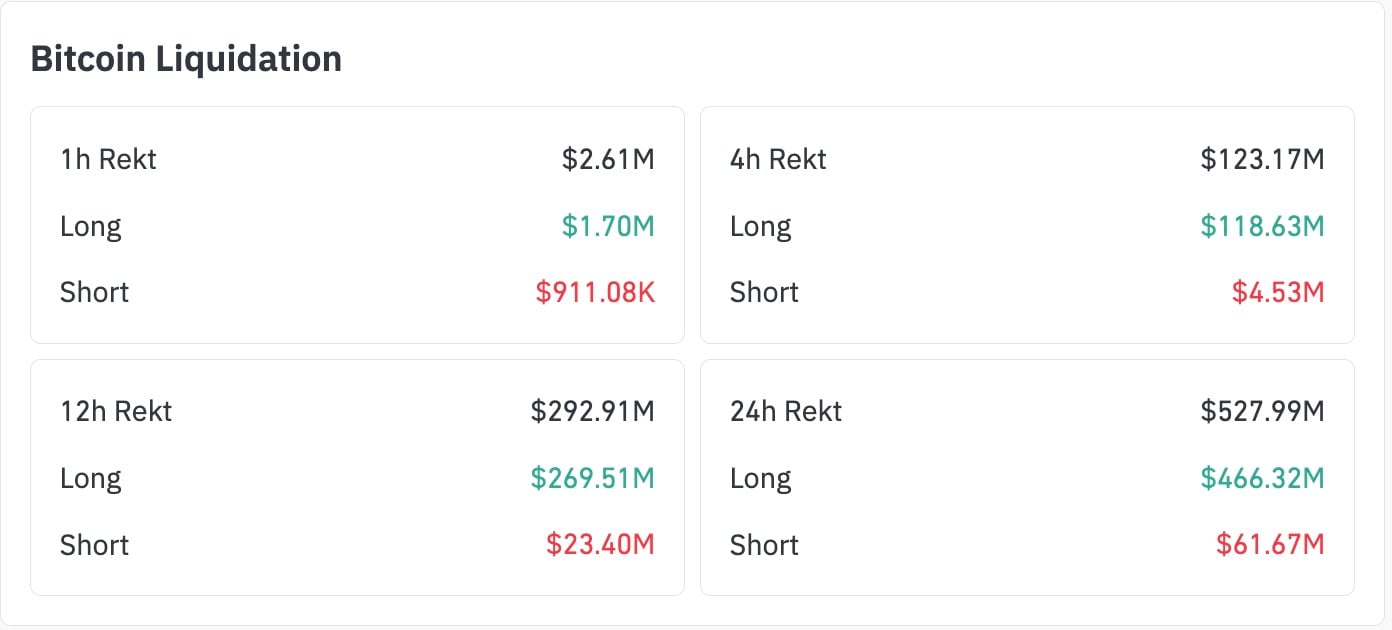

In response to CoinGlass, Bitcoin bulls bought steamrolled right now — huge time. In a ruthless four-hour window, over $118.63 million in lengthy positions have been force-liquidated, in comparison with simply $4.53 million in shorts.

That could be a 2,618% imbalance — some of the one-sided liquidation occasions since 2026.

The full four-hour “rekt” depend hit $123.17 million, exposing a brutal asymmetry in crypto dynamics. This was not simply an atypical liquidation wick. It’s honest to name it a direct liquidation flush by way of long-heavy leverage, largely concentrated close to the $70,000 BTC protection line that had already been underneath stress for the reason that earlier session.

Crypto Market Assessment: $500,000,000 in XRP Shopping for Quantity, Shiba Inu (SHIB) Surprisingly Bullish, Will Bitcoin (BTC) Be Saved Earlier than $50,000?

Bitcoin (BTC): Constancy Identifies $65K as ‘Engaging Entry Level’

Funnily, funding remained elevated throughout key platforms like Binance and Bybit, suggesting that bulls had not de-risked in any respect.

What does liquidation imbalance imply for Bitcoin (BTC)?

The liquidation imbalance on Feb. 5 factors to a leveraged market in denial, holding on to bullish bias whereas deeper structural breakdowns have been already forming throughout macro, ETF flows and derivatives.

The 24-hour figures present $466.32 million in lengthy liquidations out of $527.99 million complete — over 88% — however the four-hour chart is what caught explicit fireplace.

Bitcoin market construction has been cracked throughout this flush because the main cryptocurrency hit $69,000, a 2021 all-time excessive and essential psychological stage for BTC.

On this case, the two,618% imbalance is a forensic marker of how far bullish conviction indifferent from execution threat.

Ought to the identical surroundings persist within the subsequent periods, Bitcoin could possibly be gazing a deeper de-risking cycle that takes it far beneath present psychological zones, with the $40,000 to $50,000 vary appearing as a magnet.