Ethereum and Bitcoin proceed to commerce in outlined ranges as crypto markets present blended momentum, actions restrained, and on-chain information gaining the eye of merchants and analysts. Discussions on present Ethereum value predictions have centered on whether or not the market could possibly be in retailer for prolonged consolidation or renewed volatility.

Coin Bureau insights from IntoTheCryptoVerse Evaluation suggests a state of affairs the place Ethereum must revisit decrease ranges earlier than any sustained enlargement. Within the meantime, the commentary situates that the present situations are transitional reasonably than directional.

Ethereum Value Prediction Facilities on the $2,000 Vary

The present value of Ethereum is near $2,000, a variety usually referred to as the “mid-value zone.” Consultants say that previously, this zone served as a holding zone for the market throughout a chronic interval of stagnation. It may be noticed that the motion of the worth round this zone doesn’t manifest any vital momentum.

In accordance with numerous Ethereum prediction charts, in comparable phases of earlier market cycles, sideways value actions have been famous reasonably than a robust breakout. These are often durations of volatility compression, and analysts are looking forward to additional developments in these sectors.

Analysts Define Potential Retest of $1.5K Help

The evaluation cited by Coin Bureau indicated that there’s additionally a threat of decline to the decrease pricing band at about $1,500, however afterward within the cycle. The value buildings from earlier Ethereum cycles point out that every Ethereum value rally was adopted by some retracement earlier than it started to push ahead. This pattern is obvious in most Ethereum value prediction fashions.

In prior cycles, there have additionally been vital drawdowns earlier than highly effective expansions. Such pullbacks occurred even when total community exercise was secure. Such value motion is alleged to be a function of ‘late-stage shakeouts’ reasonably than adjustments within the underlying pattern.

On-Chain Metrics Present Community Stability

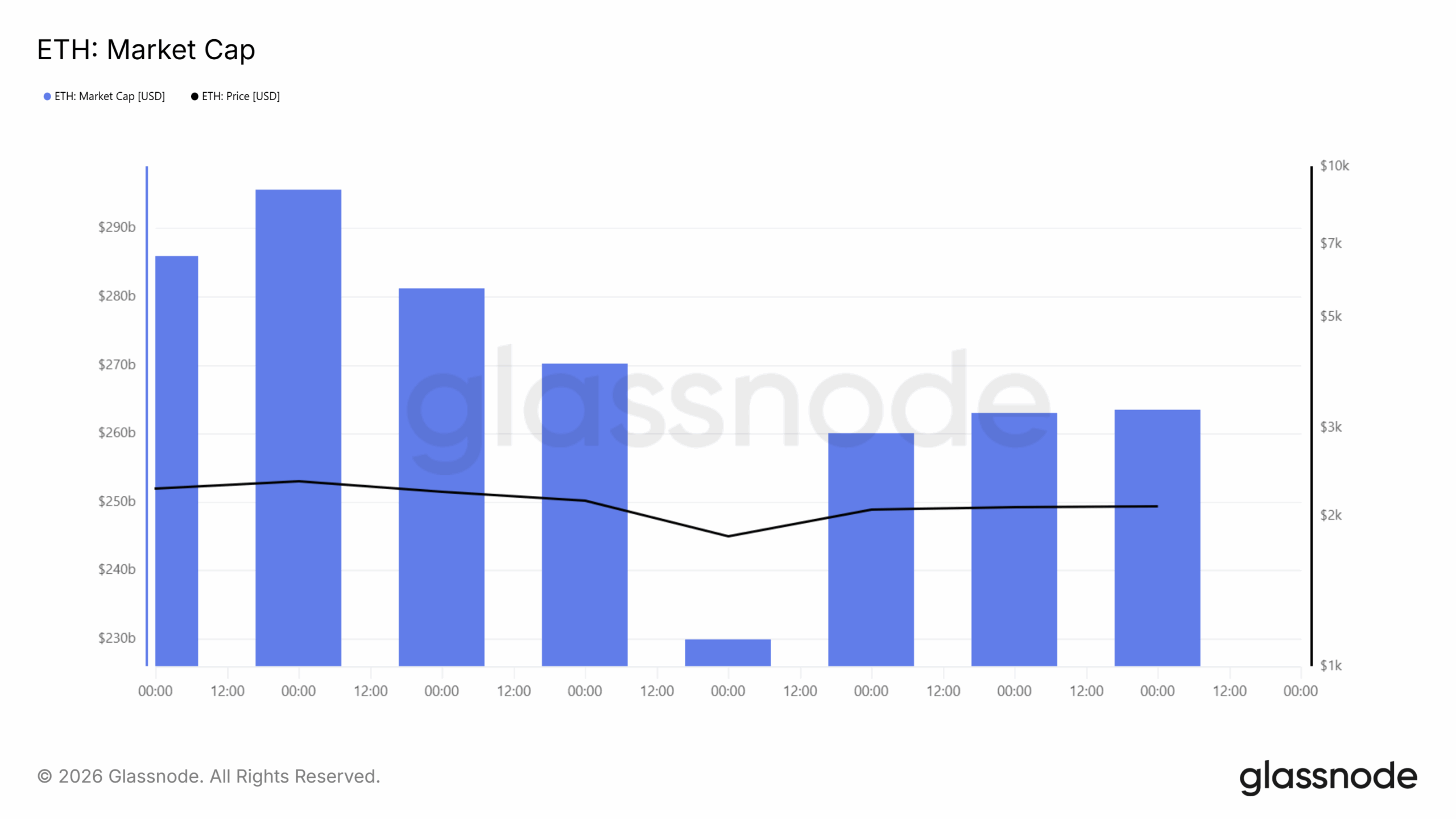

Information from Glassnode’s on-chain analytics exhibits Ethereum’s market capitalization is trending in a consolidated sample. It’s believed {that a} consolidated market capitalization stage displays the soundness of the capital remaining within the community, versus the exiting of funds on a big scale. This sample is in contrast to the deeper bear phases seen within the prior cycles.

Market cap can also be a significant component when performing value prediction for Ethereum since a constant decline on this regard often indicators a downward motion for the cryptocurrency. This, nevertheless, doesn’t appear to be the case for the time being. It seems to be a interval of accumulation for the asset, simply as in earlier

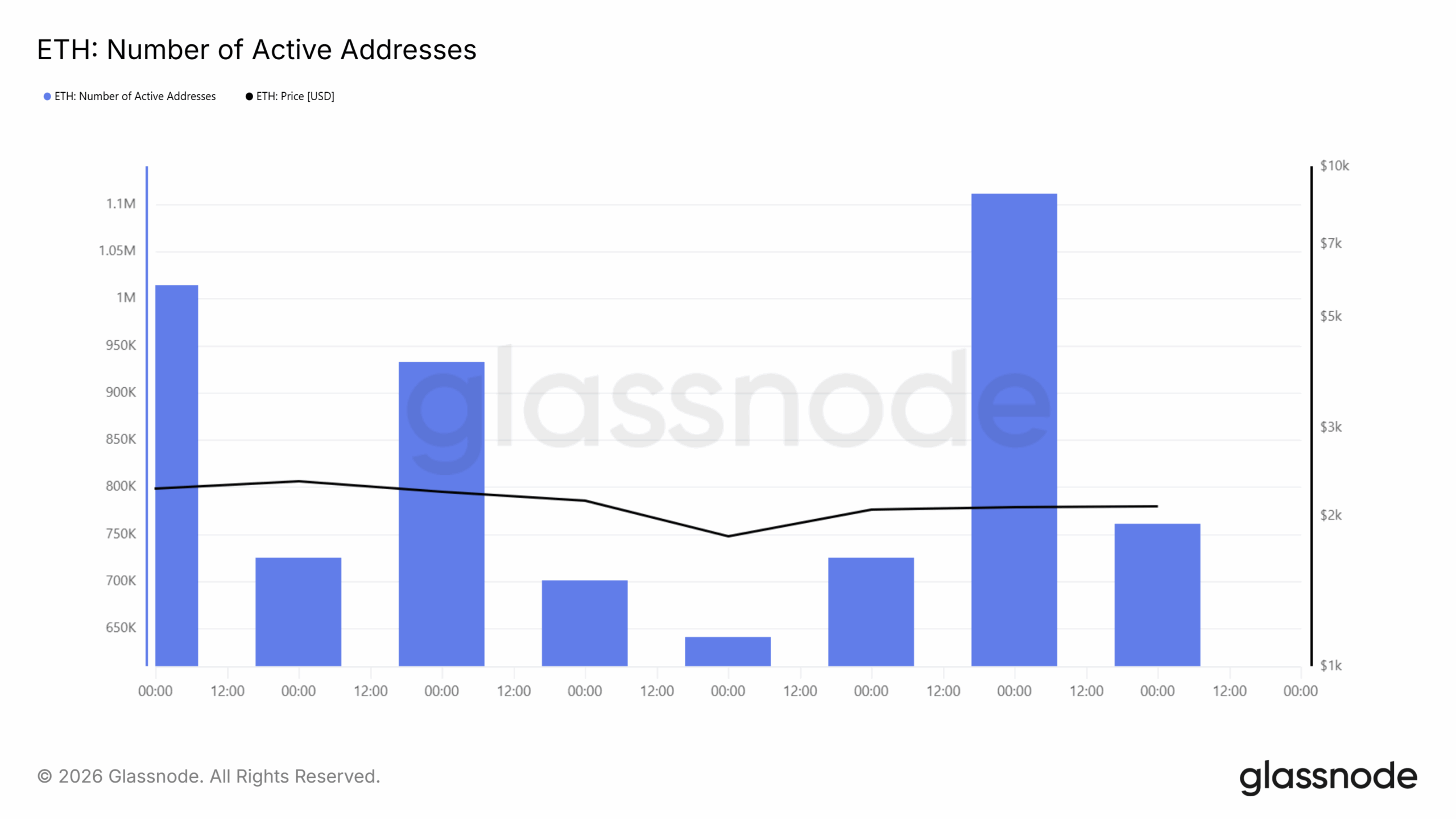

Supporting this concept, lively addresses reveal that lively Ethereum addresses comply with a fluctuating sample, reasonably than lowering constantly. The variety of lively Ethereum addresses seems to extend at common durations.

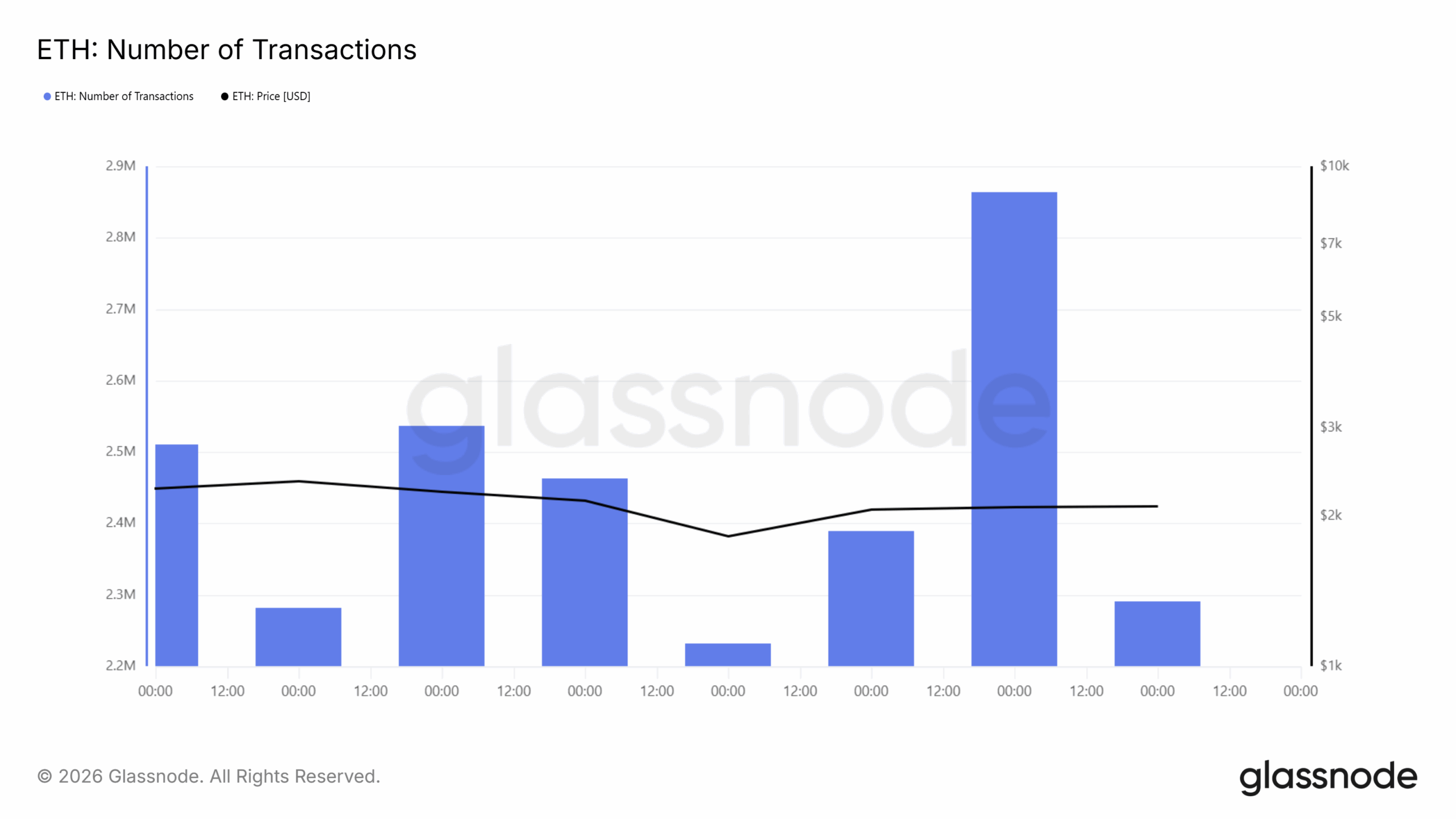

Transaction quantity additionally exhibits notable spikes throughout the identical interval. Greater transaction counts seem whereas value stays range-bound. Related divergences have been seen in earlier cycles, throughout phases of consolidation that preceded bigger value actions.

Lengthy-Time period Projections Replicate Diminishing Returns

Historic information, as prior analyzed, creates a foundation of reference for the evaluation. The 2017-2018 cycle is valued to have achieved greater than 15,000% development, whereas the expansion achieved throughout the 2020-2021 cycle has surpassed 5,000%. A mannequin of diminishing returns is at the moment into consideration.

As per this mannequin, it’s estimated by Ethereum value prediction for the upcoming development part to rise by between 1,500 and a pair of,000 p.c, resulting in a possible and attainable long-term value vary of between $24,000 and $32,000 primarily based on the proportionate cycle.

Disclaimer: This evaluation is predicated on market tendencies and doesn’t assure future outcomes. It shouldn’t be handled as monetary recommendation. Cryptocurrency investments contain threat, so at all times do your individual analysis (DYOR) earlier than investing.