- Citi accomplished a tokenization proof-of-concept on Solana, signaling institutional experimentation with real-world belongings.

- Solana processes roughly 3x extra every day transactions than Ethereum and its Layer 2 networks mixed.

- SOL ETFs noticed inflows regardless of an 11% weekly worth drop, hinting at long-term investor conviction.

Huge establishments are quietly constructing on Solana, even whereas SOL’s worth has been wobbling. On the identical time, the community is pushing out huge transaction numbers, virtually like nothing occurred. So what’s really happening right here? As a result of on the floor, worth and utilization appear to be telling two very totally different tales.

Let’s unpack it.

Solana Simply Acquired a Nod From Citi

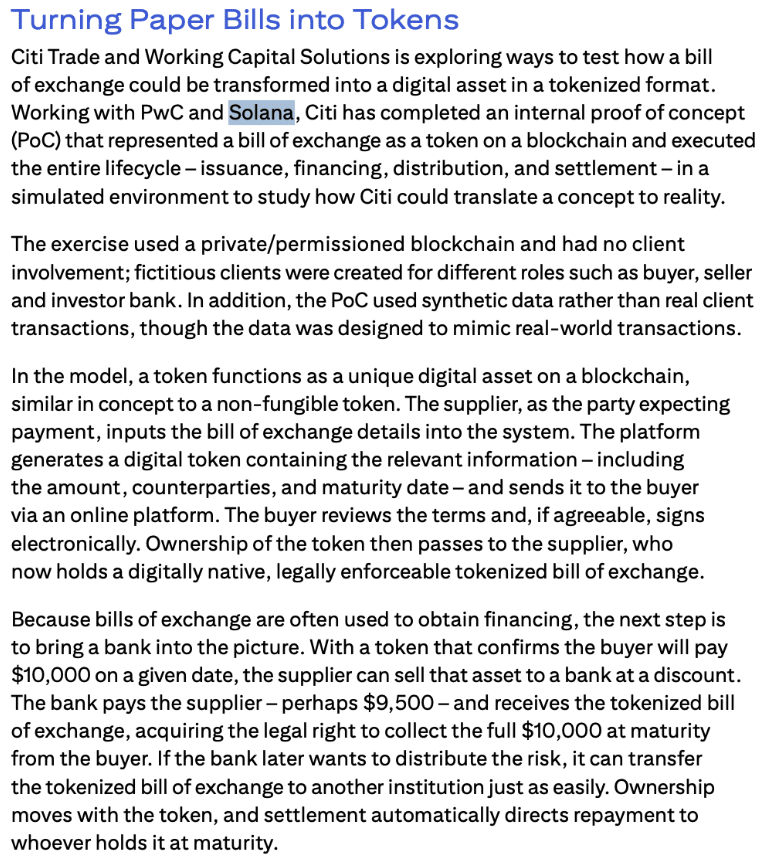

In a transfer that most likely didn’t get sufficient consideration, banking big Citi accomplished an inside tokenization proof-of-concept on Solana, working alongside PwC. This wasn’t a advertising stunt. The check simulated the complete lifecycle of tokenized payments of alternate, from issuance to distribution and ultimate settlement, all inside a managed surroundings.

The aim? To see how conventional monetary devices would possibly really perform on blockchain rails in a real-world setting. Not principle. Not whitepapers. Execution.

When a worldwide financial institution experiments with tokenization on a particular chain, that claims one thing. It doesn’t assure adoption, after all. But it surely exhibits that Solana is a minimum of being taken severely in rooms that don’t normally care about crypto narratives.

Solana Is Quietly Outpacing Ethereum in Transactions

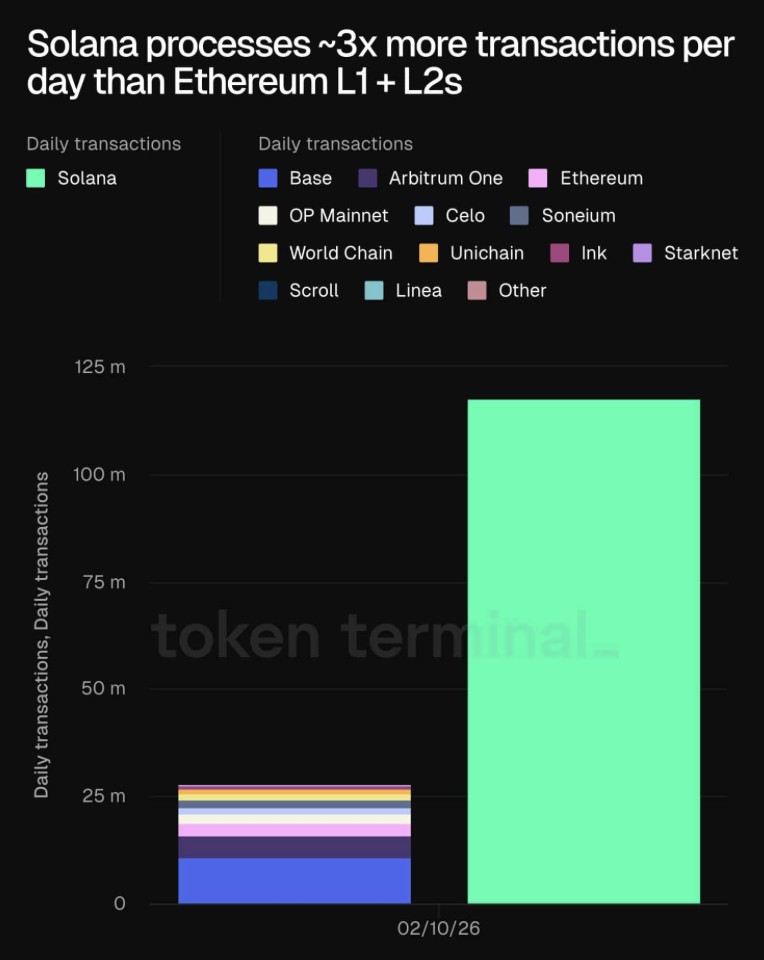

Whereas worth charts have been flashing purple, Solana’s community exercise has been flexing. Information from Token Terminal lately confirmed that Solana processes roughly 3 times extra every day transactions than Ethereum. And never simply Ethereum mainnet. Ethereum plus all of its Layer 2 networks mixed.

That’s not a small hole. It’s structural scale.

Now, critics will argue that uncooked transaction depend doesn’t equal financial worth, and that’s honest. However utilization nonetheless issues. Networks that aren’t getting used are likely to fade. Solana, a minimum of by this metric, isn’t fading.

TVL Is Decrease, However Exercise Is Nonetheless Sturdy

In keeping with DeFiLlama, Solana’s whole worth locked sits round $6.36 billion. That’s beneath its late-2025 highs, so sure, some capital has pulled again. But it surely’s not empty both.

DEX exercise stays stable, with roughly $3.72 billion in decentralized alternate quantity. That’s significant circulate. Perpetual futures buying and selling can also be notable, sitting close to $1.45 billion. Even in a risky surroundings the place SOL’s worth has dipped, customers haven’t deserted the ecosystem.

And that consistency is vital. Networks survive downturns by way of exercise, not hype.

ETFs Are Seeing Inflows Regardless of Value Weak spot

Right here’s the place it will get attention-grabbing. After a number of purple weeks, SOL spot ETFs recorded about $8.89 million in weekly inflows, pushing whole belongings underneath administration to roughly $673.99 million. This occurred throughout per week the place SOL itself dropped round 11%.

That sort of divergence normally alerts one thing. When worth falls however capital nonetheless flows in, it suggests buyers are wanting past short-term volatility. They’re positioning for the longer-term thesis.

It doesn’t imply the underside is in. But it surely does imply conviction isn’t disappearing.

The Larger Imaginative and prescient: Web Capital Markets

Zheng Jie Lim, Analysis and Information Engineer at Artemis, summed up Solana’s ambitions fairly immediately. In keeping with him, Solana leads in customers, transactions, developer development, buying and selling quantity, and costs. That’s a daring declare, however the metrics do present Solana sitting close to the highest throughout a number of classes.

His larger level was that that is how Solana turns into “the web capital markets.” That phrase isn’t simply branding. It implies a blockchain that helps buying and selling, settlement, issuance, and monetary exercise at web scale.

And while you step again, you may see the items lining up. Establishments like Citi are experimenting. Builders are constructing. Customers are transacting. Traders are allocating capital even throughout dips.

That mixture doesn’t occur randomly. It normally alerts that one thing structural is being constructed beneath the noise.

Now, whether or not SOL’s worth catches as much as that actuality within the close to time period is one other query. Markets can keep disconnected from fundamentals for longer than folks count on. However the exercise on Solana suggests the story isn’t slowing down simply because the chart seems drained.

Disclaimer: BlockNews gives impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.