- XRP’s narrative is shifting from hypothesis towards regulated settlement ambitions

- Group occasions now act extra like coordination checkpoints than hype rallies

- Institutional distribution and compliance will outline XRP’s actual adoption path

For years, XRP bulls have argued the asset was constructed for cross-border settlement. Again then, that pitch typically appeared like advertising and marketing. The SEC lawsuit in 2020 didn’t simply damage value, it poisoned the whole institutional narrative. Even companies that loved the expertise didn’t need the regulatory danger.

Now the tone is totally different. With authorized readability improved after the 2025 settlement, XRP’s institutional thesis sounds extra credible than it has in a very long time. However there’s nonetheless a spot between “the case is stronger” and “the market has adopted it.” Saying XRP is institutional-ready is straightforward. Getting regulated gamers to truly combine it’s the onerous half.

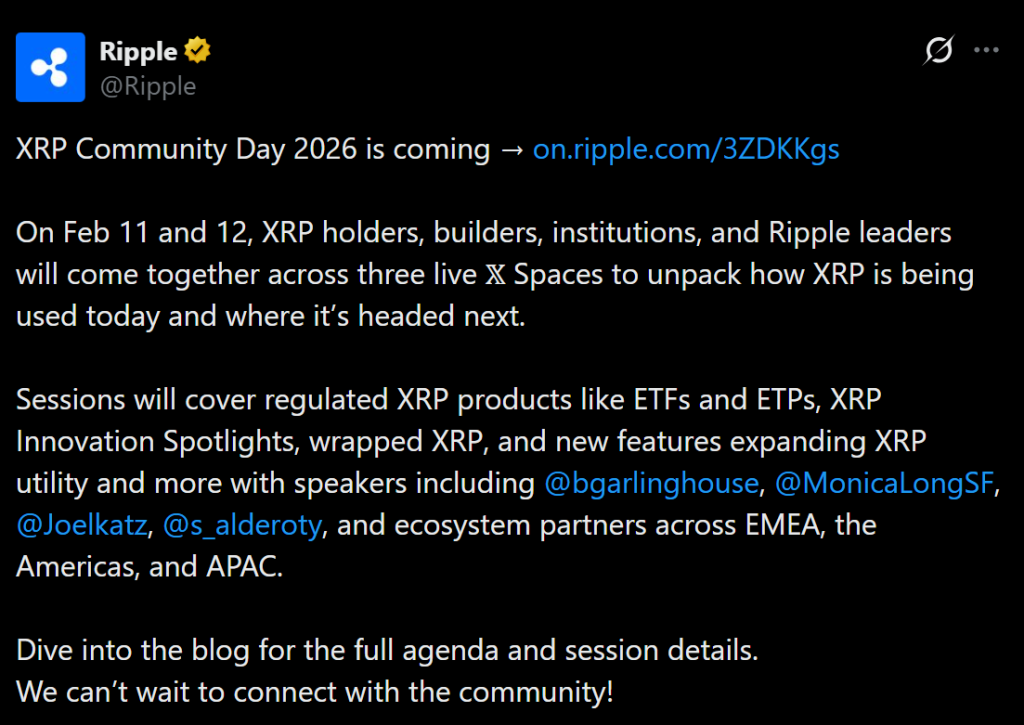

Group Day Is Turning into a Coordination Software

One refined change is how XRP ecosystem occasions operate. In earlier cycles, these gatherings have been largely about sentiment, neighborhood vitality, and typically price-driven hype. However now, occasions like XRP Group Day look extra like coordination factors.

Builders, issuers, and potential institutional companions use these moments to check roadmaps, align narratives, and quietly take a look at seriousness. That shift issues as a result of actual adoption doesn’t occur from tweets. It occurs when organizations resolve to allocate sources, combine infrastructure, and take compliance accountability. These occasions have gotten checkpoints the place these selections get nudged ahead.

XRP’s Utility Narrative Is Increasing Past Funds

The XRP story is not solely “Swift however sooner.” Funds are nonetheless central, however the ecosystem now talks extra brazenly about cross-chain liquidity, wrapped XRP, and DeFi-style purposes. That growth is intentional. It’s XRP attempting to suit right into a extra composable world with out shedding its authentic focus.

That is the place XRP’s path will get difficult. The extra it tries to be every thing, the extra it dangers diluting the simplicity that made its authentic pitch compelling. However on the similar time, if it stays too slender, it dangers being outpaced by broader ecosystems that may soak up a number of use circumstances directly.

Distribution and Regulated Entry Are the Actual Battleground

Right here’s the half that issues greater than any technical improve. If regulated monetary merchandise start holding or distributing XRP, the demand construction adjustments fully. Entry shifts from area of interest exchanges and retail-driven cycles to regulated channels the place bigger capital can transfer.

That’s why ETF-style distribution and institutional custody infrastructure matter a lot. They don’t simply create value pumps. They alter who can take part, how publicity is acquired, and the way lengthy capital tends to remain within the system.

Conclusion

XRP’s story isn’t completed, and it’s not a easy yes-or-no reply. The muse is stronger now: improved authorized readability, a extra critical compliance posture, and a extra mature ecosystem narrative. However actual adoption will hinge on whether or not regulated gamers see XRP as easier, safer, and cheaper than present rails.

Till establishments make binding integration selections, “institutional readiness” stays extra perception than reality. The subsequent section isn’t about hype. It’s about whether or not XRP can convert credibility into precise infrastructure utilization.

Disclaimer: BlockNews supplies unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.