- MARA transferred 1,318 BTC to Galaxy Digital, Two Prime, and BitGo

- The transfer comes as mining and crypto-linked shares dump sharply

- MARA stays the second-largest company Bitcoin holder after Technique

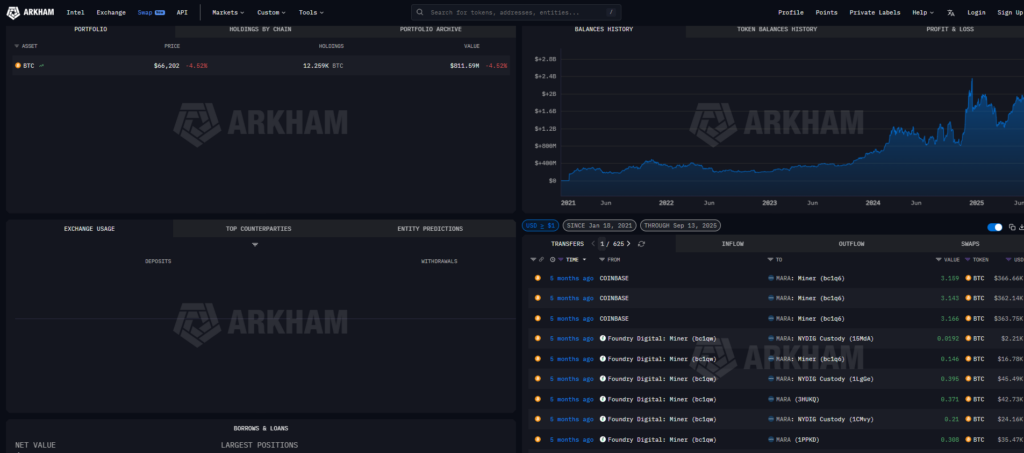

MARA Holdings, the second-largest company holder of Bitcoin, transferred 1,318 BTC price roughly $87 million on Thursday, in response to on-chain knowledge tracked by Arkham Intelligence. The BTC was despatched to Galaxy Digital, Two Prime, and BitGo, three names usually related to custody, execution, and institutional crypto providers. In a peaceful market, this may look routine. On this market, every little thing will get learn as a sign.

The timing is what’s making merchants listen. Bitcoin has been underneath heavy stress and crypto-linked equities have been promoting off aggressively. When a big miner strikes cash throughout a drawdown, the market naturally asks the uncomfortable query first: is that this treasury administration, or is that this a prelude to promoting.

MARA’s Bitcoin Treasury Is Huge by Public Firm Requirements

MARA ended Q3 2025 holding 52,850 BTC, valued round $3 billion on the time, after mining and retaining 2,144 BTC throughout that quarter. That places the corporate in a uncommon class. Amongst public companies, MARA trails solely Technique, which holds 713,502 BTC on its stability sheet, a niche so massive it nearly seems like a unique asset class.

As a result of MARA is a miner, its Bitcoin place is usually seen otherwise than Technique’s. Miners have operational prices, they must handle money stream, and so they typically transfer cash merely to remain liquid. However in a fragile market, nuance tends to get drowned out by worry, even when the transfer is impartial.

Mining Shares Are Taking the Hit First

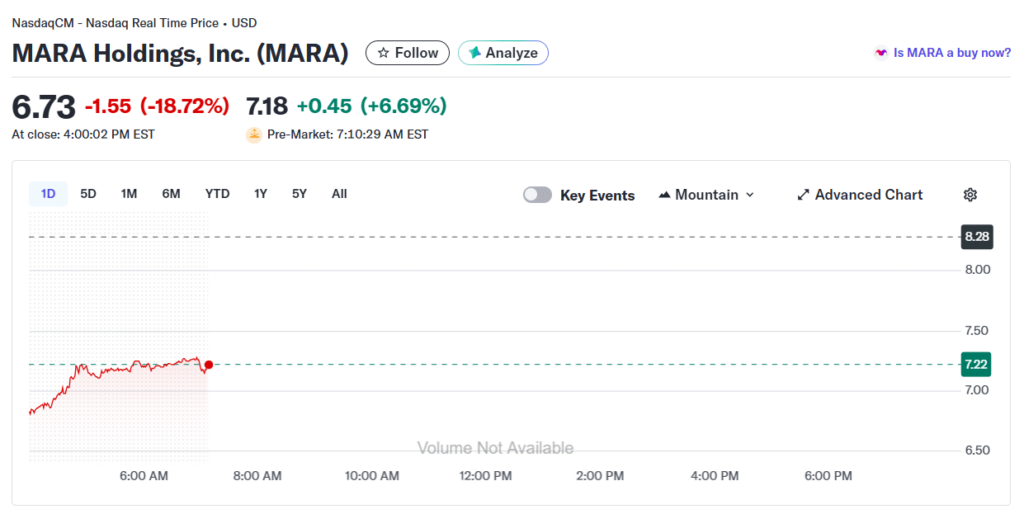

MARA shares fell practically 19% on Thursday, pushing year-to-date losses to roughly 25% as crypto market stress continues to construct. The inventory ticked barely greater in premarket buying and selling Friday, recovering a few of the earlier day’s injury, however the broader tone stays ugly. Miners are normally the primary to get punished when Bitcoin breaks key ranges, as a result of their enterprise mannequin is each cyclical and extremely delicate to cost.

And it wasn’t simply MARA. Crypto-linked equities broadly offered off as traders lowered publicity to something tied to digital belongings. Technique’s MSTR fell about 17%, Coinbase dropped roughly 13%, Robinhood misplaced round 10%, and IREN slid about 11%. The selloff regarded much less like company-specific information and extra like a coordinated risk-off exit.

What the Switch May Imply, and What It Doesn’t

A switch to Galaxy Digital, Two Prime, and BitGo doesn’t routinely imply MARA is dumping Bitcoin. These companies can be utilized for custody, structured merchandise, collateral administration, or execution providers. Nonetheless, the market treats motion as potential intent, particularly when liquidity is skinny and worth motion is already unstable.

For now, the switch reads extra like positioning than panic. However on this setting, even routine treasury operations can turn out to be catalysts, as a result of merchants are already on edge. The larger sign is probably not the switch itself. It might be how rapidly the market is now reacting to something that smells like provide.

Disclaimer: BlockNews offers impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.