In short

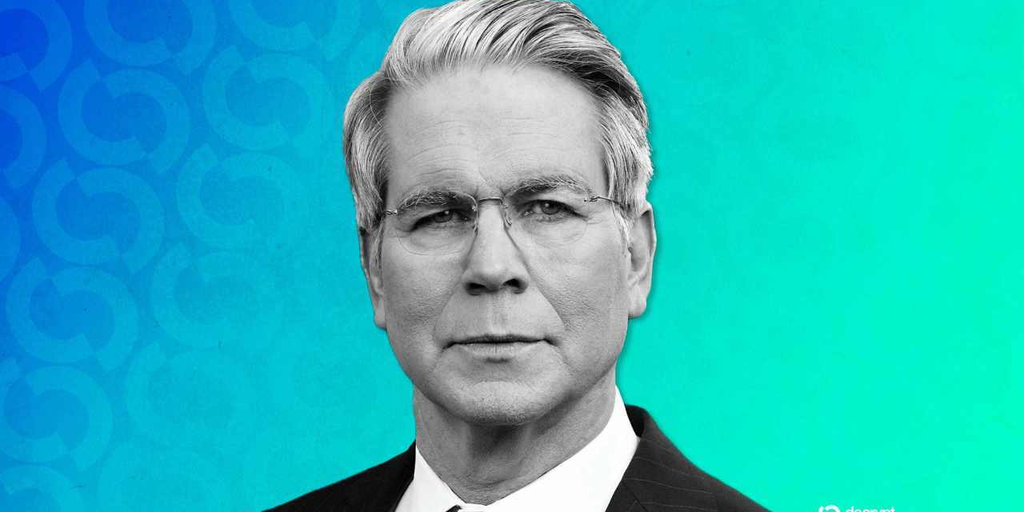

- Treasury Secretary Scott Bessent stated crypto companies opposing the Senate’s market construction invoice are nihilistic and delusional.

- His remarks observe Coinbase’s resolution final month to drag help for the invoice over its stablecoin yield provisions.

- At this time, Bessent appeared to echo the banking foyer’s considerations about stablecoin yield’s potential influence on deposit flight.

U.S. Treasury Secretary Scott Bessent issued stern phrases Thursday to crypto stakeholders who suppose they will dwell with out a market construction invoice, stating it’s “not possible to proceed” with regulating crypto in the USA if the laws doesn’t move Congress.

“There appears to be a nihilist group within the business who would like no regulation over this excellent regulation,” Bessent stated throughout testimony immediately earlier than the Senate Banking Committee.

“Now we have to get this Readability Act throughout the end line,” the Treasury Secretary added a couple of minutes later. “Any market members who don’t need it ought to transfer to El Salvador.”

Bessent’s feedback got here weeks after Coinbase, America’s prime crypto firm, abruptly pulled help for the invoice, derailing a key Senate Banking vote on the laws. Coinbase CEO Brian Armstrong stated on the time that the corporate would “quite haven’t any invoice than a nasty invoice.”

That remark was publicly rebuked by the White Home, which warned that if the crypto business believes will probably be in a position “to function indefinitely with out a complete regulatory framework,” such pondering quantities to “pure fantasy.”

Coinbase has since returned to negotiations on the invoice, however continues to insist the laws should permit for stablecoins—crypto tokens pegged to the worth of the greenback—to generate curiosity for holders. The banking foyer has furiously protested that ask, warning it might destabilize the U.S. banking system and result in deposit flight, significantly on the neighborhood financial institution stage.

Coinbase’s management has adamantly argued such fears are unfounded. However on Thursday, Bessent appeared to present some credence to the banking foyer’s worries, in response to a query from Sen. Cynthia Lummis (R-WY), one of many authors of the market construction invoice.

“I’ve been a champion of those small banks, and deposit volatility may be very undesirable,” the Treasury Secretary stated.

“It’s the steadiness of these deposits that permits them to lend into their communities, ag[riculture], small enterprise, actual property,” he continued. “We are going to proceed to work to verify there is no such thing as a deposit volatility related to this.”

At one other level in Thursday’s listening to, Sen. Mark Warner (D-VA), a key pro-crypto Democrat who has been negotiating the invoice’s finer factors for a number of months, expressed his exhaustion on the course of to the Treasury Secretary.

“I really feel like I’m in crypto hell,” Warner stated.

Bessent laughed on the remark, and appeared to virtually reply earlier than stopping himself.

Each day Debrief E-newsletter

Begin day-after-day with the highest information tales proper now, plus unique options, a podcast, movies and extra.