- LINK dropped practically 13% in 24 hours, however buying and selling quantity surged 76% to $2B

- Spot LINK ETFs recorded $1.18M in inflows, signaling accumulation regardless of bearish sentiment

- $7.20 is now the important thing assist stage, with $5.85 as the subsequent draw back goal if it breaks

Chainlink has been getting hit like all the things else these days, however what’s attention-grabbing is how a lot consideration it’s pulling in whereas the chart seems ugly. Investor curiosity in LINK has surged over the previous few days, even because the broader crypto market flipped sharply risk-off and dragged most property decrease.

LINK hasn’t been spared. It’s misplaced a number of key assist ranges and at press time was down 12.75% over the previous 24 hours, buying and selling close to $8.01. However on the identical time, participation jumped laborious, with buying and selling quantity surging 76% to roughly $2.02 billion.

Usually, rising quantity throughout a value decline screams worry. It suggests merchants are leaning into the bearish development, not combating it. However while you zoom in on what traders are literally doing, the image will get a bit bizarre, and never in a foul manner.

ETF inflows counsel accumulation is occurring below the floor

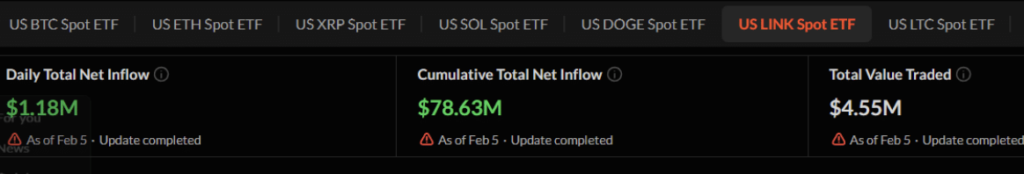

Whereas value was dumping, U.S. spot LINK ETFs quietly recorded recent inflows. On February 5, 2026, SoSoValue reported that spot Chainlink ETFs noticed $1.18 million in internet inflows. It’s not an enormous quantity in comparison with Bitcoin ETFs, positive, however the course issues greater than the dimensions.

In easy phrases, Wall Avenue traders had been including publicity to LINK whereas the market was bleeding. That’s not what you count on to see throughout a pointy drawdown, and it hints that some consumers are treating this drop as a price zone, not a purpose to run away.

This doesn’t assure a backside. However it does present that not everyone seems to be panicking.

Change reserves drop as LINK strikes off exchanges

On high of ETF exercise, alternate reserve information can be leaning towards accumulation. In accordance with CryptoQuant, Chainlink’s whole alternate reserves dropped over the previous 24 hours from 130,807,419 LINK to 130,270,399 LINK. That’s a decline of about 537,020 LINK, which isn’t small.

When alternate reserves fall, it usually means tokens are being moved off exchanges and into personal wallets. And often, individuals don’t withdraw cash as a result of they plan to promote them instantly. It’s usually an indication of longer-term positioning, or at the very least diminished promote strain within the brief run.

So whereas merchants are clearly promoting, there’s additionally a gradual undercurrent of consumers quietly taking provide off the market. That’s the type of divergence that tends to matter later.

LINK breaks a key long-term assist, however $7.20 is now the principle line

From a technical standpoint, LINK’s each day chart reveals that the latest decline broke beneath the long-standing $8.35 assist stage. This was a significant line that had held since October 2023, and shedding it shifts the construction bearish. When a assist like that breaks, it often flips into resistance, which means any bounce again towards it might get offered.

Through the drop, LINK additionally examined one other assist zone close to $7.20. This stage issues as a result of it beforehand acted as a protracted consolidation space earlier than LINK finally broke out above $8.35 again in 2023. In different phrases, $7.20 is not only “a stage,” it’s a traditionally confirmed demand zone.

If LINK can maintain above $7.20 and later reclaim $8.35, a reversal setup begins to kind. But when $7.20 fails, draw back momentum might lengthen additional, with analysts pointing towards a possible transfer all the way down to $5.85, roughly one other 20% decrease.

ADX reveals the development is robust, and that’s a warning

One purpose this transfer feels so aggressive is as a result of development power is elevated. The Common Directional Index, which measures how sturdy a development is, reached round 50.63. Something above 25 is taken into account sturdy, so 50+ suggests LINK is at present in a strong directional transfer.

The catch is that ADX doesn’t let you know whether or not the development is up or down, it simply tells you it’s sturdy. And proper now, the sturdy development is clearly bearish. That’s why even when LINK is oversold, rebounds can nonetheless be short-lived and uneven.

Derivatives merchants are leaning bearish, and the imbalance is evident

Within the derivatives market, intraday merchants look like following the development reasonably than betting in opposition to it. CoinGlass’ LINK Change Liquidation Map reveals heavy positioning round $7.91 on the draw back and $8.42 on the upside.

At these ranges, merchants have constructed roughly $1.44 million in leveraged lengthy positions versus about $4.32 million in leveraged shorts. That imbalance is fairly telling. It displays bearish sentiment and reveals that merchants are extra assured betting in opposition to LINK than making an attempt to front-run a bounce.

Chainlink is being offered, however it’s additionally being collected

In order that’s the state of affairs. LINK is below strain, key assist has been misplaced, and derivatives merchants are leaning bearish. However on the identical time, ETF inflows are optimistic and alternate reserves are dropping, suggesting accumulation is occurring beneath the chaos.

LINK isn’t out of hazard but. The $7.20 zone is the principle line within the sand. But when it holds, the present sell-off could find yourself wanting like a shakeout, not the beginning of a protracted collapse.

Disclaimer: BlockNews gives impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.