VIRTUAL value has skyrocketed, cementing its place because the chief amongst AI crypto brokers and now rating because the 4th largest AI coin available in the market, above WLD. With a staggering 536.03% improve prior to now 30 days, VIRTUAL has additionally entered the Prime 50 largest cryptocurrencies by market capitalization.

The coin’s spectacular rally has been fueled by sturdy momentum, pushing it to new all-time highs because it goals to interrupt additional resistance ranges. Nonetheless, with its RSI in overbought territory, merchants are maintaining a detailed eye on potential corrections that might problem its present bullish trajectory.

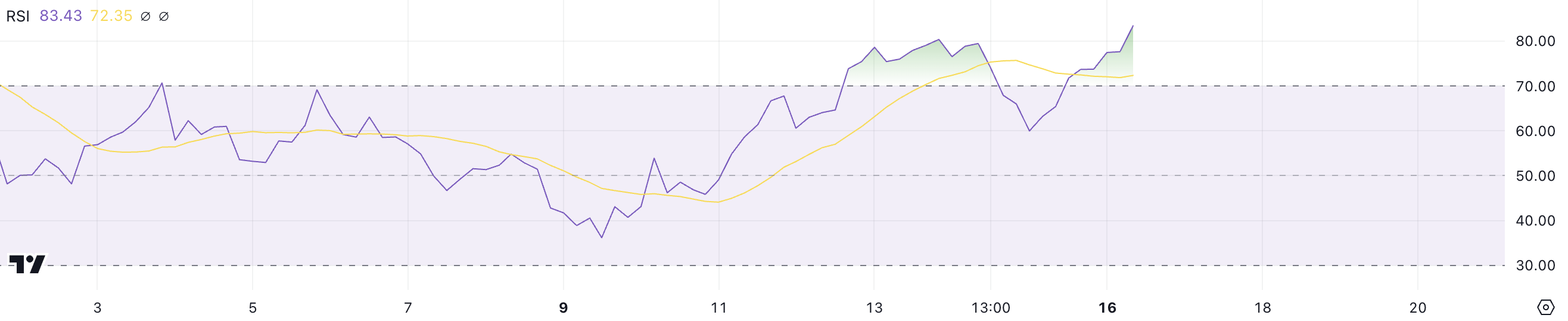

VIRTUAL RSI Is Exhibiting an Overbought Zone

VIRTUAL Relative Energy Index (RSI) is at the moment at 83, a pointy improve from 60 simply sooner or later in the past. RSI is a key momentum indicator that measures the velocity and magnitude of value adjustments on a scale from 0 to 100.

Values above 70 point out overbought situations, suggesting sturdy bullish momentum, whereas values under 30 mirror oversold situations and potential undervaluation. VIRTUAL’s RSI is effectively above the overbought threshold, highlighting important shopping for strain because the asset pushes towards new all-time highs.

Between December 12 and December 14, VIRTUAL’s RSI constantly stayed above 70, signaling sturdy momentum throughout that interval. Whereas this development may proceed within the coming days as VIRTUAL makes an attempt to interrupt new data, staying above 70 for an prolonged interval is difficult and infrequently unsustainable.

An RSI this excessive suggests the potential for a correction, as patrons could ultimately take income, easing upward strain on the worth. Merchants needs to be cautious of a possible pullback within the close to time period.

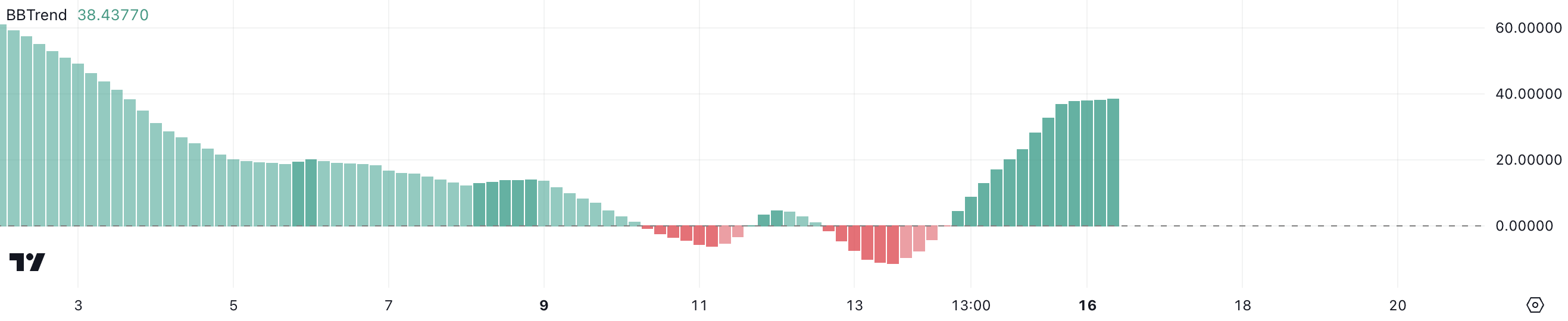

VIRTUAL BBTrend Is Nonetheless Excessive

VIRTUAL’s BBTrend is at the moment at 38.4, a big rise from -0.01 on December 14. This sharp improve signifies a considerable shift in momentum, highlighting sturdy bullish exercise.

BBTrend, derived from Bollinger Bands, measures value momentum and development route. Constructive values counsel bullish developments, and damaging values level to bearish strain. The transfer into firmly optimistic territory exhibits the power of VIRTUAL’s present uptrend.

After reaching ranges round 36 on December 15, VIRTUAL’s BBTrend stabilized at 38.4, signaling sustained bullish momentum. This elevated BBTrend worth means that VIRTUAL is in a robust uptrend, with value motion seemingly supported by continued shopping for strain, because the narrative round AI crypto brokers turns into extra standard.

Nonetheless, the stabilization signifies a attainable plateau in momentum, which merchants ought to monitor carefully for indicators of both additional acceleration or potential consolidation in VIRTUAL value development.

VIRTUAL Worth Prediction: Will It Fall Beneath $2?

VIRTUAL value is at the moment reaching new all-time highs, showcasing sturdy bullish momentum regardless of its excessive RSI ranges. If the uptrend continues, VIRTUAL may break by means of key resistance ranges and take a look at $3.5 and even $3.75 within the close to time period, solidifying its place because the top-performing synthetic intelligence coin within the final month.

Nonetheless, if the uptrend loses steam, a correction could happen, with VIRTUAL value doubtlessly testing assist ranges at $2.28 and $1.99. Ought to these helps fail to carry, the worth may drop additional to $1.34, marking a big retracement.

Disclaimer

According to the Belief Venture pointers, this value evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. All the time conduct your personal analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.