Bitcoin is printing on-chain loss-taking on a scale final seen in the course of the Luna/UST meltdown, however at a radically completely different value level, a distinction that adjustments what the sign possible means for this drawdown.

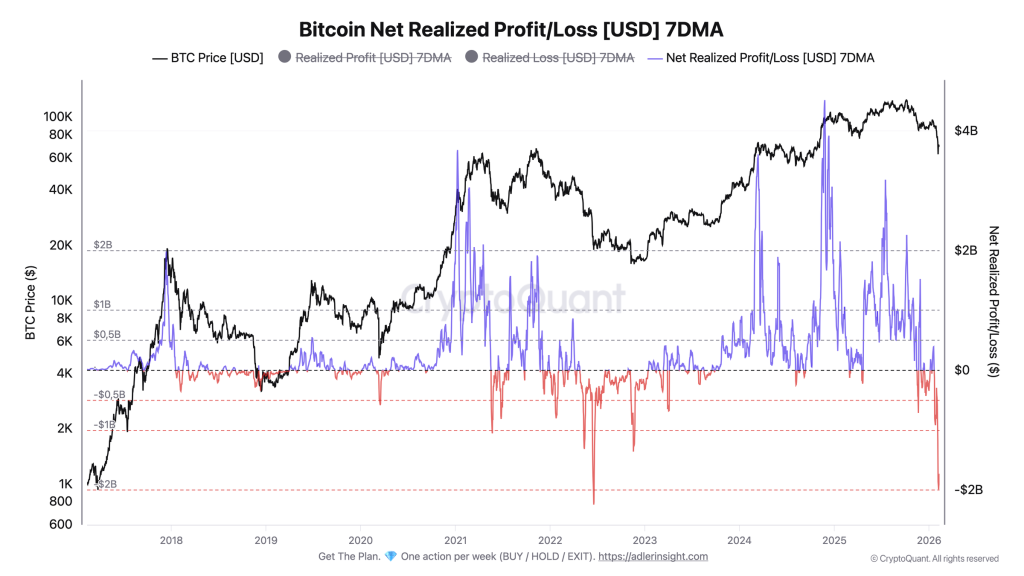

Axel Adler Jr. mentioned Bitcoin’s Web Realized Revenue/Loss has sunk deep into adverse territory, with the 7-day transferring common falling to -$1.99 billion on Feb. 7 earlier than bettering barely to -$1.73 billion by Feb. 10. That locations the present regime among the many most extreme loss-dominant stretches on document. Adler described it as “the second deepest adverse studying in your entire historical past of observations,” exceeded solely by June 18, 2022, when the metric hit -$2.24 billion amid the Luna/UST crash and cascading liquidations.

The important thing element, Adler argues, is persistence. Web Realized Revenue/Loss has stayed beneath roughly -$1.7 billion for 5 consecutive days, forming what he framed as a sustained cluster of vendor strain, the sort of multi-day compression that sometimes marks capitulation habits moderately than a single shock print.

In Adler’s framing, the mechanic is simple: realized losses are dominating realized income on moved cash, and the market is working by means of the availability owned by contributors pressured or keen to promote beneath their value foundation.

Associated Studying

“The depth and length of the present adverse regime level to huge capitulation of contributors who purchased cash at greater ranges,” he wrote. “The important thing reversal set off is the return of Web Realized Revenue/Loss above zero, which might sign the market’s transition from loss dominance to revenue dominance. So long as the metric stays in deeply adverse territory, vendor strain persists.”

Bitcoin Losses Match Luna Crash Scale

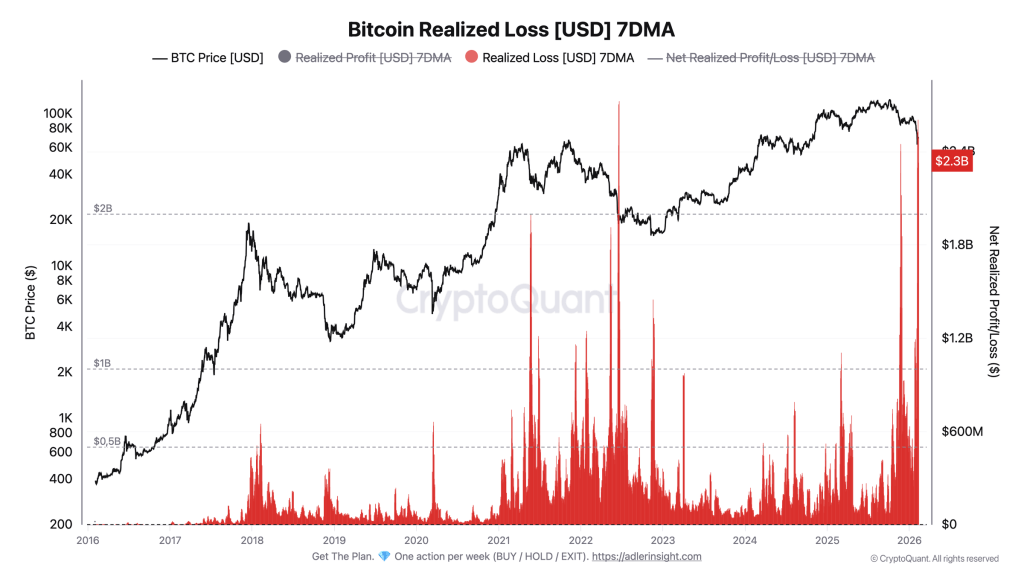

The companion chart, Bitcoin Realized Loss (7DMA), reveals realized losses rising to about $2.3 billion on Feb. 7 and holding close to that stage by means of Feb. 10, one other rarity in historic context. Adler referred to as it “one of many highest smoothed ranges in your entire historical past of observations,” explicitly evaluating it to June 2022.

He additionally emphasised that the 7-day smoothing understates peak stress in actual time. On the peak of the 2022 episode, Adler famous, single-day losses have been roughly thrice greater than the weekly-smoothed determine. Within the present window, he pointed to a single-day realized lack of $6.05 billion on Feb. 5, the second-largest one-day loss in Bitcoin’s historical past, in response to his be aware.

The headline comparability, nonetheless, is not only magnitude however setting. In 2022, an identical realized-loss regime occurred with bitcoin buying and selling round $19,000. This time, Adler says, the losses are being crystallized round $67,000 after a pullback from $125,000, a context he frames as a correction that’s flushing out late entries moderately than an ecosystem-wide failure cascade.

Associated Studying

“Again then, Realized Loss at $2.7B was occurring at a value of $19K,” Adler wrote. “Now, comparable loss volumes are being locked in at a value of $67K, which suggests not a systemic crash however moderately a flushing out of late bull-cycle entries. That is capitulation of native prime patrons, not a basic lack of community worth.”

Adler’s playbook places two markers entrance and heart. The primary is a sustained transfer of Web Realized Revenue/Loss (7DMA) again above zero for a number of weeks, which he frames because the transition from loss dominance to revenue dominance. The second is a decline of Realized Loss (7DMA) beneath $1 billion, which might point out that the wave of pressured or pain-driven promoting is fading.

The danger, in his view, is that the market’s “cleaning stress” shifts into one thing extra last if value weak point compounds. Adler flagged the sub-$60,000 space as a line the place continued progress in realized losses alongside additional value decline may flip a correction into “full-blown capitulation”, not as a result of the present prints are small, however as a result of the regime may prolong and deepen.

For now, Adler’s core declare is that Bitcoin is producing Luna-sized loss indicators with out Luna-like structural harm. Identical order of magnitude on-chain, completely different story within the tape.

At press time, BTC traded at $67,924.

Featured picture created with DALL.E, chart from TradingView.com