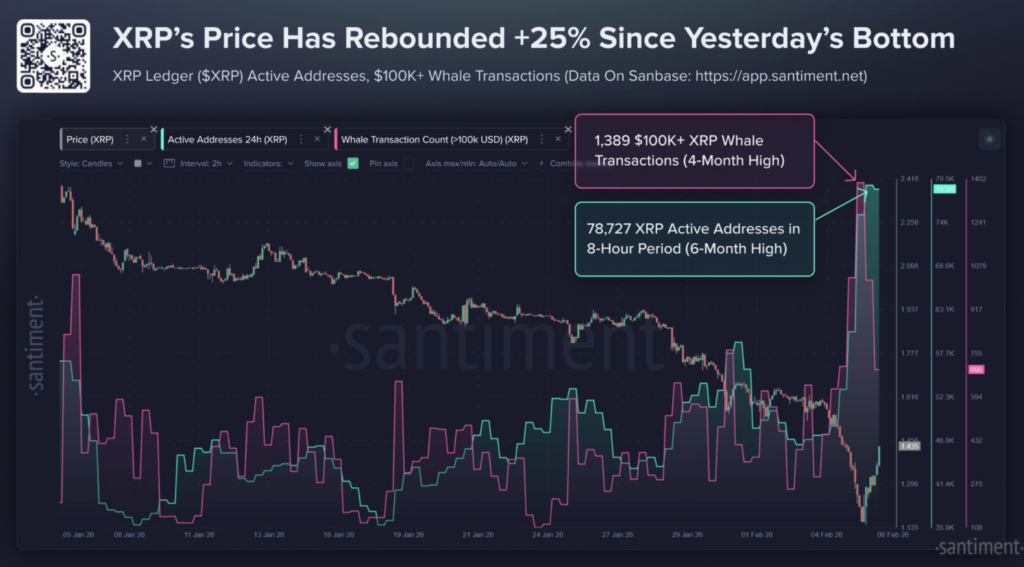

- XRP rebounded roughly 25% from the lows after dropping beneath $1.15 throughout peak market panic

- Whale transactions over $100K spiked to a four-month excessive, signaling aggressive accumulation

- XRPL energetic addresses hit a six-month report, confirming heavy participation throughout the reversal

The previous couple of days have been a number of the ugliest crypto has seen in months. Bitcoin, Ethereum, and XRP all took brutal hits, with main belongings dropping round 15% in a single day as panic ripped by exchanges. Liquidations piled up, worry spiked, and a number of merchants did what they at all times do in these moments, they rushed for the exits.

However XRP is now doing one thing that caught the market off guard.

In keeping with a brand new report from Santiment, XRP’s sharp breakdown beneath key psychological ranges might have been the precise second whales had been ready for. As an alternative of constant to break down, XRP snapped again aggressively, climbing roughly 25% off the underside in lower than a day, making it one of many strongest recoveries amongst large-cap crypto belongings.

And the on-chain knowledge suggests this transfer wasn’t random luck or a “useless cat bounce.” One thing larger was taking place beneath.

Santiment says XRP bounced 25% from the lows in 18 hours

Santiment highlighted that XRP bottomed beneath $1.15 lower than a day in the past, proper in the course of peak market panic. At that second, sentiment was breaking down quick, and merchants had been brazenly questioning whether or not XRP might slide beneath $1.00.

Then the market flipped.

Inside roughly 18 hours, XRP surged again above $1.50, forcing a number of panic sellers to observe the bounce with out them. Santiment described the transfer as “a very big tear,” noting that even in a broader market rebound, XRP’s restoration stood out.

The takeaway is fairly easy, even when it’s uncomfortable for anybody who offered the lows: the sell-off might have been pushed by worry, however whales had been treating it like a possibility.

Whale accumulation spiked to a four-month excessive throughout the dip

One of many strongest alerts in Santiment’s knowledge was the sudden explosion in whale exercise. Through the sell-off, the XRP Ledger recorded 1,389 separate transactions value $100,000 or extra. That’s the best whale transaction depend in 4 months, and the timing is the half that basically issues.

It occurred exactly when retail merchants had been panic-selling.

That is the basic footprint of smart-money habits. Massive holders are likely to accumulate when liquidity is excessive and weaker fingers are exiting, as a result of it lets them construct positions with out chasing value. Santiment’s chart suggests the XRP dip wasn’t only a crash, it was additionally a serious accumulation window taking place in actual time.

XRP energetic addresses hit a six-month report in a single burst

Much more hanging than whale transfers was the spike in community participation. Santiment reported that distinctive energetic addresses on XRPL surged to 78,727 in a single 8-hour candle, marking the best exercise stage in six months.

On the chart, it exhibits up as a pointy vertical transfer, principally a participation explosion. And while you see that type of tackle progress throughout a sell-off, it normally means certainly one of two issues.

Both the market is getting flooded with speculative curiosity as a result of volatility is insane, or large-scale accumulation and repositioning is going down as merchants rotate again in. Typically it’s each. Both manner, it confirms the identical level: XRP’s dip was closely traded, closely watched, and never ignored.

Panic promoting and whale shopping for created a textbook reversal setup

Santiment’s commentary makes the dynamic clear. Retail merchants had been centered on worry, asking the standard questions: is XRP going beneath $1, is the crash getting worse, ought to I exit earlier than the following leg down. In the meantime, whales had been doing the alternative, stepping in throughout the precise window when panic was peaking.

That distinction is what makes this rebound really feel completely different. Traditionally, robust reversals usually start when retail capitulates, on-chain exercise spikes, giant holders step in, and value rebounds sharply off the lows. XRP might have checked each a type of containers in a single day, which isn’t widespread.

It’s additionally why the bounce felt so violent. When promoting exhausts and purchase stress hits on the identical time, value doesn’t get better slowly. It snaps.

What this might sign subsequent for XRP

Santiment emphasised that each whale accumulation and energetic tackle surges are main reversal alerts for any asset. That doesn’t imply XRP is assured to maneuver straight up from right here, as a result of crypto by no means strikes that cleanly. Nevertheless it does counsel the market might have reached an vital inflection level.

After one of many harshest multi-day drawdowns in latest reminiscence, XRP’s bounce now has on-chain affirmation behind it, not simply value motion. If whale demand continues and broader market situations stabilize, XRP might enter a brand new restoration section quicker than many merchants anticipated, and possibly quicker than they’re prepared for.

Disclaimer: BlockNews gives unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.