The Bitcoin market would undoubtedly backside if Michael Saylor’s Technique will get rekt, says Maksim Balashevich, founding father of the crypto sentiment platform Santiment.

“The most important bull catalyst would be the liquidation of Saylor,” Balashevich tells Journal.

“The bull catalyst is when every little thing is dangerous. So dangerous it can’t be even worse,” the Switzerland-based crypto entrepreneur says.

“It will likely be a remaining blow. Nevertheless it’s a bull sign; it’s the strongest. It’s like FTX crashing,” he says. When crypto change FTX collapsed in November 2022, Bitcoin dropped to round $15,500. By June, the worth had doubled to round $30,000. On the time, FTX’s disgraced founder Sam Bankman-Fried was seen because the poster boy for crypto.

Technique at present holds 771,992 Bitcoin, roughly 3.7% of the whole Bitcoin provide, and a few speculate that if market circumstances worsen and persist for lengthy sufficient, the corporate might be compelled to promote or scale back its holdings to fulfill liquidity and operational wants. Others level out that Technique’s debt matures between late 2027 and 2032, so it has loads of time but.

Balashevich is talking speculatively, and there aren’t any public indicators that Technique is planning to promote anytime quickly. “I’m unsure if it may even occur…however his shareholders [could] push him to promote one thing or transfer him out of the board,” Balashevich says.

We’re sick of profitable, President Trump

Balashevich says the present market decline started across the time of US President Donald Trump’s inauguration, which was broadly seen as a significant bullish catalyst for crypto.

“What could be higher for crypto? Yeah, and precisely on the time, it simply goes down,” he says.

Bitcoin jumped to $109,000 round Trump’s inauguration in January 2025. Its most up-to-date all-time excessive, reached 9 months later in October, was solely about 15% greater at $126,100, earlier than the market reversed, and the worth has since slid again to round $70,000.

Balashevich believes a significant fear-driven occasion would reassure traders {that a} market backside has shaped and doesn’t suppose costs are that removed from that time. “I imply, it already feels painful,” Balashevich says.

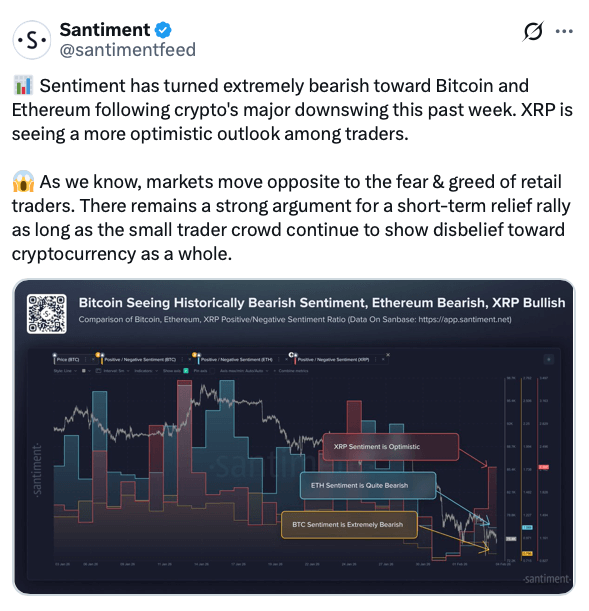

Santiment is legendary for noting how usually market sentiment foreshadows strikes in the wrong way.

Balashevich’s love for crypto sentiment

Balashevich is obsessive about how sentiment and psychology form crypto markets. In 2016, he based Santiment, a platform that tracks market temper throughout social media, together with X, Fb, Discord, and, till lately, Telegram.

“We briefly eliminated Telegram. It turned type of spammy. I don’t know what’s occurring, however there are some large influx of spam,” he says.

Earlier than launching the platform nearly a decade in the past, Balashevich would spend hours scanning on-line dialogue boards to gauge total market sentiment. He’d then flip his observations into experiences for his public following, relying totally on studying sufficient to get a intestine really feel for the development.

“After I learn one thing, I get the underlying intentions and feelings of debate,” he says.

Santiment now has a workforce of 42 full-time employees and skilled information engineers worldwide. Balashevich not spends hours combing by means of Reddit threads, as machine studying fashions now deal with the heavy lifting.

Learn additionally

Options

Korea to elevate company crypto ban, beware crypto mining HDs: Asia Specific

Options

Child boomers value $79T are lastly getting on board with Bitcoin

Regardless of the market maturing, with institutional curiosity and crypto exchange-traded funds (ETFs) launching worldwide, Balashevich nonetheless holds agency conviction that sentiment is an important indicator for crypto.

How does Santiment really work?

Many skeptics most likely look in any respect these flashy crypto sentiment instruments and surprise: Ought to I be utilizing social media trackers to make monetary selections?

“I’d put it this manner, it was, is, and at all times will likely be a very powerful,” he says.

Balashevich explains that Santiment collects information from a broad vary of crypto-focused social media accounts representing various market views, not simply bullish shillers, to supply a extra balanced view of sentiment.

“Possibly 9000 curated accounts,” he says, emphasizing that the listing is audited repeatedly.

“To construct within the sentiment, it needs to be huge information,” he says, including that there are “a whole lot of shifting elements.”

He explains that Santiment’s machine studying mannequin pulls in 1000’s of posts from numerous social media platforms and routinely tags them as “bullish,” “bearish,” or different classes. Behind the scenes, it does a bunch of advanced stuff most individuals don’t see, after which spits out a easy rating anybody can perceive.

“We gather a whole lot of messages, label them, cluster them, put them collectively, after which run different fashions to assign values, after which some statistical arithmetic, after which we construct the worth,” he says.

Learn additionally

Options

Lawmakers’ concern and doubt drives proposed crypto laws in US

Options

Ethereum is consuming the world — ‘You solely want one web’

Whereas Balashevich stresses the significance of sentiment, he emphasizes that it must be simply one in every of a number of indicators guiding market selections.

$250K ‘appears much less seemingly’ in 2026

Within the short-term, Balashevich thinks Bitcoin could be hovering round a brief backside.

He expects a short-term restoration to $92,000-$95,000, however warns that the rally might be interrupted by one other sell-off.

“A second wave may come to emerge, this sale, liquidation degree narrative,” he says.

Trying additional forward, Balashevich is skeptical of the possibilities of Bitcoin reaching $250,000 in 2026 and says it’s wanting “much less seemingly.”

Nevertheless, he says finally, it’s going to “almost definitely occur.”

“Simply give it time,” he says, including, “we simply don’t know when.”

Subscribe

Probably the most partaking reads in blockchain. Delivered as soon as a

week.

Ciaran Lyons

Ciaran Lyons is a Cointelegraph employees author protecting cryptocurrency markets and conducting interviews inside the digital asset business. He has a background in mainstream media and has beforehand labored in Australian broadcast journalism, together with roles in nationwide radio and tv. Previous to becoming a member of Cointelegraph, Lyons was concerned in media tasks throughout information, documentary, and leisure codecs. He holds Solana, Ski Masks Canine, and AI Rig Advanced above Cointelegraph’s disclosure threshold of $1,000.