- PEPE is down over 38% in a month and almost 87% from its all-time excessive

- Memecoins are being hit hardest as merchants flee high-risk belongings

- Analysts warn PEPE might nonetheless fall one other 25% earlier than stabilizing

The crypto market goes by considered one of its sharpest pullbacks in latest reminiscence, and Pepe hasn’t been spared. Bitcoin dropping towards the $62,000 stage earlier this month set the tone, and most altcoins adopted. PEPE has slipped steadily as liquidity dried up and danger urge for food vanished nearly in a single day.

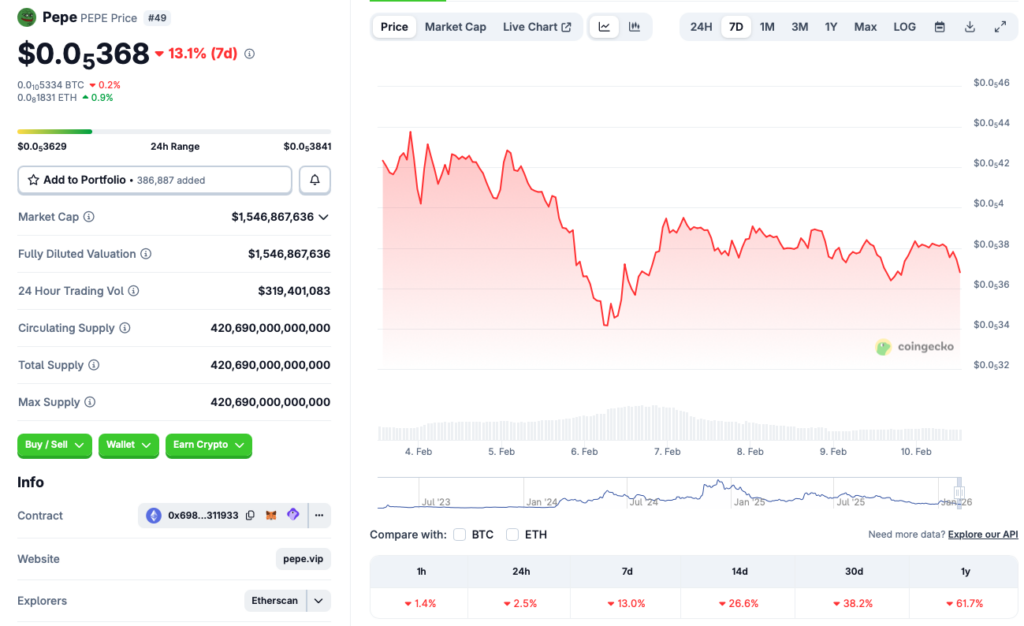

In line with CoinGecko knowledge, PEPE is down about 2.5% within the final 24 hours, 13% over the previous week, 26.6% throughout two weeks, and roughly 38.2% over the past month. Zoom out additional and the harm appears worse. The token is now down near 87% from its December 2024 all-time excessive of $0.00002803, a stage reached when Bitcoin first pushed previous $100,000.

The Memecoin Commerce Is Dropping Oxygen

PEPE’s decline isn’t occurring in isolation. Market contributors are actively rotating away from high-risk belongings, and memecoins are usually the primary to endure when sentiment breaks. In contrast to bigger crypto belongings, memecoins don’t have robust fundamentals to lean on throughout drawdowns. They depend on consideration, momentum, and liquidity, all three of that are scarce proper now.

PEPE did have a formidable run after launching in April 2023, hitting milestone after milestone over the last bull section. However as soon as that momentum pale, there was little or no structural help beneath the value. Since its 2024 peak, the token has been grinding decrease, not collapsing in a single transfer, however bleeding slowly as curiosity evaporates.

Analysts See Extra Draw back Earlier than Any Restoration

For merchants occupied with shopping for the dip, the near-term outlook stays uncomfortable. CoinCodex analysts at the moment anticipate PEPE to fall to round $0.000002666 by Feb. 19, 2026. From present ranges, that might suggest a further drop of roughly 27.5%, even after the heavy losses already absorbed.

That projection displays a broader actuality. In risk-off markets, memecoins not often backside early. They have a tendency to overshoot on the draw back as merchants prioritize capital preservation over speculative upside. Any significant rebound probably is determined by a broader crypto restoration, led by Bitcoin stabilizing first.

So, Is This a Purchase-the-Dip Second

Whether or not PEPE is a purchase right here relies upon much less on the token and extra in your danger tolerance. For long-term holders who consider memecoin cycles will return, decrease costs could ultimately look engaging. However within the quick time period, catching falling knives in a weak market isn’t rewarded.

Proper now, PEPE appears extra like a sentiment gauge than a possibility. Till the broader market finds its footing, additional draw back stays an actual risk. On this atmosphere, endurance could matter greater than timing, particularly for belongings that stay and die by hype.

Disclaimer: BlockNews gives impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.