- Solana is thrashing Ethereum in perp quantity, stablecoin progress, and ETF outflow stress throughout a risk-off market

- Ethereum is dealing with heavier FUD and large-holder promoting, together with a significant realized loss from Pattern Analysis

- SOL/ETH holding close to 0.04 assist may very well be a rotation sign, not random sideways value motion

Nothing on this market is going on by chance proper now. Not with volatility this excessive, not with liquidity this skinny, and positively not with large cash rotating out and in of positions prefer it’s a each day routine.

After three straight days of outflows pushed main large-cap belongings under key assist zones, the market snapped again onerous on February 6 with a single-day transfer of greater than 10%. That sort of swing doesn’t simply “catch merchants off guard,” it wipes out anybody who’s positioned too confidently on the flawed aspect. And in this type of atmosphere, traders cease counting on vibes. They begin watching information.

So when Solana (SOL) begins quietly outpacing Ethereum (ETH) throughout a number of metrics, it reads like greater than only a short-term pump.

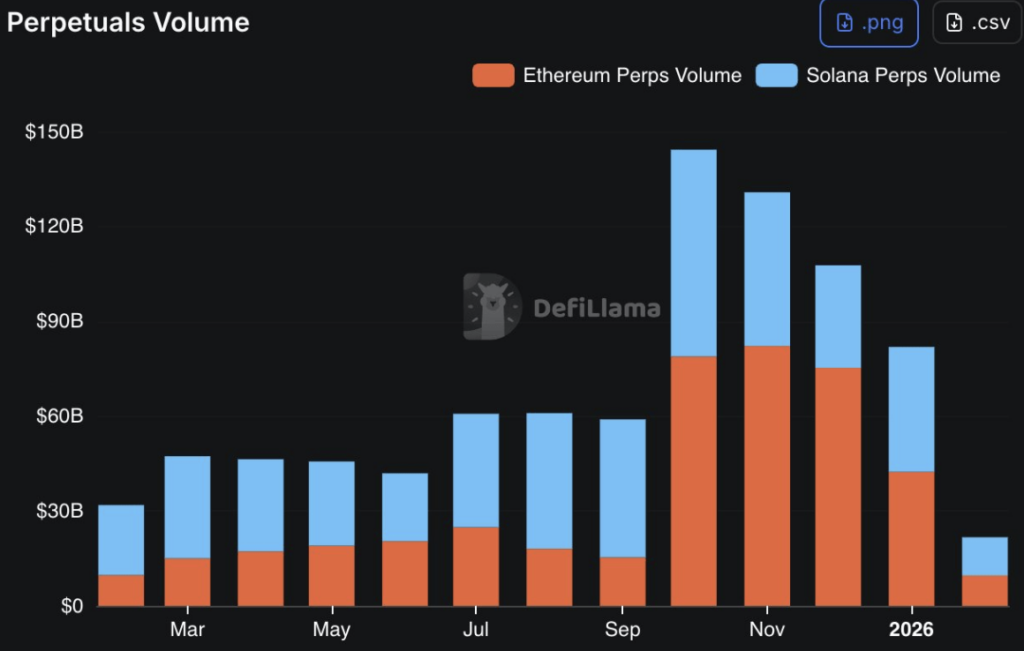

One of many cleanest examples is perpetual futures quantity. Based on DeFiLlama, Solana lately printed round $12.1 billion in perp quantity, in comparison with Ethereum’s $9.6 billion. That’s roughly 26% larger, and it issues as a result of perps quantity is mainly the market’s heartbeat. Greater quantity doesn’t assure path, however it does present the place merchants are spending their consideration, and the place liquidity is transferring.

Solana’s momentum is exhibiting up within the locations that matter

The divergence will get even sharper once you take a look at institutional flows. Solana’s ETF narrative has taken a lighter hit throughout this sell-off, with about $18 million in web outflows over the previous three days. Ethereum, however, noticed roughly $180 million go away over the identical window. That’s not a small hole. That’s a really loud sign.

After which there’s DeFi, the place Solana has been pulling forward in a means ETH holders in all probability don’t love seeing. Solana’s stablecoin market has climbed about 8.5% this week, whereas Ethereum’s stablecoin market barely moved, sitting round 0.2%. The gasoline behind that bounce is fairly direct too: roughly $2.75 billion in USDC was minted on Solana throughout the identical interval.

That’s the sort of circulate that normally doesn’t present up except there’s actual demand. Stablecoins are liquidity. Liquidity is DeFi oxygen. And when stablecoins increase on one chain whereas one other stays flat, it begins to seem like capital is making a selection.

Ethereum is getting hit with heavy promoting stress

Ethereum’s previous couple of days have been tough, and never simply because value is pink. The larger problem is what the big gamers are doing.

As LookOnChain identified, Pattern Analysis has practically bought off its ETH place. The numbers are ugly. They reportedly withdrew 792,532 ETH at round $3,267, then later deposited 772,865 ETH again to Binance at round $2,326. The end result? A lack of roughly $747 million.

That’s not retail panic. That’s institutional ache. And once you see that sort of loss being realized, it tends to feed the narrative that ETH is dealing with heavier stress than most individuals anticipated.

Why the SOL/ETH ratio is instantly the chart everybody ought to watch

That is the place the SOL/ETH ratio begins to look essential once more. Whereas Ethereum is coping with promote stress and headline-level FUD, SOL/ETH has been holding inside a good vary close to a key assist space.

On the time of writing, SOL/ETH was hovering round 0.04. That’s not a random quantity. It’s a stage that sparked a 35% rebound in the course of the Q3 2025 rally, so merchants keep in mind it. Markets have reminiscence, even when they fake they don’t.

And once you mix that with Solana outperforming ETH throughout perps quantity, stablecoin progress, and ETF circulate stress, the sideways chop in SOL/ETH begins to look much less like indecision and extra like positioning.

This isn’t “coincidence” – it appears to be like like rotation

In regular markets, you’ll be able to shrug off these divergences as noise. However this isn’t a traditional market. The previous couple of days have been a risk-off atmosphere, and risk-off markets normally expose what’s robust and what’s weak in a short time.

Proper now, Solana is exhibiting energy within the actual locations that have a tendency to guide. Buying and selling exercise, stablecoin liquidity, and relative institutional stress. In the meantime, Ethereum is coping with heavy outflows and main holders exiting at a loss, which is the sort of story that may drag on sentiment for weeks.

So no, SOL/ETH chopping sideways close to assist doesn’t really feel like coincidence. If this rotation holds over the following few periods, it may simply set the stage for one more SOL rally, pushed much less by hype and extra by the market’s oldest rule: capital flows towards energy.

Disclaimer: BlockNews gives impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.