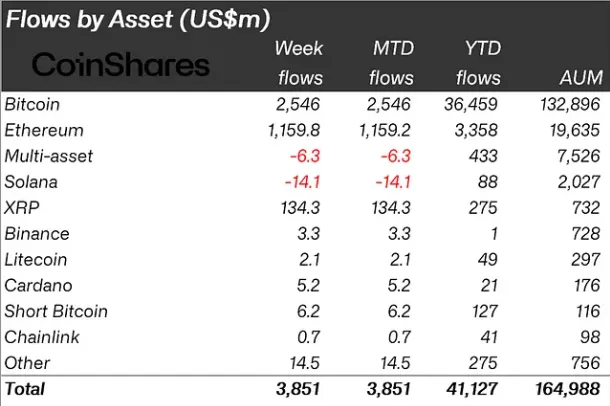

Crypto inflows skilled a record-breaking surge final week, reaching a outstanding $3.85 billion. The optimistic flows to digital asset funding merchandise surpassed the earlier document set simply weeks in the past.

This monumental exercise has propelled the whole year-to-date (YTD) inflows to $41 billion.

Bitcoin Leads the Cost As Crypto Inflows Method $4 Billion

Bitcoin (BTC) led the cost, accounting for $2.5 billion of final week’s inflows. This brings its YTD complete to a staggering $36.5 billion. The sustained bullish momentum has traders projecting additional good points, with some analysts eyeing $100,000 as a possible goal this cycle.

Quick Bitcoin merchandise noticed inflows of $6.2 million, a pattern traditionally noticed after sharp value will increase. In keeping with James Butterfill within the newest CoinShares report, this highlights cautious investor sentiment, with many hesitant to guess towards Bitcoin’s present energy.

In the meantime, Ethereum made headlines with its largest weekly inflows on document, totaling $1.2 billion. This surpasses the joy seen through the launch of Ethereum ETFs (exchange-traded funds) in July. The numerous inflows spotlight rising confidence in Ethereum’s long-term potential, notably because the blockchain cements its position in decentralized finance (DeFi) and NFT (non-fungible token) ecosystems.

Nevertheless, Ethereum’s success seems to be coming on the expense of opponents like Solana (SOL), which noticed $14 million in outflows final week. This marks the second consecutive week of declines for Solana, signaling a shift in investor sentiment away from altcoins.

Institutional gamers like BlackRock, which lately delayed plans for altcoin ETFs, opting as an alternative to prioritize merchandise centered on Bitcoin and Ethereum, have additional strengthened the market’s desire for these. The record-breaking inflows replicate a broader pattern of institutional curiosity in digital belongings.

Companies like MicroStrategy and BlackRock have been on the forefront of this motion. For the latter, its Bitcoin spot ETF providing continues to function a serious catalyst for market optimism.

With Bitcoin and Ethereum commanding the lion’s share of inflows, questions stay about the way forward for altcoins in an more and more aggressive market. The outflows from Solana may sign broader challenges for smaller blockchain ecosystems, notably as institutional cash gravitates towards the market’s giants.

Investor Sentiment: Income and Methods

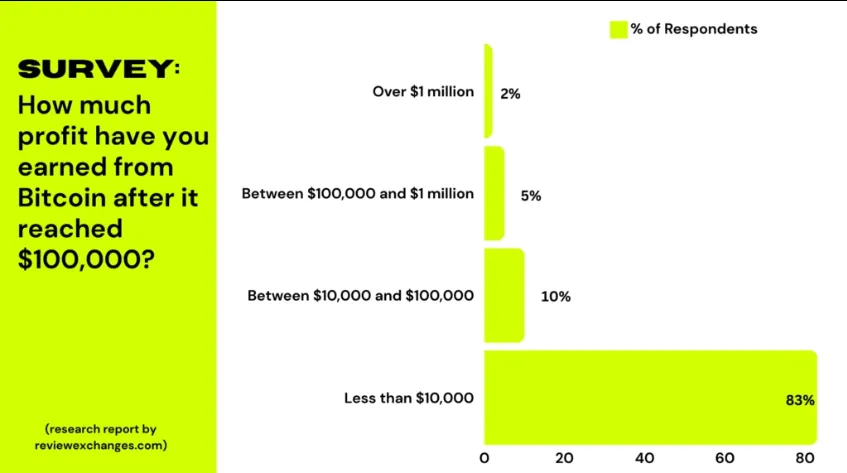

Elsewhere, a latest analysis by ReviewExchanges sheds gentle on how Bitcoin’s rise to $100,000 has impacted US crypto traders. A survey of 719 traders revealed blended feelings, methods, and expectations following the milestone.

A big 48% of respondents admitted they missed out on main good points throughout Bitcoin’s bull run and remorse not appearing earlier. One other 31% believed it was nonetheless not too late to speculate. In the meantime, solely 15% reported efficiently timing their investments to realize monetary objectives, whereas 6% revealed they weren’t desirous about Bitcoin throughout its surge.

The survey additionally confirmed that 83% of traders earned lower than $10,000 from the bull run, with solely 2% making over $1 million. This displays the rarity of considerable good points and highlights the significance of timing and technique.

The survey additionally discovered that 72% of contributors view cryptocurrency as a serious future funding. Whereas 43% expressed elevated confidence out there, 29% remained cautiously optimistic on account of inherent dangers. In the meantime, 7% reported low confidence, reflecting issues over volatility.

A majority of respondents, 67%, indicated they’re holding their belongings for long-term good points, whereas 18% are diversifying their portfolios. Solely 10% selected to money out totally, and 5% reinvested income into altcoins, reflecting a rising curiosity in blockchain innovation past Bitcoin.

Disclaimer

In adherence to the Belief Challenge tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed info. Nevertheless, readers are suggested to confirm details independently and seek the advice of with knowledgeable earlier than making any selections based mostly on this content material. Please observe that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.