XRP stays capped beneath resistance as futures positioning and whale distribution tilt short-term dangers to the draw back.

XRP’s market uncertainty persevered into one other buying and selling day after it closed the final session with no clear market path. As noticed by on-chain observers, the coin is sitting beneath a key resistance zone. And as anticipated, this wrestle has stored merchants cautious. Though short-term charts point out relative stability, draw back dangers stay seen.

XRP Caught in Tight Vary as $1.5160 Resistance Caps Worth

As per market information, XRP is exchanging fingers round $1.45 following a comparatively flat market outing. Successfully, this locations the coin beneath the $1.5160 every day resistance.

Wanting on the XRP/BTC chart, the weekly worth motion closed barely bearish however left a big decrease wick. That construction factors to demand stepping in at decrease ranges, lowering rapid draw back strain. Apart from, promoting curiosity seems much less aggressive than earlier within the decline.

Picture Supply: X/CRYPTOWZRD

A weekly pin bar shaped on the pair, a sample usually linked to potential upside. Oftentimes, such a sign suggests relative power might emerge if follow-through develops. Even at that, affirmation is but to be seen in the coin’s development.

Additional examination of the development construction reveals that sellers are nonetheless holding the higher hand. Technically, XRP trades beneath a long-term descending trendline. And this has stored the broader downtrend intact.

Although the asset has rebounded from the $1.30 assist zone, larger ranges stay unreclaimed. For now, a restoration stays elusive till the asset flips the $1.5160–$1.5300 stage.

Market watchers CRYPTOWZRD famous that XRP is at present transferring sideways. Usually, motion round this stage signifies hesitation, as consumers have but to exhibit power. Market members seem centered on a clear breakout to outline the following transfer. Basically, the asset wants this development flip for an outlined short-term path.

Shopping for curiosity might resume if the coin flips its present resistance to $1.516. Extra so, a sustained keep above $1.53 might flip the broader outlook bullish. In truth, analysts imagine such a transfer might push costs even larger. Nevertheless, XRP is more likely to maintain buying and selling inside a decent vary till a attainable development triggers this upside transfer.

Merchants Keep Defensive as Derivatives Imbalance Indicators Draw back Stress

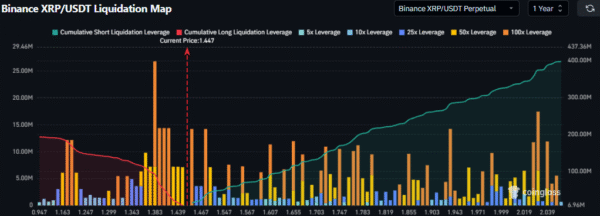

Liquidation information level to roughly $390 million on the brief aspect. As compared, lengthy publicity stands at over $190 million. Normally, such an imbalance means that futures merchants are betting on additional downsides. In the mean time, betting in opposition to a sustained bounce stays the dominant theme amongst merchants.

Picture Supply: CoinGlass

Heavy brief curiosity might increase volatility if the value slips once more. Fairly than cushioning declines, derivatives flows might amplify them. Worth forecasts, due to this fact, carry uneven threat, with draw back strikes more likely to speed up sooner than upside positive factors.

Sadly, on-chain information presents little reassurance over a possible development flip. Wallets holding between 10 million and 100 million XRP steadily shed their holdings since early February. Bigger addresses, holding 100 million to 1 billion XRP, have additionally turned bearish over the previous day. Distribution from these teams usually precedes deeper worth exams.

Help close to present ranges nonetheless holds, however time works in opposition to it. A drift towards $1.00 would increase the chance of cascading liquidations. For now, XRP stays above that threshold, although conviction from consumers has but to seem. Market members are actually ready for affirmation from each worth and positioning information earlier than committing to a brand new development.