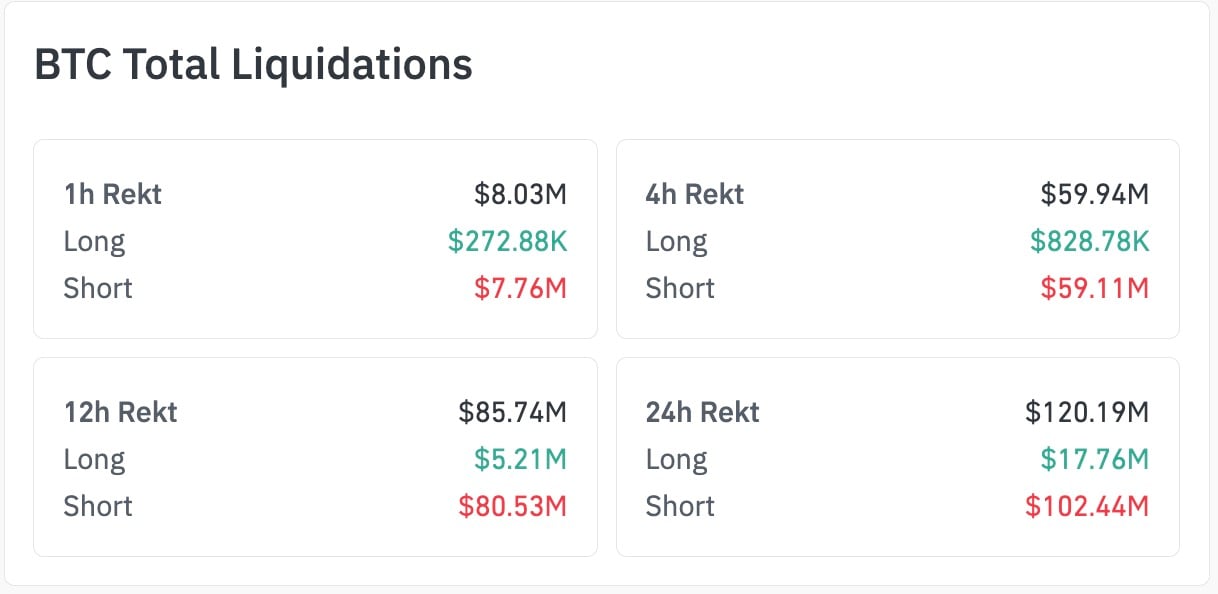

Bitcoin’s newest liquidation knowledge by CoinGlass reveals an aggressive quick wipeout which will trace at a serious turning level. In simply 4 hours, $59.11 million in brief positions had been liquidated in comparison with solely $828,780 in longs, making a 7,132% imbalance.

Contemplating that, over 24 hours, shorts accounted for $102.44 million out of $120.19 million complete liquidations, the information suggests aggressive mispositioning into native weak point. Whereas such imbalances typically precede bounce makes an attempt, the hope of any sustainable upside will depend on whether or not natural demand replaces the compelled purchase strain by quick sellers.

However, for now, bears have misplaced the spherical.

Morning Crypto Report: ‘I Am Capitulating’: What’s Vitalik Buterin Speaking About? Bitcoin Quantum Risk Drama Will get 20,000 BTC Twist, Cardano out of Prime 10 as Bitcoin Money Wins Again 25% of BCH Value

XRP Defies Market Bearishness with $45M in Weekly ETF Inflows

Bitcoin skyrockets, however not in value

Bitcoin simply delivered a kind of liquidation prints that modifications the tone of a complete week — not as a result of the value “feels higher” however as a result of the market paid a invoice, and it was paid by quick sellers.

In response to CoinGlass knowledge, proper now shorts are getting worn out a lot more durable than longs throughout each main time window. Within the four-hour reduce, complete BTC liquidations hit $59.94 million, with shorts at $59.11 million versus solely $828,780 in lengthy liquidations.

That short-to-long ratio works out to a few 7,132% ratio. In different phrases, it was a one-sided squeeze for BTC, not a pure deleveraging occasion.

So, does a bullish liquidation imbalance — the “7,132%” quantity these bullish on crypto are happy to see — finish a bear market? No. It ended the positioning that was offside.

The actual sign is what occurs after the squeeze gasoline is gone: does spot demand maintain, do bids rebuild above reclaimed ranges and do funding and open curiosity reinflate with out immediately flipping into one other overcrowded lengthy?

This imbalance print continues to be significant. However a “regime change” for Bitcoin wants follow-through, not simply compelled buybacks.