- Solana fell to $85.73 after a 26% weekly drop, with quantity surging above $13B

- The break beneath $100 POC and the $128–$150 vary indicators a serious bearish construction shift

- Regardless of the sell-off, Solana’s RWA ecosystem surpassed $1B and added immediate redemption instruments

Solana slipped to $85.73 on Friday, February 6, 2026, extending a brutal weekly decline of roughly 26.5%, in keeping with CoinMarketCap information. What actually stood out wasn’t simply the worth drop, however the exercise behind it. Buying and selling quantity surged over 49% to round $13.34 billion, displaying that this transfer wasn’t taking place quietly. The market was lively, aggressive, and fairly emotional.

Technically, SOL additionally broke decisively beneath its January 2024 consolidation vary between $128 and $150. That breakdown issues as a result of it indicators a structural shift, not simply one other dip. When value loses a long-held vary like that, it typically takes time to rebuild, and the promoting strain tends to remain sticky.

SOL breaks beneath the $100 level of management

In a put up on X, analyst Umair Crypto identified that Solana’s fall beneath the $100 Level of Management triggered an approximate 27% sell-off. After that, value managed solely a small bounce earlier than drifting towards the $73 to $67 help zone. In accordance with Umair, the important thing element is the connection between value and quantity.

Value is pulling again whereas quantity expands, which often indicators draw back conviction moderately than a fast V-shaped restoration. That’s the sort of tape motion that makes merchants cautious. Even when SOL bounces, analysts warn that it might be corrective, not the beginning of a brand new uptrend.

From a technical standpoint, SOL is buying and selling effectively beneath key transferring averages throughout short-, medium-, and long-term timeframes, and people averages are sloping downward. That’s the definition of a pattern that’s nonetheless in management. The truth that the breakdown occurred on rising quantity additionally suggests institutional involvement, that means the latest decline could also be pushed extra by large-scale promoting than retail panic alone.

Oversold RSI doesn’t assure an actual bounce

Momentum indicators present SOL is now deeply oversold. RSI has dropped beneath 30, which may typically set off short-term aid rallies. However oversold circumstances don’t routinely imply the underside is in. In robust downtrends, RSI can keep pinned for longer than most merchants anticipate, and bounces typically get bought into.

Analysts be aware that volatility is more likely to stay elevated till SOL finds acceptance in new high-volume zones, notably round $73 and $57. These are the areas being watched as potential “reset” ranges the place the market would possibly lastly stabilize, or not less than pause.

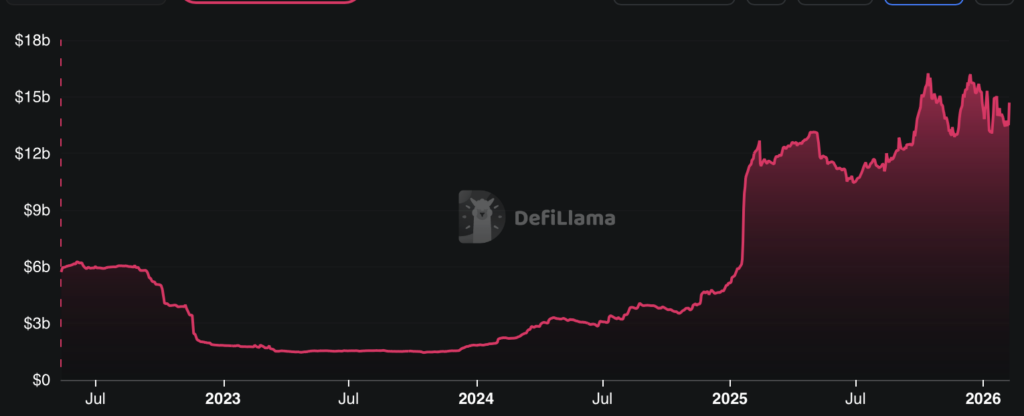

Solana’s RWA ecosystem retains increasing regardless of the sell-off

Apparently, whereas value motion has been ugly, Solana continues pushing ahead on the real-world asset facet. In accordance with a press launch, Multiliquid and Metalayer Ventures launched an immediate redemption facility for tokenized belongings on Solana. The objective is straightforward however vital: enable holders to transform tokenized positions into stablecoins 24/7, with out ready on sluggish liquidity home windows.

This tackles a serious bottleneck for establishments. One of many largest points with tokenized non-public credit score, fairness, and actual property is that exits are sometimes unpredictable. A redemption facility like this provides a cleaner path out, which makes all the market extra usable for critical capital.

The power, operated with help from Uniform Labs and the Multiliquid protocol, dynamically costs redemptions beneath web asset worth. That method prioritizes velocity whereas nonetheless compensating liquidity suppliers, which is principally the trade-off establishments care about most. Quick exits, predictable pricing, and no drama.

Solana’s RWA market has now surpassed $1 billion, together with tokenized belongings from issuers like VanEck, Janus Henderson, and Fasanara. Nick Ducoff, Head of Institutional Progress on the Solana Basis, emphasised that dependable redemption capability is important infrastructure for tokenized markets and strengthens Solana’s place as a hub for issuance, buying and selling, and exit options.

What merchants are watching subsequent

Proper now, SOL is caught in a troublesome spot. The chart is bearish, quantity is rising, and the breakdown beneath key ranges has modified the market construction. On the identical time, improvement on the RWA facet is transferring ahead, displaying that the ecosystem itself hasn’t stopped constructing, even whereas value bleeds.

Within the brief time period, the main focus stays on whether or not SOL can maintain and stabilize close to $73 to $67. If that zone fails, the following main space of curiosity sits nearer to $57. Till SOL builds a base once more, rallies could proceed to look extra like aid bounces than true recoveries.

Disclaimer: BlockNews offers impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.