at ~$62,000.

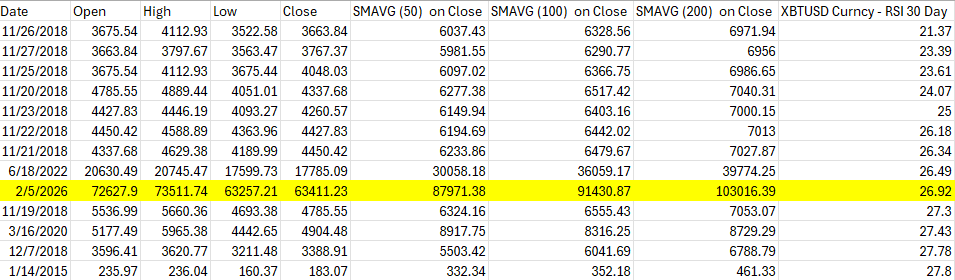

Coutts additionally underscored how excessive the momentum reset seemed on day by day charts, citing a day by day RSI of 15.64, “at or beneath March 2020 COVID crash lows.” He added: “Margin calls are firing. Pressured liquidations are doubtless nonetheless working by means of the system. This has the signature of a capitulation occasion, however capitulation could be a course of, not a single candle (until we get a large wick!). These circumstances can persist for weeks and even months earlier than a sturdy low types.”

Macro dealer Alex Krüger stopped wanting a value goal for the lows, however argued the market was registering the type of positioning and pricing distortions that are likely to cluster round turning cut-off dates.

“Pals I actually have no idea the place the bitcoin backside is however I can acknowledge excessive circumstances that you just solely see near bottoms in time, resembling excessive damaging funding, choices skew at ranges solely seen as soon as earlier than since 2022 (FTX day), and volumes & liquidations at extraordinary ranges,” he wrote. “You even have some monster shorts that opened between 64k and 60k, materials for a brief squeeze sending value to 68k, and if we see so then everybody will begin speaking in regards to the backside.”

Krüger’s caveat was simply as direct: “Within the meantime after all equities want to carry. And having a backside in doesn’t imply that you will notice a significant pattern from right here.”

Galaxy’s Alex Thorn described the tape as traditionally stretched on RSI measures, saying bitcoin was “essentially the most oversold at present than any day since 3AC blew up in June 2022 (30d RSI),” and calling it “principally within the high 3 oversold occasions ever,” alongside November 2018 and June 2022.

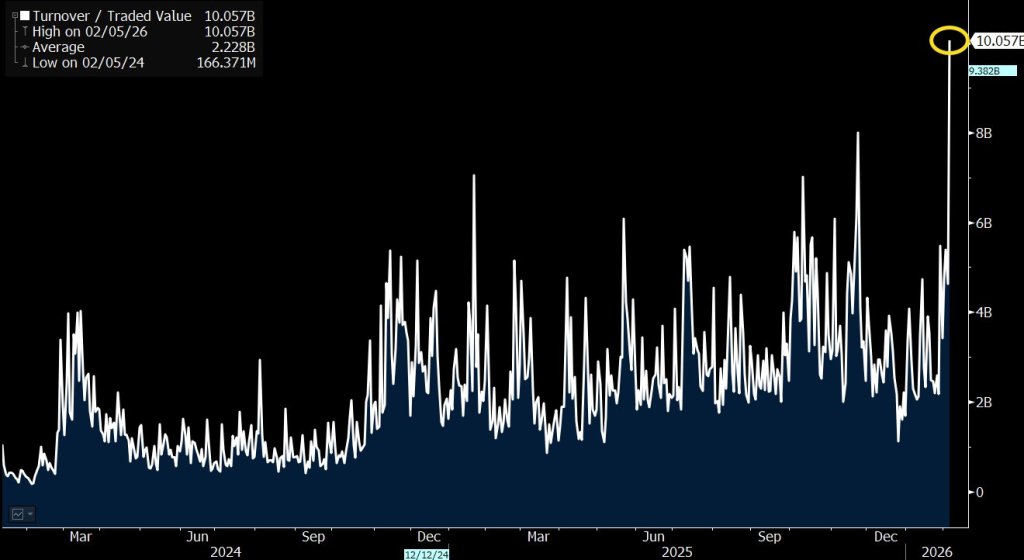

The US spot Bitcoin ETF market didn’t cushion the transfer, it amplified the day’s exercise. Bloomberg Intelligence’s Eric Balchunas stated BlackRock’s iShares Bitcoin Belief (IBIT) “simply crushed its day by day quantity report with $10b price of shares traded” because the fund’s value fell 13%, its second-worst day by day drop since launch.

Head of Analysis for Anchorage Digital David Lawant added that IBIT alone buying and selling above $10 billion was the best since launch, beating prior data by 69% in shares and 27% in USD quantity.

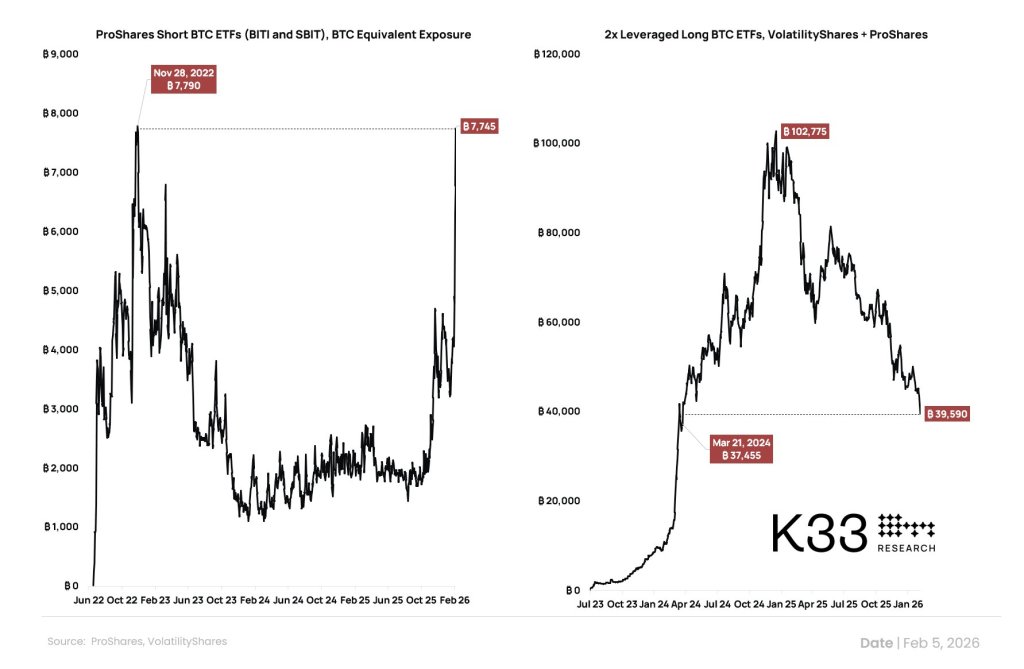

Positioning information hinted at a posh, two-sided ETF ecosystem. Head of Analysis at K33 Analysis Vetle Lunde famous web equal brief publicity in brief BTC ETFs was nearing the November 2022 peak at 7,745 BTC, whereas 2x leveraged lengthy BTC ETFs—merchandise that didn’t exist then—at present maintain 39,590 BTC, “at ranges not seen since Mar 24.”

Volatility remained the throughline. ProCap CIO Jeff Park stated: “Bitcoin implied vol is now at 75%. That is the best degree for the reason that ETF launch in 2024. Additionally it is lastly larger than gold volatility. Understand it’s loads of ache proper now, however that is all a part of the method required for Bitcoin to make new highs. The soften up will probably be quick.”

At press time, BTC rebounded from $60,000 to roughly $64,900, a acquire of about 9% from the session low.