Bitcoin has entered a extremely delicate part after an aggressive draw back continuation. The latest sell-off has pushed it right into a traditionally reactive demand area of $60K, whereas broader threat sentiment stays fragile. The market is approaching a juncture the place technical construction, higher-timeframe demand, and on-chain liquidity dynamics converge, making the approaching periods crucial for short- to mid-term path.

Bitcoin Worth Evaluation: The Each day Chart

On the each day timeframe, Bitcoin has decisively damaged under its latest construction and continued to respect the descending channel, whereas the rejection from the center boundary of $75K confirms that sellers stay firmly in management. Crucial improvement is the impulsive breakdown towards the decrease boundary of the channel, the place the asset is now testing a significant demand zone on the $60K worth area that beforehand acted as a powerful consumers’ base earlier within the cycle.

This demand space, situated on the $60K area, is structurally important because it represents the final main consolidation earlier than the earlier impulsive enlargement. Whereas prior worth motion on the chart confirms this zone’s historic relevance, the present interplay is way extra aggressive, suggesting that any bullish response from this area would probably start as a corrective bounce somewhat than a right away pattern reversal.

So long as Bitcoin stays under the descending channel resistance and the 100- and 200-day shifting averages, the each day construction stays decisively bearish, with draw back continuation nonetheless a legitimate threat if demand fails to soak up promoting stress.

BTC/USDT 4-Hour Chart

Zooming into the 4-hour timeframe, the bearish construction turns into even clearer. The latest transfer exhibits a pointy sell-side enlargement into the present demand zone at $60K psychological assist, adopted by a minor reactive bounce, which to date lacks sturdy follow-through.

From a short-term perspective, the important thing stage to watch is the closest provide zone overhead on the $75K, shaped after the final impulsive breakdown. Any corrective rebound is more likely to face promoting stress as the value approaches this space, particularly if quantity and momentum stay weak.

So long as Bitcoin fails to reclaim and maintain above this provide area, rebounds must be handled as pullbacks inside a broader bearish pattern somewhat than affirmation of a pattern shift. A failure to carry the present demand zone would expose the value to a deeper draw back extension towards the channel’s decrease boundary of $55K.

Sentiment Evaluation

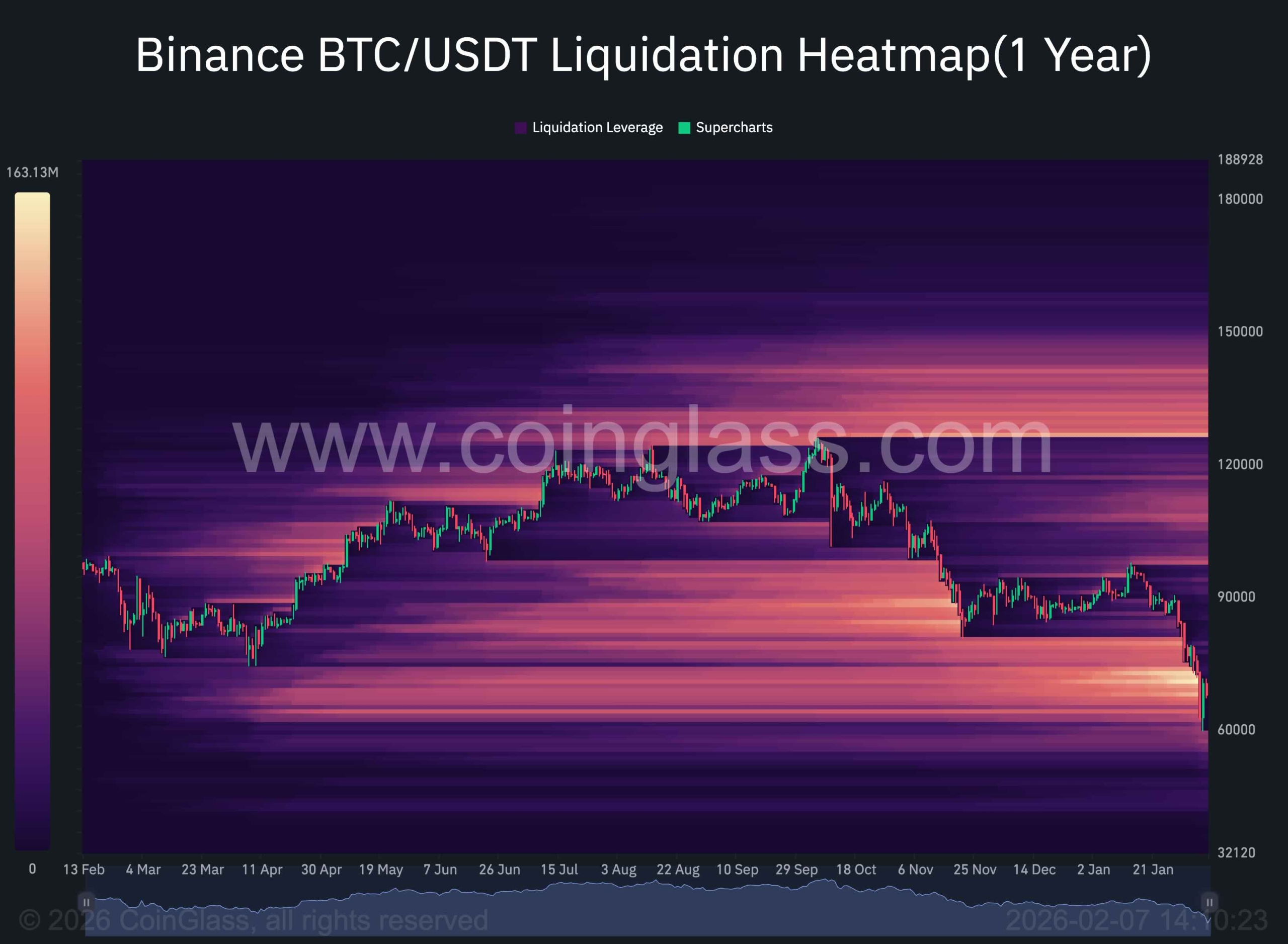

The liquidation heatmap offers useful context for the latest worth conduct. The one-year BTC/USDT liquidation heatmap exhibits a dense liquidity pocket concentrated round and barely under the $60K–$65K area, which aligns carefully with the present worth space. This clustering of liquidity means that this zone has been a magnet for worth, pushed by compelled liquidations of over-leveraged lengthy positions in the course of the latest sell-off.

Notably, as worth approaches this area, liquidation depth declines relative to present ranges, indicating {that a} substantial portion of draw back leverage has already been unwound. This dynamic will increase the chance of short-term stabilization or a reactive bounce, notably if aggressive sellers start to lose momentum.

Nevertheless, the absence of great liquidation clusters above present worth ranges implies that upside liquidity is proscribed within the brief time period, reinforcing the concept that any rebound is extra more likely to be corrective somewhat than trend-changing.

General, whereas the broader construction stays bearish, the convergence of sturdy historic demand and lowered draw back liquidation stress means that Bitcoin might try a aid transfer or consolidation part from this zone.

The publish Bitcoin Worth Prediction: Sub-$60K Subsequent for BTC or a Sturdy BTC Rebound? appeared first on CryptoPotato.