In Seoul, crypto is loud and onerous to disregard. In Pyongyang, it strikes in silence, however its affect spreads far past the nation’s closed borders.

The 2 Koreas are among the many most influential nations in crypto immediately, however for reverse causes. South Korea drives markets by way of retail participation, tradition and politics.

In the meantime, its secretive neighbor up north extracts billions in crypto by way of cyber operations. Its state-backed hackers are main suspects in among the business’s most damaging incidents.

North Korea’s affect is invisible by design. Crypto is just not hypothesis or innovation within the communist dictatorship, however infrastructure that enables a sanctioned state to maneuver cash outdoors the standard monetary system.

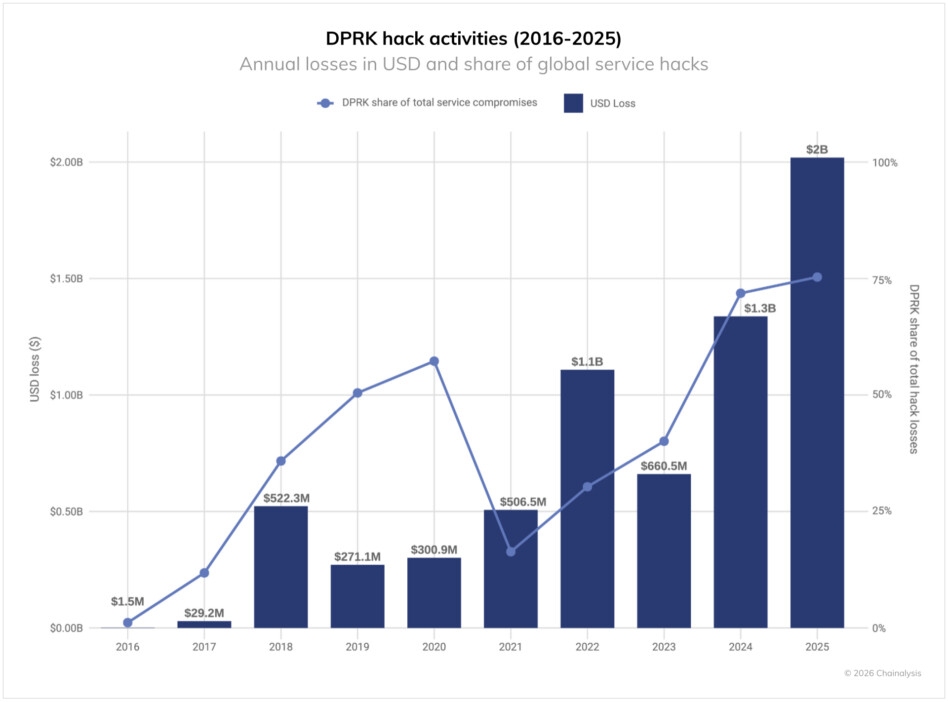

It was attributed to $2.02 billion in crypto theft final 12 months. Whereas the nation doesn’t publish official GDP figures, the United Nations estimates its 2023 GDP at round $15 billion-$17 billion, placing crypto theft at roughly 13.5% of the entire.

Crypto is the golden ticket for youthful professionals in South Korea

Crypto in South Korea unfold by way of habits that already existed. John Park, Arbitrum Basis’s head of Korea, traces the home business’s roots to the late Nineteen Nineties, when the nation grew to become one of many first to undertake nationwide high-speed web.

“Individuals realized to soak up info in a short time, and the web grew to become a supply of knowledge, neighborhood and tradition. That didn’t begin with crypto, however crypto suits neatly into that system,” Park tells Journal.

He argues that one other accelerant was a fascination with wealth. Cash sits excessive in South Korea’s hierarchy of values, and information of monetary success travels as quick as some other.

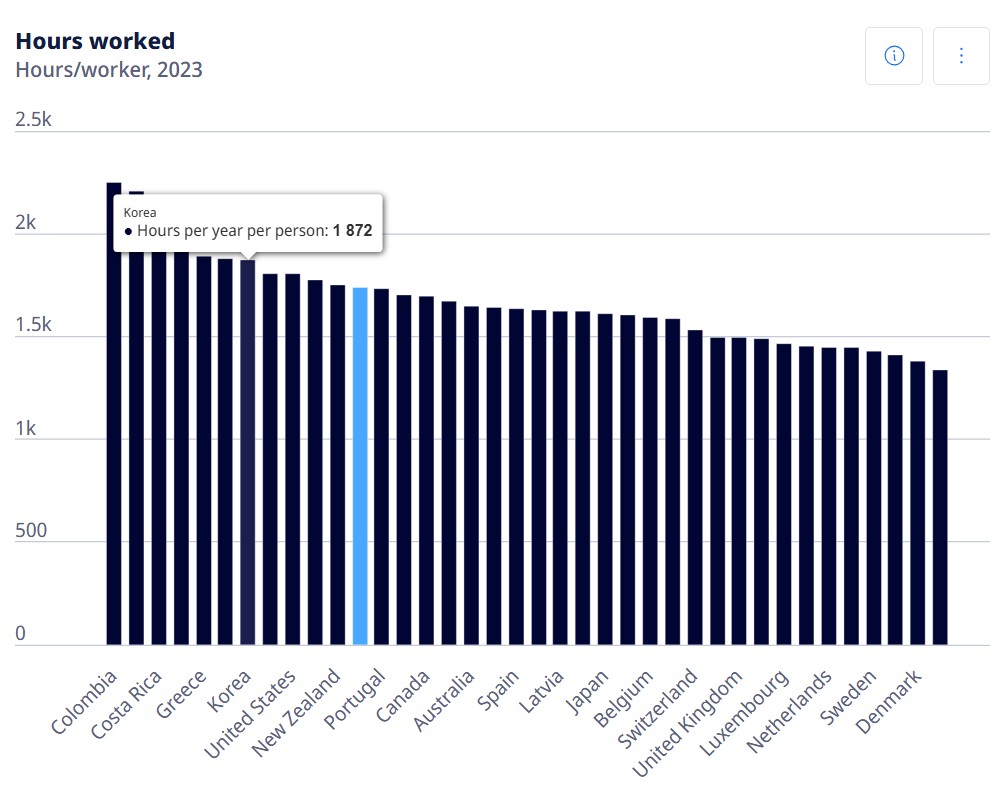

When mixed with the nation’s financial actuality of lengthy work hours, predictable profession paths and restricted upside, crypto began to appear to be a means out of the rat race.

What started as a speculative market grew to become an electoral precedence in 2022. Ex-president Yoon Suk Yeol gained the election after adopting crypto-friendly guarantees geared toward Gen Z and Millennial voters, together with help for metaverse growth, reversing the ICO ban and pursuing a complete crypto regulation.

Yoon’s presidency was minimize brief after a botched declaration of martial regulation, earlier than legislative talks might advance. The metaverse hype fizzled.

However within the subsequent snap election, crypto once more emerged as a key subject for courting youthful professionals amongst all main candidates, together with eventual president Lee Jae Myung. So, the native business would find yourself with a crypto-friendly administration no matter who gained.

Terra crashed, however Koreans survived the touchdown

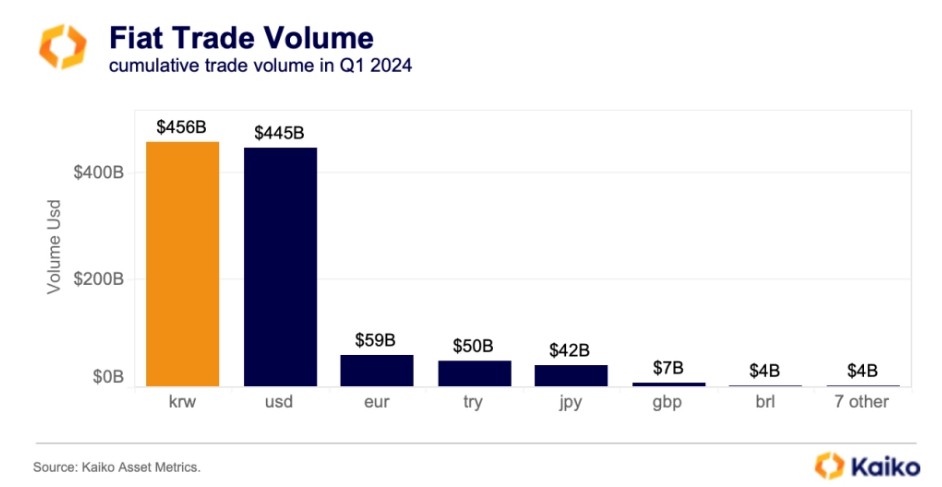

At this time, South Korea’s crypto affect reveals up in won-denominated buying and selling volumes that at instances rival or surpass the US greenback.

Park factors to the rise of Terraform Labs’ cryptocurrency Luna and its 2022 collapse as a turning level. It was based by South Korean nationwide Kwon Do-hyung (higher referred to as Do Kwon), who was lately sentenced to fifteen years in jail after pleading responsible to US fraud costs.

“Earlier than it failed, Luna was the delight of our neighborhood,” Park says. “It was the primary time folks checked out South Korea as a severe nation that would construct a world-class crypto product.”

Terra was certainly “world-class,” however for various causes than its supporters initially thought. The implosion of the Singapore-incorporated firm grew to become one of many principal shocks that led to cascading bankruptcies and a chronic crypto winter.

At dwelling, the incident was seen as a nationwide shame, and it accelerated coverage discussions. South Korea’s crypto person safety regulation took impact in 2024. Regulators are actually working towards a broader regulatory framework, although coordination between the federal government, central financial institution and business has slowed progress.

Nonetheless, retail enthusiasm and bettering regulatory readability have been sufficient to attract capital and expertise. Enterprise agency a16z, which described South Korea because the “second-largest crypto market,” lately opened its Asia-Pacific go-to-market workplace in Seoul.

Solana has constructed a Korea-focused ecosystem presence with native groups and structured neighborhood applications. Comparable dynamics are seen throughout different ecosystems, together with LayerZero, Aptos and Arbitrum, the latter of which is regionally led by Park. Hashed, one of many nation’s prime crypto backers, lately launched its personal blockchain for a won-backed stablecoin, a class that’s gaining traction amongst conventional finance conglomerates and banks.

Collectively, retail-dominated volumes, political sturdiness and a rising native presence have made South Korea a structurally essential crypto market even after Terra.

Learn additionally

Options

The Vitalik I do know: Dmitry Buterin

Options

Cryptocurrency buying and selling dependancy: What to look out for and the way it’s handled

The peninsula’s break up reappears in crypto

After Japan’s give up in World Warfare II, outdoors powers divided the Korean Peninsula. By 1948, two states aligned with opposing blocs of the Chilly Warfare — the north with the Soviet Union and the south with the US.

The Korean Warfare from 1950 to 1953 ended with no peace treaty. From that time on, the 2 Koreas developed underneath basically completely different constraints.

South Korea rebuilt by tying its survival to commerce, exports and international markets.

North Korea moved in the wrong way, and isolation grew to become a governing precept. Cash grew to become a vulnerability. Buying it, transferring it and concealing its origin become issues of the regime’s survival.

Crypto was not round when this division was created, however it’s nonetheless mirrored within the international markets.

“Crypto is infrastructure for North Korea,” Heechang Kang, chief technique officer of blockchain analysis firm 4 Pillars, tells Journal. “It lets a sanctioned state transfer cash with out banks or intermediaries.”

A UN Safety Council report in 2024 claimed that its crypto hacks are used to fund its weapons of mass destruction program.

The hermit kingdom’s state actors are accused of stealing $6.75 billion in crypto, Chainalysis reported in December.

Learn additionally

Options

The $2,500 doco about FTX collapse on Amazon Prime… with assist from mother

Options

Peter McCormack’s Actual Bedford Soccer Membership places Bitcoin on the map

North Korea’s crypto playbook

Kang has expertise decoding North Korean indicators, although he declined to elaborate on his earlier work. However he was prepared to share with Journal some observations. Kang says that North Korea treats cryptography and safe communications as nationwide priorities.

“When it comes to cryptographic communication, the highest is America [US], and the second is North Korea,” he says. “For them, stopping interception is crucial.”

Cryptocurrency theft naturally stems from that system. North Korea has used a spread of strategies, together with deploying operatives to work for crypto or tech corporations by deceiving employers and posing as authentic professionals. They usually obtain cost in crypto. Not like one-off hacks, this strategy is extensively believed to supply a extra constant earnings stream for the regime.

Hacking continues to draw media headlines and affect international regulatory discourse. North Korea’s $1.4-billion exploit in opposition to crypto alternate Bybit was reported as the biggest in historical past, although later investigations into different circumstances sophisticated that rating.

The incident additionally drew the eye of the Monetary Motion Process Drive (FATF), an intergovernmental physique usually described because the regulator of regulators for its function in assessing international Anti-Cash Laundering (AML) and Combating the Financing of Terrorism (CFT) compliance.

In its June 2025 replace, the FATF explicitly pointed to North Korea as a serious driver of its urgency round crypto oversight. The report factors to the rising use of crypto and stablecoins by state actors. It argued that jurisdictions should speed up implementation and enforcement of Advice 15, which calls on nations to deal with crypto as regulated monetary infrastructure.

A number of nations tightened their crypto licensing frameworks and kicked out non-compliant exchanges throughout the identical interval that FATF launched its June 2025 replace.

Kang says North Korea’s cyber and crypto exercise needs to be understood as a part of a broader technique to protect regime stability, defend present assets and restrict publicity to outdoors strain.

Inside South Korea, these operations don’t provoke alarm as a lot as resignation.

“When South Koreans hear about North Korea doing shady issues in crypto, most individuals do probably not care,” Kang says. “It’s extra like, ‘Right here it goes once more.’”

Learn additionally

Options

How crypto bots are ruining crypto — together with auto memecoin rug pulls

Options

GENIUS Act reopens the door for a Meta stablecoin, however will it work?

The crypto irony of the 2 Koreas

There’s an irony in how Korea’s crypto story is unfolding. Whereas North Korea has lengthy relied on isolation and onerous borders to earn the title “The Hermit Kingdom,” South Korea’s strategy to crypto has quietly produced its personal type of isolation.

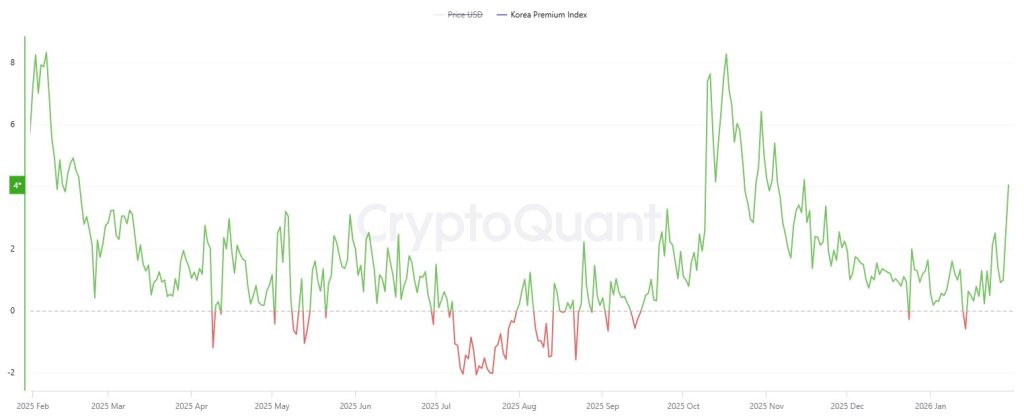

AML/CFT obligations tie crypto entry to home accounts, whereas alternate licensing hinges on unique banking partnerships. Collectively, these guidelines have restricted overseas and company participation and have made cross-border arbitrage troublesome. The result’s a won-based retail market the place costs can drift above international averages, also called the “kimchi premium.”

For years, that construction insulated South Korea’s crypto financial system from international capital flows, however that’s now shifting. Regulators have begun decreasing the obstacles that saved companies and establishments on the sidelines.

The change is contemporary. Till very lately, crypto sat outdoors the institutional mainstream.

“In the event you rewind a few years, crypto was nonetheless considered as a high-risk business, one thing area of interest and just a little bizarre, taking place contained in the tech neighborhood. In [South] Korea, particularly, regulators and establishments didn’t take it critically,” Park of Arbitrum says.

“During the last 12 months, that shifted. You’ve seen main gamers, together with Tether, paying nearer consideration to Korea as an essential market,” he provides.

North Korea’s exercise is now colliding with a broader shift in international crypto governance. In 2025, main jurisdictions moved past drafting frameworks and commenced implementing enforceable licensing, supervision and risk-management regimes for crypto companies, as suggested by the FATF.

These measures are unlikely to remove North Korea’s operations. Nevertheless, they’re tightening the perimeter round crypto exchanges and cost rails that North Korean actors have exploited.

In its personal irony, North Korea is exploiting gaps within the system, however it’s additionally serving to advance the legitimacy of the business by accelerating regulatory conversations.

Subscribe

Essentially the most partaking reads in blockchain. Delivered as soon as a

week.

Yohan Yun

Yohan (Hyoseop) Yun is a Cointelegraph workers author and multimedia journalist who has been overlaying blockchain-related matters since 2017. His background contains roles as an project editor and producer at Forkast, in addition to reporting positions targeted on expertise and coverage for Forbes and Bloomberg BNA. He holds a level in Journalism and owns Bitcoin, Ethereum, and Solana in quantities exceeding Cointelegraph’s disclosure threshold of $1,000.