- Ethereum surged over 7% in 24 hours, main main crypto property larger.

- Softer inflation information and rate-cut expectations boosted danger urge for food.

- Brief masking in derivatives markets possible amplified the rally.

Ethereum lastly gave buyers one thing to smile about.

Over the previous 24 hours, ETH has climbed greater than 7%, buying and selling round $2,048 as of late afternoon. That sort of transfer may not sound extraordinary in crypto phrases, however contemplating how sluggish — and actually painful — the previous 4 months have been, it feels vital. There simply haven’t been many clear inexperienced days recently, so when Ethereum jumps this quick, folks discover.

And it’s not simply Ethereum shifting. The broader crypto market is flashing inexperienced throughout the board, however among the many prime 5 digital property by market cap, ETH is main the cost at this time. That management issues. It tends to sign that buyers are leaning again into danger just a little extra confidently.

A Reduction Rally After Months of Strain

Ethereum had been overwhelmed down arduous. At one level, it was sitting greater than 55% beneath its earlier peak, which is the sort of drawdown that forces even long-term believers to second-guess issues. When an asset with Ethereum’s monitor report falls that a lot, although, some buyers begin viewing it in another way — not as damaged, however as discounted.

Right now’s transfer additionally coincided with a softer-than-expected Client Value Index (CPI) studying. Inflation got here in lighter than many feared, and that small shift in information can change sentiment shortly. If inflation retains cooling and the labor market exhibits indicators of slowing, the argument for decrease rates of interest turns into stronger over time. And decrease charges are inclined to favor speculative, high-growth property like crypto. Ethereum sits close to the highest of that record.

So a part of this rally feels macro-driven. It’s not simply technical noise. It’s the market beginning to value in a barely extra forgiving atmosphere.

Ethereum’s Function in DeFi Nonetheless Carries Weight

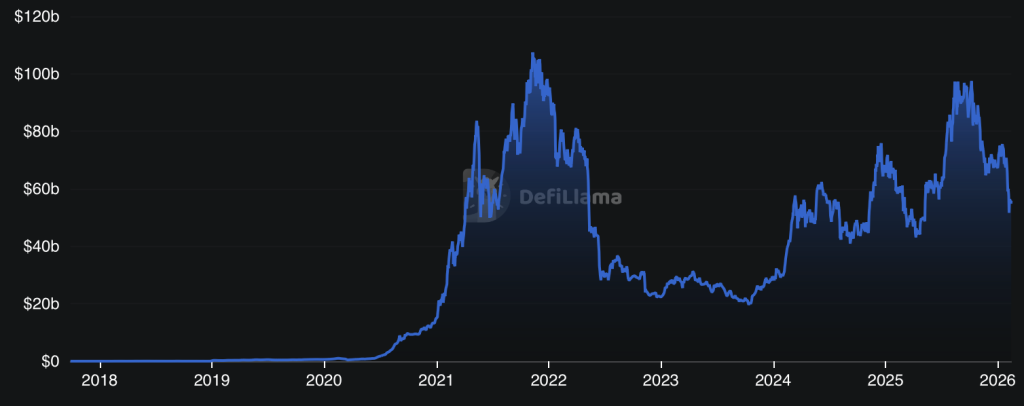

Past macro elements, Ethereum’s structural significance can’t be ignored.

It stays the dominant power in decentralized finance, with deep liquidity, robust developer exercise, and big community results. When risk-on sentiment returns, even briefly, Ethereum usually reacts extra aggressively than a few of its friends as a result of a lot of the derivatives and DeFi ecosystem runs by way of it.

That outperformance isn’t random. It displays Ethereum’s place on the middle of a whole lot of crypto infrastructure. When merchants rotate again into higher-beta performs, ETH is often one of many first main property to profit.

Brief Overlaying Might Be Fueling the Surge

There’s additionally a mechanical component at play right here.

A wave of bearish bets had constructed up in Ethereum’s perpetual futures and derivatives markets over current weeks. When value begins shifting towards these positions, merchants are compelled to shut shorts — which suggests shopping for again ETH. That purchasing strain can create a suggestions loop, accelerating positive factors quicker than spot demand alone would justify.

In different phrases, a few of at this time’s rally possible comes from quick masking. And as soon as that course of begins, it might probably transfer shortly.

Wanting forward, the important thing query is whether or not momentum holds. Ethereum had been deeply oversold by many technical measures, so there’s room for a continued restoration with out instantly flashing overbought alerts. But when this rally extends too far, too quick, merchants could begin locking in earnings simply as shortly.

For now although, the tone has clearly shifted. Ethereum isn’t out of the woods, not but, however at this time’s transfer exhibits that when sentiment turns — even barely — it might probably flip quick.

Disclaimer: BlockNews gives impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.