Bitcoin tracks macro strikes, amplifies downturns, and lacks structural management within the present cycle.

Crypto markets proceed to commerce inside a broader risk-driven surroundings. Worth swings stay tied to macro circumstances moderately than inside momentum. Bitcoin nonetheless reacts to fairness strikes as a substitute of setting its personal tempo. In keeping with current evaluation, structural energy has but to return.

BTC Lacks Independence From Shares as Traders Pull Capital

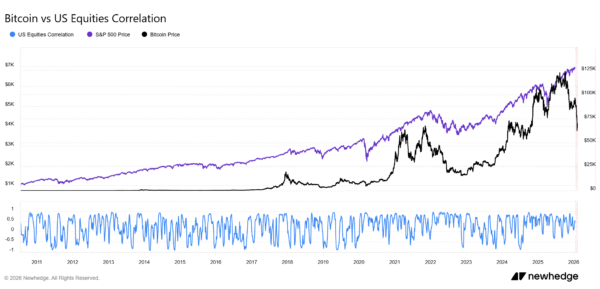

Bitcoin nonetheless strikes partly with the inventory market. Over the previous month, its reference to the S&P 500 has been reasonable, not very sturdy, however not unbiased both. Meaning Bitcoin just isn’t performing like a secure asset that strikes by itself. As an alternative, it’s nonetheless influenced by the identical financial pressures that have an effect on shares.

Throughout market stress, when shares or metals start to say no, Bitcoin responds extra aggressively. Small declines in conventional markets can result in bigger proportion losses in BTC.

Furthermore, value motion throughout main property displays a cautious surroundings. Bitcoin’s 30-day rolling correlation with the S&P 500 sits close to 0.25. Whereas the S&P 500 tendencies upward and gold holds energy, Bitcoin doesn’t transfer a lot. It doesn’t rise strongly or appeal to recent momentum. As an alternative, the asset trades sideways or drifts barely decrease.

Picture Supply: Newhedge

Latest Bitcoin ETF information additionally exhibits related weak point. On February 12, traders withdrew $410 million from spot Bitcoin ETFs, whereas not one of the 12 funds acquired new funds. Meaning cash flowed out of Bitcoin ETFs, with no offsetting inflows into different Bitcoin-based choices.

Taking a look at how Bitcoin strikes in comparison with the inventory market additionally helps clarify issues. The connection between Bitcoin and the S&P 500 just isn’t significantly sturdy, however it’s nonetheless evident. In easy phrases, Bitcoin just isn’t absolutely unbiased. It continues to reply to developments within the broader crypto market.

Altcoin Restoration in Doubt as Bitcoin Struggles to Lead

Bitcoin can be not behaving like a “secure haven” asset, similar to gold, which traders typically purchase throughout uncertainty. As an alternative, it continues to behave as a threat asset. When broader markets expertise stress or concern, Bitcoin normally does as properly.

Volatility indicators are starting to show increased once more. Information from the Bitcoin Volatility Index exhibits a 30-day volatility estimate of round 2.20%, whereas the 60-day studying stands close to 1.88%.

Latest compression of value swings signifies short-term stabilization. Nonetheless, the renewed uptick suggests expectations of wider value actions forward. Such will increase in volatility are related to uncertainty and repositioning.

If BTC fails to point out structural energy, smaller tokens face steeper odds. In keeping with the market analyst, as many as 95% of altcoins could by no means reclaim former peaks.

He stated the current weak point doesn’t sign the top of the cycle or an imminent collapse. Nonetheless, he argued that till BTC outperforms or demonstrates relative energy, any upside needs to be considered as a technical rebound.

The scenario, in the event you take a look at it with out bias, is nearly ironic in how easy it’s to learn.

When $SPX, gold and silver rise, Bitcoin doesn’t react strongly. It doesn’t speed up, it doesn’t present management. It stays there… flat, typically with a slight downward slope. It is as…

— EliZ (@eliz883) February 12, 2026

In his view, sustained management and resilience are wanted to verify a stronger pattern. The analyst added that crypto cycles stay intact and that one other growth part is more likely to comply with over time.

For now, he suggested market members to handle threat rigorously and protect capital whereas ready for clearer indicators of pattern reversal.