- Bitcoin is down over 25% in a month, reviving fears of a deeper reset

- The present crash is macro-driven, not brought on by an change implosion like 2022

- Some analysts see sub-$40K threat, however a full $15K repeat seems to be unlikely

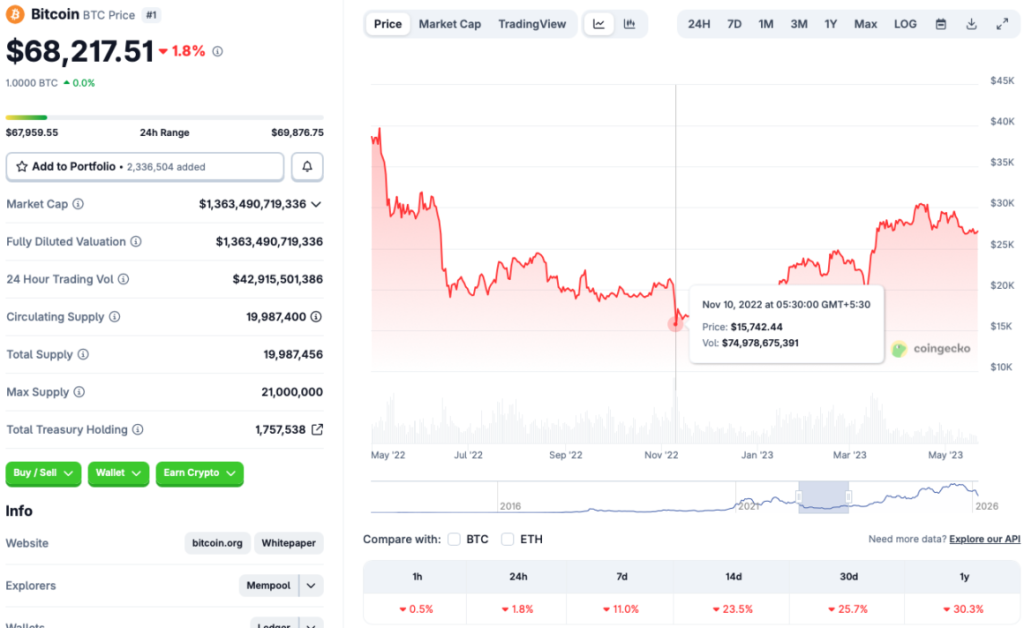

Bitcoin has slid again towards its 2021 all-time excessive vary, a stage that feels psychologically heavy even when it’s not technically “new.” The asset not too long ago dipped to round $62,000 earlier than bouncing barely, however the broader development nonetheless seems to be fragile. In accordance with CoinGecko information, Bitcoin stays down roughly 11% over the past week, 23.5% over the previous 14 days, and about 25.7% throughout the final month.

That sort of drawdown is sufficient to revive the worst-case conversations. When BTC loses momentum this quick, the market stops considering by way of “wholesome pullbacks” and begins considering by way of outdated trauma. For a lot of buyers, the worry is easy. If Bitcoin as soon as hit $15,000, might it occur once more.

Why $15K Occurred in 2022

The November 2022 crash wasn’t only a worth correction. It was a systemic collapse tied on to the FTX failure. As soon as the change suffered a bank-run model unraveling, confidence evaporated throughout your complete business. Bitcoin fell to the $15,000 stage, and the remainder of the market imploded alongside it. Solana dropping to round $9 grew to become one of many defining symbols of that part.

The essential level is that 2022 wasn’t nearly macro. It was about crypto infrastructure breaking in actual time. That sort of occasion forces liquidation and contagion in a means regular risk-off cycles don’t.

This Crash Is Macro and Liquidity, Not a Single Crypto Blowup

This time, the drivers look totally different. The present drawdown is being blamed on macroeconomic uncertainty, geopolitical rigidity, and a tightening liquidity surroundings. These are severe forces, however they don’t have the identical “on the spot demise spiral” high quality as a serious change defaulting.

That’s why a straight-line repeat of $15K is unlikely beneath the present setup. Not unimaginable, however much less possible. To get that sort of draw back, Bitcoin would doubtless want a second shock layered on high, one thing like a serious credit score occasion, a big establishment failing, or a hidden blowup inside crypto markets.

Some Analysts Nonetheless See Sub-$40K as Practical

Even when $15K is a stretch, deeper draw back remains to be on the desk. Some specialists consider Bitcoin might fall under $40,000 this cycle. Stifel, for instance, has urged BTC might dip to round $38,000 this yr. That’s the extra lifelike bearish goal vary merchants preserve circling, as a result of it matches how Bitcoin usually behaves when liquidity will get tight however the system itself doesn’t break.

A drop into the $30Ks would nonetheless really feel brutal. It might additionally doubtless set off widespread capitulation in altcoins and memecoins. However it might be a unique sort of crash than 2022, extra “macro washout” than “business collapse.”

The Lengthy-Time period Thesis Nonetheless Has Institutional Assist

Regardless of the ugly short-term motion, many establishments stay optimistic about Bitcoin’s longer-term trajectory. Corporations like Grayscale and Bernstein nonetheless count on BTC to achieve a brand new all-time excessive in 2026, arguing that Bitcoin could also be following a five-year cycle quite than the basic four-year rhythm.

That view is principally saying this isn’t the top of the story. It’s the uncomfortable center. Bitcoin might look weak now, however the broader thesis hasn’t been invalidated, no less than not but. For now, the market remains to be within the part the place worry will get louder than math.

Disclaimer: BlockNews offers impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.