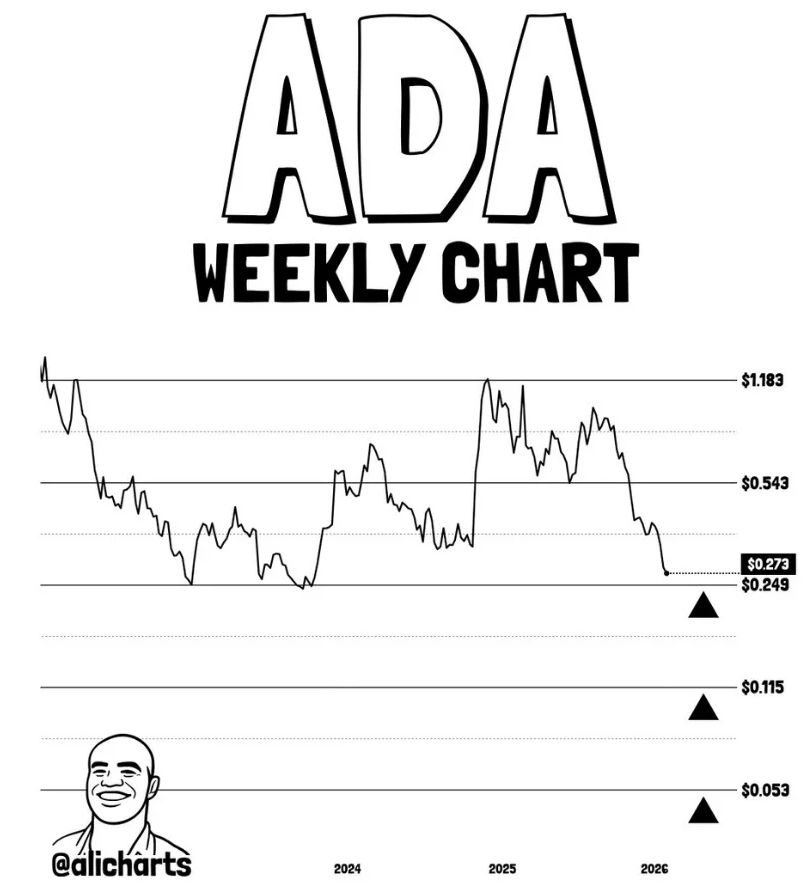

- Cardano is buying and selling close to $0.25–$0.27, a significant assist zone from prior bear market lows

- Weekly RSI is deeply oversold, suggesting draw back momentum could start compressing

- A weekly shut beneath $0.24 dangers opening a transfer towards $0.115 and doubtlessly $0.053

Cardano is again at a type of ranges that merchants keep in mind, even when they don’t wish to. After a protracted downtrend and repeated failures to reclaim greater resistance zones, ADA is now buying and selling across the $0.25 to $0.27 space, in accordance with Courageous New Coin pricing. This zone isn’t simply one other random quantity on the chart both. It traces up with ranges that marked the depth of the final bear market, which is why the market is watching it so carefully.

At this level, Cardano value motion is much less about momentum and extra about location. ADA has drifted again right into a traditionally vital assist area, and when an asset returns to those sorts of ranges, the following transfer tends to matter greater than ordinary. It’s the place longer-term individuals both step in, or step away.

Weekly chart exhibits multi-year trendline assist below stress

On the weekly timeframe, ADA is urgent right into a multi-year trendline assist zone that traces again to the 2022 bear market lows. This assist sits broadly between $0.24 and $0.27, and value is at the moment hovering simply above it. That makes it a structurally vital choice space, not the type of zone you casually ignore.

An extended-term situation shared by Sssebi frames this area as a potential pivot if 2026 turns right into a extra constructive yr for crypto total. The chart doesn’t indicate speedy upside, however it does counsel that draw back momentum could start compressing, so long as ADA holds $0.24 on a weekly closing foundation. If it loses that degree, the chart opens up into a lot deeper historic helps, and people aren’t fairly.

Beneath the present band, the following main assist ranges are available round $0.115 and $0.053. These are ranges that have been highlighted throughout prior cycle lows, they usually signify what a real capitulation situation might appear like if the market breaks down additional.

Key Cardano assist ranges merchants are watching

A separate weekly chart shared by Ali Charts highlights three main assist zones that matter most from right here. The primary is $0.249, which is mainly the present space of interplay and speedy assist. If ADA can maintain right here, it retains the construction alive.

If that fails, the following historic demand zone sits round $0.115. And if the market enters a deeper washout, the intense draw back assist degree close to $0.053 comes into focus, which ties again to prior cycle capitulation.

The repeated retests round $0.25 additionally carry a warning. Help zones are likely to weaken the extra they’re examined. Every bounce can take away consumers from the extent, and finally the ground stops being a flooring. That’s why this area feels so tense proper now, it’s vital, however it’s additionally been used up.

Weekly RSI turns deeply oversold, however reversals aren’t automated

Momentum indicators add one other layer. On the weekly chart, ADA’s RSI has slipped into deeply oversold territory, and a few analysts have famous that Cardano has not often been this oversold on a weekly foundation in its whole buying and selling historical past. That’s not a bullish sign by itself, however it does counsel promoting strain is changing into much less environment friendly.

Oversold situations don’t assure a reversal. Markets can keep oversold longer than individuals anticipate, particularly in risk-off environments. However traditionally, these sorts of readings usually line up with intervals the place draw back follow-through begins weakening. Even when value doesn’t rally instantly, the market could shift right into a slower base-building section as an alternative of continuous straight down.

Sentiment stays fragile as risk-reward begins to shift

Even with the technical significance of this zone, sentiment round ADA continues to be shaky. Quantity has tapered off, participation is down, and danger urge for food throughout altcoins stays selective. On this surroundings, false indicators are widespread, and lengthy consolidations can drag on longer than anybody desires.

That stated, Cardano is now not buying and selling in technical no-man’s land. From a structural perspective, ADA is sitting at ranges the place longer-term individuals normally reassess draw back danger quite than chase weak point. It’s a zone that naturally attracts consideration, not as a result of it ensures upside, however as a result of the risk-reward profile adjustments.

The place Cardano goes subsequent is dependent upon one degree

Cardano’s value outlook now revolves round whether or not the $0.25 to $0.27 zone can maintain. If it does, ADA might stabilize and start constructing a base, with any restoration try possible needing to reclaim $0.32 to $0.35 first. Above that, heavier resistance sits close to $0.54, the place prior vary provide stays.

If ADA breaks down and closes beneath $0.24 on the weekly chart, the construction weakens materially. In that case, focus shifts towards $0.115, adopted by the deeper cycle assist close to $0.053. It’s a easy setup, however not a simple one, as a result of the market is sitting proper on the fringe of a long-term choice level.

Disclaimer: BlockNews supplies unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.