The market is caught between deep concern and short-term stabilization as Bitcoin crypto at the moment trades close to key pivot ranges with volatility nonetheless elevated.

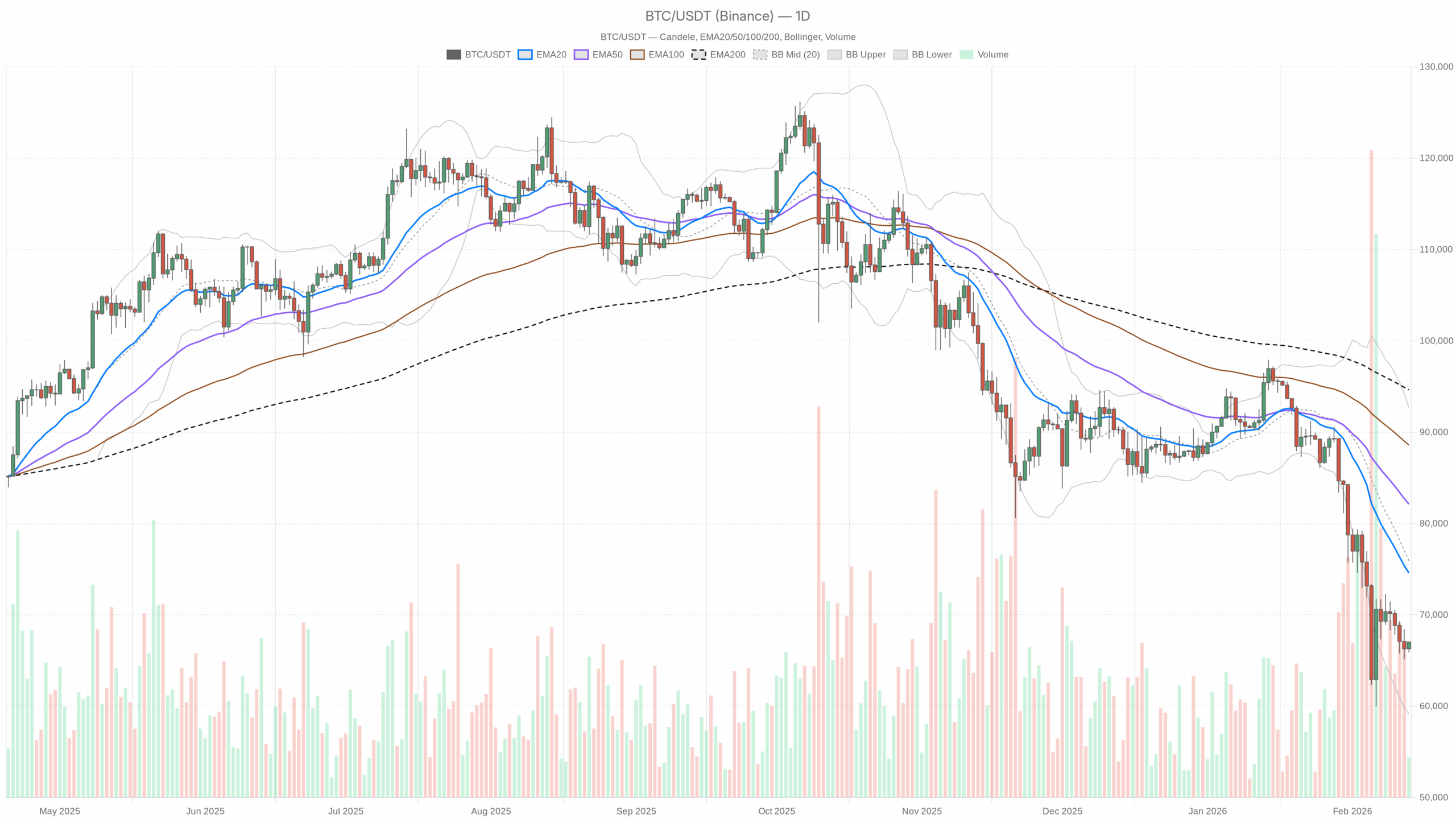

Day by day Timeframe (D1): Macro Bias – Bearish With Early Stabilization Makes an attempt

Day by day shut: $67,005

Regime: Bearish

Development Construction – EMAs

• 20-day EMA: $74,578.87

• 50-day EMA: $82,113.95

• 200-day EMA: $94,627.39

Worth is buying and selling far under the 20, 50, and 200 EMAs. Your entire moving-average stack is above spot, sloping down. That may be a basic, well-established downtrend: rallies into the low-70Ks would nonetheless be thought-about bounces inside a bearish construction, not a pattern reversal. In plain phrases, the market has loads of overhead provide to chew via earlier than bulls can discuss an actual restoration.

Momentum – RSI (14)

RSI (14): 31.14

Day by day RSI is hovering simply above oversold territory. Momentum remains to be unfavorable, however it isn’t in full capitulation mode anymore. Sellers have clearly dominated the current transfer, but they’re not urgent worth relentlessly to new lows. That opens the door for a reflexive bounce, but it surely doesn’t assure one. This will sit close to 30 for some time in entrenched downtrends.

Momentum – MACD

MACD line: -5,814.24

Sign line: -5,279.06

Histogram: -535.18

The MACD is deeply unfavorable with the road nonetheless under the sign. The histogram can be unfavorable, displaying bearish momentum stays in place. The excellent news for bulls is that the histogram’s measurement suggests the draw back impulse is not accelerating aggressively. Nevertheless, we’re not seeing a clear bullish cross but. The pattern remains to be down; the bleeding is simply slowing reasonably than reversing.

Volatility & Vary – Bollinger Bands

Center band: $75,915.57

Higher band: $92,674.33

Decrease band: $59,156.81

Worth at about $67K is parked within the decrease half of the band, effectively under the midline. The bands are large after the sharp selloff, confirming we’re in a high-volatility setting. Buying and selling this implies accepting greater intraday swings and the danger of sharp squeezes each methods. Being caught below the center band reinforces the bearish bias: the market remains to be dwelling within the decrease volatility regime of its current vary.

Volatility – ATR (14)

ATR (14): $5,200.43

A day by day ATR over $5K indicators very large common day by day ranges. Place sizing is crucial right here; small leverage could be worn out rapidly. Furthermore, for directional merchants, this volatility is alternative, but it surely additionally signifies that stops want extra room and also you should be ready for $3–6K swings with out overreacting.

Key Day by day Ranges – Pivot

Pivot level (PP): $66,659.30

First resistance (R1): $67,446.15

First help (S1): $66,218.64

Worth is hovering barely above the day by day pivot and slightly below R1. That tells you at the moment’s session is tilting mildly constructive intraday however nonetheless trapped in a good, indecisive band. So long as BTC holds above the pivot on a day by day closing foundation, the market is attempting to carve out a short-term base. Lose the pivot decisively, and the subsequent leg down opens up.

D1 Takeaway: The principle situation on the day by day is bearish. The pattern is down, momentum is weak, and volatility is elevated. The one silver lining is that some indicators are not accelerating to the draw back, which frequently precedes a reduction rally. Nevertheless, that might be a countertrend transfer till main EMAs are reclaimed.

Hourly Timeframe (H1): Brief-Time period Reduction Inside a Bear Market

Hourly shut: $66,978.24

Regime: Impartial

Development Construction – EMAs

• 20-hour EMA: $66,570.22

• 50-hour EMA: $67,014.44

• 200-hour EMA: $69,365.69

On the 1H chart, worth is sandwiched between the 20 and 50 EMAs and nonetheless effectively under the 200 EMA. That may be a short-term impartial to mildly constructive setup inside a bigger downtrend. The market has stopped trending straight down intraday and is attempting to construct a sideways-to-up consolidation. Nevertheless, the 200 EMA close to $69K stays a transparent cap. Any push there’ll check how aggressive sellers nonetheless are.

Momentum – RSI (14)

RSI (14): 54.42

Hourly RSI has recovered to the center vary. This displays modest shopping for strain after the selloff, however nothing euphoric or overstretched. Dip-buyers have stepped in sufficient to cease the bleeding on low timeframes, but there isn’t any robust momentum pattern up or down proper now. It’s extra of a rebalancing part.

Momentum – MACD

MACD line: -84.07

Sign line: -213.37

Histogram: +129.30

The MACD line remains to be under zero however has crossed above the sign, and the histogram is optimistic. That’s the footprint of a short-term bullish momentum swing inside an total weak backdrop. Sellers are dropping some management intraday, permitting for a corrective transfer increased or at the very least a range-bound pause after the aggressive drop.

Volatility & Vary – Bollinger Bands

Center band: $66,246.54

Higher band: $67,225.46

Decrease band: $65,267.63

BTC is buying and selling close to the higher half of the hourly bands, nudging nearer to the higher band. That usually displays a reduction part the place worth grinds increased or holds agency after a selloff. Till worth begins closing above the higher band repeatedly, that is extra according to a managed bounce reasonably than runaway upside.

Volatility – ATR (14)

ATR (14): $468.04

Hourly ATR round $450–500 factors to first rate however not excessive intraday ranges. For brief-term merchants, that is lively however tradable volatility. You possibly can construction intraday trades with no need absurdly large stops, although you continue to want some respiration room.

Key Hourly Ranges – Pivot

Pivot level (PP): $66,959.40

First resistance (R1): $67,118.81

First help (S1): $66,818.84

Worth is sitting virtually precisely on the hourly pivot. That’s the definition of a stability zone: neither bulls nor bears have actual intraday dominance at this second. A sustained push and maintain above R1 would verify the continued intraday reduction. A failure that drifts again below S1 would sign that sellers are regaining short-term traction.

H1 Takeaway: The hourly chart is neutral-to-mildly-bullish inside a macro downtrend. It exhibits stabilization and a possible bounce part, however nothing right here but challenges the day by day bearish construction.

15-Minute Timeframe (M15): Execution Context – Brief-Time period Consumers in Management

15m shut: $66,986.77

Regime: Impartial

Development Construction – EMAs

• 20-EMA: $66,634.93

• 50-EMA: $66,499.86

• 200-EMA: $66,970.18

On the 15-minute chart, worth is above the 20 and 50 EMAs and roughly consistent with the 200 EMA. Brief-term, patrons are clearly lively and have the micro-trend tilting upward. The truth that worth is testing across the 200 EMA exhibits we’re at a call level for scalpers. Both we proceed to construct a better intraday base above it, or we slip again below and return to cut.

Momentum – RSI (14)

RSI (14): 65.67

RSI on the 15m is pushing into the higher vary however not but at excessive ranges. Momentum is clearly favoring the upside for now on this timeframe. For very short-term merchants, this implies chasing right here has much less edge; the higher entries got here earlier within the transfer. For swing merchants, that is simply noise contained in the bigger day by day downtrend.

Momentum – MACD

MACD line: 163.57

Sign line: 107.51

Histogram: 56.06

The MACD on the 15m is optimistic and above the sign with a optimistic histogram. Brief-term momentum patrons are in command of the tape proper now. This helps the thought of an intraday rally or consolidation at increased ranges reasonably than rapid breakdown, aligning with the hourly image of short-term reduction.

Volatility & Vary – Bollinger Bands

Center band: $66,518.19

Higher band: $67,131.23

Decrease band: $65,905.15

Worth is hugging the higher half of the 15m bands, near the higher band. That’s what you usually see throughout intraday up-legs or squeezes. It’s constructive for short-term longs, but it surely additionally means the market is beginning to get crowded within the very close to time period. Small pullbacks are possible as late patrons pile in.

Volatility – ATR (14)

ATR (14): $230.33

Fifteen-minute ATR a bit above $200 is according to actively buying and selling circumstances. Brief-term swings are significant sufficient to matter for scalps, however not chaotic. It’s a workable setting for tactical entries and exits.

Key 15m Ranges – Pivot

Pivot level (PP): $66,960.50

First resistance (R1): $67,080.61

First help (S1): $66,866.66

Worth is simply above the 15m pivot and urgent towards R1. Microstructure favors the lengthy facet for the second: so long as we maintain above the pivot, dips are being purchased on this timeframe. A clear break under S1 would present the short-term push working out of steam.

M15 Takeaway: Brief-term patrons management the very near-term motion, however they’re buying and selling towards a dominant day by day downtrend. That is good for tactical performs, not a standalone cause for a long-term bullish stance.

Market Context: Dominance, Sentiment, and DeFi Exercise

• Bitcoin dominance: 56.6%

• Complete crypto market cap: about $2.37T (down 1.3% over 24h)

• Worry & Greed Index: 9 – Excessive Worry

BTC dominance above 56% tells you capital is hiding in Bitcoin relative to alts, which is basic risk-off habits inside crypto. Buyers are decreasing speculative bets and clustering within the perceived safer finish of the spectrum, or exiting the market outright. The drop in whole market cap and a roughly 9% droop in quantity over 24 hours reinforce the concept new cash just isn’t speeding in but. That is nonetheless a defensive tape.

Excessive concern at 9 is uncommon and tends to cluster round essential medium-term inflection factors. Traditionally, such readings have usually coincided with late-stage selloffs or accumulation zones for affected person capital. That stated, excessive concern by itself doesn’t imply the low is in. It means the market is fragile and yet one more shock can nonetheless set off pressured promoting.

On the DeFi facet, charges on main DEXes like Uniswap V3 and Curve are sharply down on the day and much more so over the week, which factors to decrease speculative buying and selling and leverage unwinds. The market is de-risking throughout the stack, not simply on centralized exchanges. This reinforces the macro view: speculative urge for food is muted, and liquidity is thinner.

Current information headlines are additionally leaning unfavorable: a crypto lender (BlockFills) suspending withdrawals, narratives round Bitcoin’s giant drawdown and weekend danger, and commentary that the age of hypothesis could also be ending. This type of information movement tends to speed up capitulation, however as soon as it’s absolutely priced in, it may well additionally mark the zone the place dangerous information stops pushing worth a lot decrease.

Placing It All Collectively: Conflicting Timeframes, One Dominant Development

Right here is the important thing rigidity: the day by day pattern is clearly bearish, whereas the hourly and 15-minute charts present a short-term restoration. That’s precisely how bear markets breathe. They function violent legs down adopted by sharp however fragile bounces.

- The day by day EMAs and MACD body a robust downtrend with heavy overhead resistance.

- The hourly MACD and RSI present that sellers are backing off intraday and permitting a reduction part.

- The 15m indicators verify that short-term momentum is up, possible pushed by brief overlaying and tactical dip-buying.

- Excessive concern and excessive ATR inform you volatility is excessive and positioning is careworn, which is fertile floor for each sharp squeezes and additional flushes.

The online consequence: macro bias is bearish, microstructure is stabilizing. Brief-term longs may fit tactically, however they’re swimming towards the prevailing present.

Clear Eventualities for Bitcoin Crypto At the moment

Bullish Situation

Within the bullish case, at the moment’s stabilization close to the day by day pivot evolves right into a extra significant reduction rally.

What helps this:

• Day by day RSI close to 30 has room to push increased on a mean-reversion bounce.

• Hourly MACD has already flipped optimistic on the histogram, and 15m momentum is firmly to the upside.

• Worth is sitting above intraday pivots (H1 and M15), and short-term EMAs are beginning to present help under spot.

On this situation, BTC would:

• Maintain above the day by day pivot at roughly $66.6K and convert that zone right into a short-term flooring.

• Push via rapid intraday resistances (R1s on 15m and 1h) and problem the 200-EMA on the hourly across the high-$60Ks to about $69K.

• Probably lengthen towards the 20-day EMA within the mid-$70Ks on a stronger squeeze, the place heavy provide is more likely to present up once more.

What would invalidate the bullish situation:

A decisive break and day by day shut again below about $66K, particularly if accompanied by rising day by day quantity and a recent rollover within the hourly MACD. That will point out the bounce was simply brief overlaying and that the dominant downtrend is prepared for one more leg decrease.

Bearish Situation

The bearish case is that the present reduction try stalls below close by resistance and the upper timeframe downtrend reasserts itself.

What helps this:

• Worth is much under the 20, 50, and 200 EMAs on the day by day, leaving a large air pocket above that usually attracts promoting on rallies.

• Day by day MACD stays deeply unfavorable with no confirmed flip, according to a prevailing bear pattern reasonably than a bottoming construction.

• Excessive concern, de-risking in DeFi, and unfavorable information movement point out broader risk-off, which might cap rallies.

On this situation, BTC would:

• Fail to carry above the hourly and 15m pivots, slipping again under roughly $66.8K after which the day by day pivot close to $66.6K.

• See the hourly MACD roll again over whereas RSI fails to push a lot past the mid-50s, signaling that patrons are exhausted even at depressed ranges.

• Retest and probably break the decrease day by day Bollinger Band area towards the low-$60Ks to high-$50Ks, consistent with the band’s decrease boundary round about $59K.

What would invalidate the bearish situation:

A sustained reclaim of the 20-day EMA (mid-$70Ks) with day by day closes above it, accompanied by an upturn within the day by day MACD, or at the very least a bullish cross, and RSI transferring again into neutral-to-positive territory (40s–50s). That will sign a real shift from pattern continuation to early pattern reversal.

Positioning, Threat, and The best way to Assume About This Tape

For merchants and buyers taking a look at Bitcoin crypto at the moment, the message from the chart just isn’t delicate. The trail of least resistance on the day by day remains to be down, however we’re getting into a zone the place each sharp squeezes and sharp flushes are on the menu.

Day by day ATR above $5K and hourly ATR close to $500 imply volatility is elevated throughout timeframes. Place measurement and leverage have to be aligned with that actuality. In a market with excessive concern and a broken day by day construction, rallies could be quick, and reversals could be brutal.

The multi-timeframe image provides a easy framework:

• The day by day tells you to not belief countertrend euphoria: till main EMAs are reclaimed, bounces are responsible till confirmed in any other case.

• The hourly and 15m present the place the reduction legs and intraday alternatives are, however they’re working inside a broader downtrend.

Brief-term members can work with the intraday pivots and EMAs, treating present power as a tactical window, not as affirmation of a brand new bull part. Longer-horizon members may even see excessive concern and heavy reductions from the highs because the early phases of an accumulation window, however the structural danger of decrease lows remains to be on the desk.

In this sort of tape, the sting comes much less from predicting the precise backside and extra from respecting the volatility, the higher-timeframe pattern, and the truth that sentiment is fragile. Till the day by day chart repairs itself, Bitcoin stays in a bear-controlled setting with intermittent, tradable bounces, not but in a confirmed restoration.