- Transferring in darkness

- XRP Ledger exercise grows

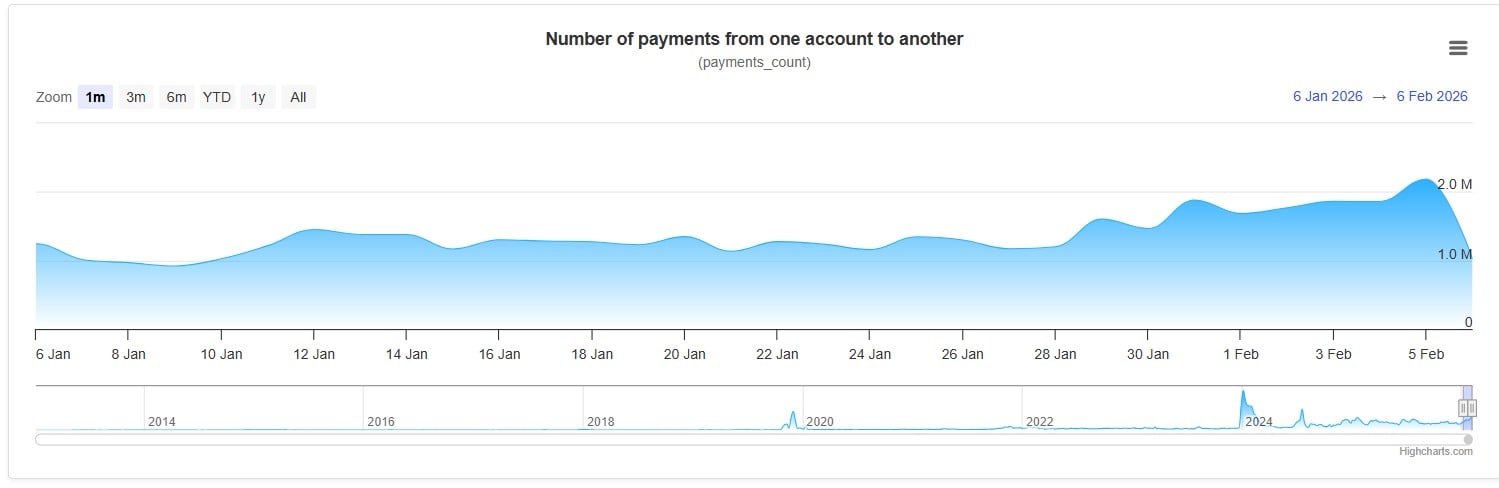

In current weeks, XRP Ledger has seen a pointy enhance in exercise, with on-chain metrics indicating that transaction counts and fee volumes have rapidly elevated by nearly 20%.

Traders are presently awaiting the Feb. 8 outcomes of XRP ETF buying and selling and its impression on value dynamics and total market sentiment, so this spike comes at a important time for XRP markets.

Transferring in darkness

Cryptocurrency markets have traditionally been considerably impacted by ETF-related flows; as an illustration, Bitcoin ETFs noticed outflows of virtually $500 million throughout a time of elevated market stress, which drove the market as a complete decrease and put vital downward stress on BTC.

Crypto Market Evaluation: $500,000,000 in XRP Shopping for Quantity, Shiba Inu (SHIB) Surprisingly Bullish, Will Bitcoin (BTC) Be Saved Earlier than $50,000?

Bitcoin (BTC): Constancy Identifies $65K as ‘Engaging Entry Level’

Traders in XRP are actually not sure whether or not an identical scenario would possibly happen or if XRP will act in a different way. In line with the present market construction, XRP would possibly escape a disastrous sell-off, pushed by ETFs just like the one which not too long ago occurred with Bitcoin. Regardless of its weak point, the value motion has not utterly crashed, and there’s nonetheless some shopping for exercise close to vital help zones.

XRP Ledger exercise grows

Then again, on-chain exercise presents a extra nuanced image. There’s a huge community transaction move indicated by the spike in XRP Ledger utilization. Whereas elevated exercise could often be an indication of increasing adoption or rekindled investor curiosity, it can be an indication of elevated token motion towards exchanges.

XRP is at a turning level as we method the ETF outcomes. ETF flows staying regular and basic market sentiment enhancing might trigger XRP to degree off and begin constructing a restoration base. Additional draw back stress remains to be attainable, although, if ledger exercise retains displaying heavy distribution and ETF flows fall wanting expectations.