- BitMineâs ETH Treasury hits $8.82 billion

- BitMineâs ETH portfolio down by over $7.8 billion

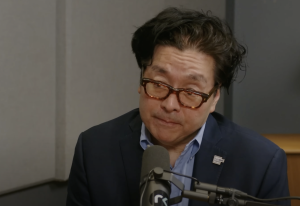

Though the previous week has seen crypto buyers largely exiting the market amid fears sparked by the latest market volatility, BitMine Immersion Applied sciences (BMNR), a publicly traded Ethereum-focused firm chaired by Tom Lee, has seen one other alternative to purchase extra Ethereum at decrease costs.

On Monday, Feb. 9, information from blockchain monitoring platform Lookonchain reveals that Tom Lee’s BitMine has as soon as once more doubled down on its common Ethereum buy regardless of weak market circumstances.

BitMine’s ETH Treasury hits $8.82 billion

The transfer, which occurred whereas Ethereum was displaying notable worth declines, noticed the agency buy a complete of 40,613 ETH value about $82.85 million during the last week.

Morning Crypto Report: XRP Skyrockets $63.1 Million on Its Personal ETF Bull Market, 23,799,579,141 SHIB: Coinbase Whale Grabs Billions of Shiba Inu and Disappears, Dogecoin Creator’s Crypto Market Prediction Amid Tremendous Bowl Comes True

Saylor Buys the Dip… at $78,000

Contemplating the timing of the acquisition, as many have speculated that the transfer goes past short-term buying and selling exercise; quite, it’s one among BitMine’s long-term Ethereum accumulations.

Whereas Ethereum had plunged massively in the course of the earlier week, retesting its multiyear low whereas falling under the $2000 mark, BitMine’s latest buy reveals that the agency had purchased the asset’s dip when it was buying and selling round $2,039.

BitMine’s ETH portfolio down by over $7.8 billion

Whereas the latest crypto market pullback has seen giant crypto treasuries like BitMine, Technique and others report large losses of their crypto treasuries, the BitMine ETH treasury noticed its place fall massively.

Following the large Ethereum worth crash, the latest buy made by BitMine has didn’t offset its losses as the information reveals that the agency is sitting on a paper lack of $7.8 billion at Ethereum’s present buying and selling worth, which stands at $2,034 as of writing time, with a lower of three.91% over the previous day.