- Bitcoin and gold are each rising, however the market narrative is shifting past a easy “either-or” debate.

- Cathie Wooden believes AI-driven commerce may make Bitcoin a core monetary infrastructure asset.

- Establishments look like pairing gold for stability with Bitcoin for upside, altering how portfolios are constructed.

Bitcoin vs gold has been a kind of debates that simply refuses to die. For months now, buyers have gone forwards and backwards on which asset actually deserves the “retailer of worth” crown, and truthfully, the argument is just getting louder. That’s partly as a result of each charts have been in every single place these days, with volatility making it tougher for individuals to really feel assured in both camp.

From a pure value standpoint although, Bitcoin has began exhibiting some life once more after taking a success in current weeks. On the time of writing, BTC was buying and selling round $70,681, up 3.03% over the previous 24 hours. That type of bounce tends to carry again the “purchase the dip” crowd quick, and it additionally retains the digital gold narrative alive, even when it’s nonetheless a bit fragile.

Gold, to be truthful, hasn’t precisely been sitting nonetheless both. The metallic climbed 2.03% to roughly $4,966.26 per ounce, placing it proper close to that psychologically essential $5,000 degree. Strikes like that often sign one factor: demand for conventional safe-haven property remains to be robust, even in a world the place crypto is meant to be changing the whole lot.

However right here’s the place issues get extra attention-grabbing. The Bitcoin vs gold dialog is not nearly inflation hedges and worry trades. It’s being reshaped by AI, institutional conduct, and the concept blockchains would possibly grow to be one thing nearer to monetary infrastructure than a speculative on line casino.

Cathie Wooden’s take: Bitcoin is turning into core infrastructure

ARK Make investments CEO Cathie Wooden has been leaning arduous into the concept “agentic commerce” is coming. Principally, AI techniques that may transact autonomously with out people clicking buttons all day. In her view, that pushes blockchains like Bitcoin, Ethereum, and Solana into a brand new class, not simply property individuals gamble on, however networks that would truly underpin the subsequent period of finance.

Wooden’s broader level is that buyers are beginning to deal with Bitcoin much less like a dangerous facet guess and extra like one thing that belongs within the heart of contemporary portfolios. Not a meme. Not a short lived fad. Extra like a foundational asset, the way in which individuals used to speak about gold and even U.S. Treasuries.

She summed it up in a manner that was fairly direct, saying Bitcoin is “main the way in which” and that it stays “probably the most safe of all of the crypto.” That safety narrative has at all times mattered, however it hits otherwise now when establishments are allocating billions as a substitute of retail merchants chasing pumps.

What’s behind Bitcoin’s current weak spot

Even with the bounce, Bitcoin hasn’t been proof against stress. Wooden pointed to a number of macro forces weighing on crypto markets, together with rising rates of interest in Japan, tighter liquidity situations within the U.S., and portfolio rebalancing from giant buyers. The important thing element is that these aren’t “Bitcoin is lifeless” alerts, they’re signs of Bitcoin being related to world finance greater than ever earlier than.

In different phrases, Bitcoin isn’t appearing like some remoted insurgent asset anymore. It’s reacting to capital flows, threat urge for food, and central financial institution coverage, identical to the whole lot else. That’s not essentially unhealthy, however it does imply the value can get dragged round when the macro image shifts.

She additionally instructed that gold’s momentum may weaken if China’s development stays sluggish and inflation fears preserve fading. And if that occurs, capital might begin rotating towards Bitcoin as a substitute. Not as a result of gold turns into ineffective, however as a result of buyers begin searching for the subsequent place the place upside nonetheless exists, particularly as soon as the AI-stock commerce will get crowded and overheated.

Bitcoin and gold may not be rivals anymore

One of many extra refined shifts on this complete debate is that Bitcoin and gold are beginning to look much less like enemies. Gold remains to be the old-school hedge when worry spikes and uncertainty hits, and it’s nonetheless the asset individuals belief throughout true disaster moments. However Bitcoin is more and more being seen as a digital counterpart, providing an identical defensive narrative whereas additionally bringing development potential and programmability into the combination.

Wooden even stated she wouldn’t be shocked if gold “continued to return all the way down to Bitcoin’s profit.” That’s a daring declare, however it matches her thesis that Bitcoin remains to be in a long-term adoption curve, whereas gold is already totally established and, in a manner, capped.

She additionally dropped one other attention-grabbing line: “Gold precedes a giant transfer in Bitcoin.” What she’s implying is that gold’s value motion may act as an early sign, nearly like a number one indicator, for Bitcoin’s subsequent main breakout. It’s not a assure clearly, however it’s the type of sample that establishments take note of.

And that’s the larger story. Establishments aren’t at all times selecting one or the opposite anymore. They’re pairing them. Gold for stability and insurance coverage, Bitcoin for innovation and upside. That mixture modifications the query from “gold or Bitcoin?” into one thing extra sensible, like “how a lot of every will we maintain?”

Are Bitcoin’s market alerts flashing warning indicators?

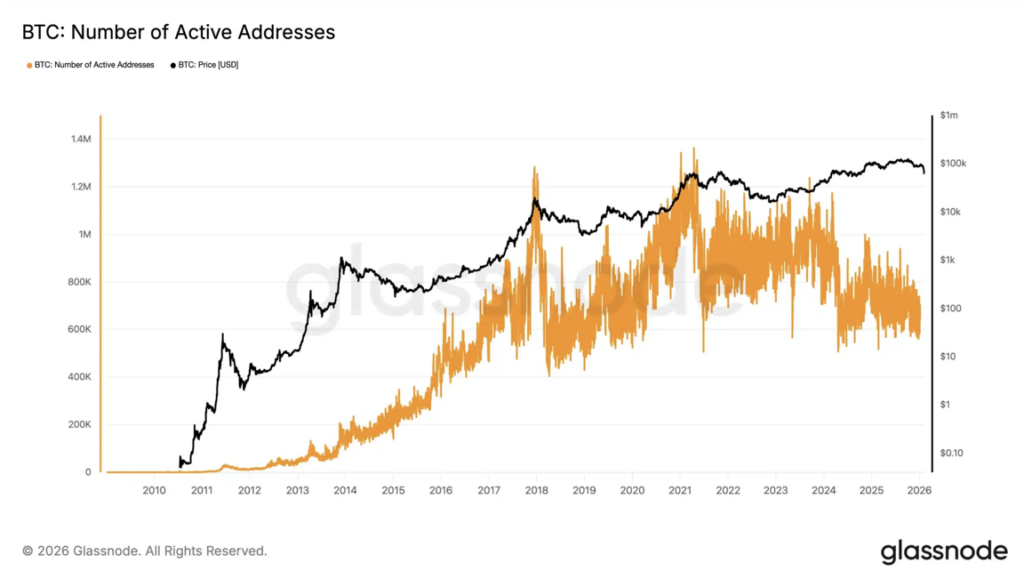

Bitcoin’s long-term outlook nonetheless seems to be robust, however short-term information has been just a little messy. On-chain metrics from Glassnode confirmed a drop in lively customers, which often hints at weaker retail participation. That issues as a result of retail is usually what fuels probably the most explosive strikes, the sort the place BTC doesn’t simply grind upward, it launches.

On the identical time although, Bitcoin’s market dominance climbed to round 59%. That’s often an indication that buyers are rotating away from riskier altcoins and shifting again into Bitcoin because the “safer” crypto guess. It’s nearly like a defensive transfer contained in the crypto market itself.

Wooden additionally reiterated that Bitcoin’s traditional four-year cycle of large rallies adopted by brutal crashes is likely to be breaking down. She stated the present downturn may find yourself being the mildest in Bitcoin’s historical past, which is a reasonably large assertion contemplating how ugly previous drawdowns have been. If she’s proper, it may imply Bitcoin is slowly maturing right into a extra steady macro asset, not totally steady, however much less wild than earlier than.

Disclaimer: BlockNews offers impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.