Briefly

- Bitcoin miner Cango (CANG) bought 4,451 BTC or about $305 million value this weekend.

- The agency used the proceeds to repay a BTC-backed mortgage and clear its stability sheet because it expands into AI.

- Shares are down round almost 3% on the day, and 62% over the past six months.

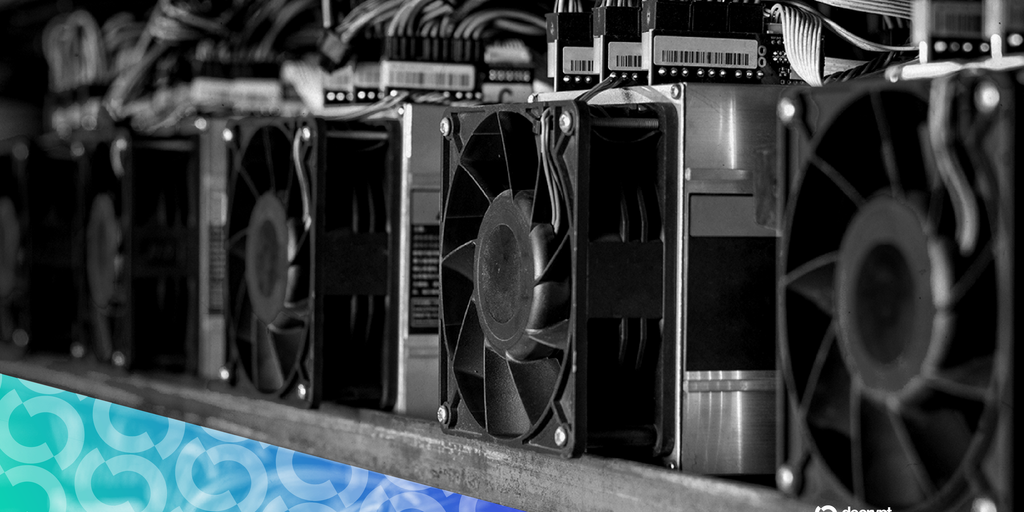

Publicly traded Bitcoin miner Cango (CANG) parted methods with 4,451 BTC this weekend, elevating roughly $305 million because it goals to gasoline its enlargement into offering compute energy for the factitious intelligence (AI) growth.

The agency used the entire proceeds to repay a portion of a Bitcoin-collateralized mortgage.

“The corporate is executing a strategic pivot by using its globally accessed, grid-connected infrastructure to offer distributed compute capability for the AI business,” Cango mentioned in a press release.

Along with the sale, the agency additionally introduced Jack Jin, previously of video conferencing software program agency Zoom, as its new CTO to assist construct out its AI enterprise line.

Shares within the Dallas-based mining agency are down almost 3% following the information, not too long ago altering fingers beneath $0.95. Shares have fallen 62% within the final six months.

Whereas different publicly traded Bitcoin miners, like Bitfarms, have signaled an entire departure from mining, Cango intends to proceed utilizing assets to mine Bitcoin alongside its rising AI compute enterprise.

“Cango stays dedicated to its mining operations, with a continued deal with enhancing mining economics and in search of an optimum stability between hashrate scale and operational effectivity,” the agency’s announcement reads. “The corporate will likely be guided by a disciplined framework for asset allocation in pursuit of long-term worth creation.”

The agency, which says it operates over 40 websites throughout 4 distinct geographic areas, mined almost 500 BTC in January, based on its most up-to-date month-to-month manufacturing replace. It additionally bought 550 BTC or about $39 million value of BTC in the course of the month, leaving it with 7,474.6 BTC or about $528 million value on the shut of January.

On the time of the sale, Cango CEO Paul Yu telegraphed that the agency can be offloading extra Bitcoin sooner or later.

“Beginning this month, we are going to selectively promote a portion of newly mined Bitcoin to assist the enlargement of our inference platform and different near-term progress initiatives,” mentioned Yu in a press release. “This tactical flexibility will enable us to grab new enterprise alternatives and handle our liquidity with larger agility.”

A consultant for the agency didn’t instantly reply to Decrypt’s request for remark.

Bitcoin is down round 0.2% within the final 24 hours, not too long ago altering fingers at $70,727. The highest crypto asset is down almost 10% within the final week and is 44% off its October all-time excessive of $126,080, although it has partially recovered since dipping to almost $60,000 final week.

Day by day Debrief E-newsletter

Begin daily with the highest information tales proper now, plus unique options, a podcast, movies and extra.