- Solana processes much more each day transactions than Ethereum L1 and L2 mixed, pushed by ultra-low charges.

- Large utilization doesn’t translate into equally large protocol income, highlighting a value-capture hole.

- Whale deposits into exchanges and realized losses add promote stress as SOL trades in a fragile zone.

Solana’s story proper now isn’t actually about value. It’s about sheer utilization.

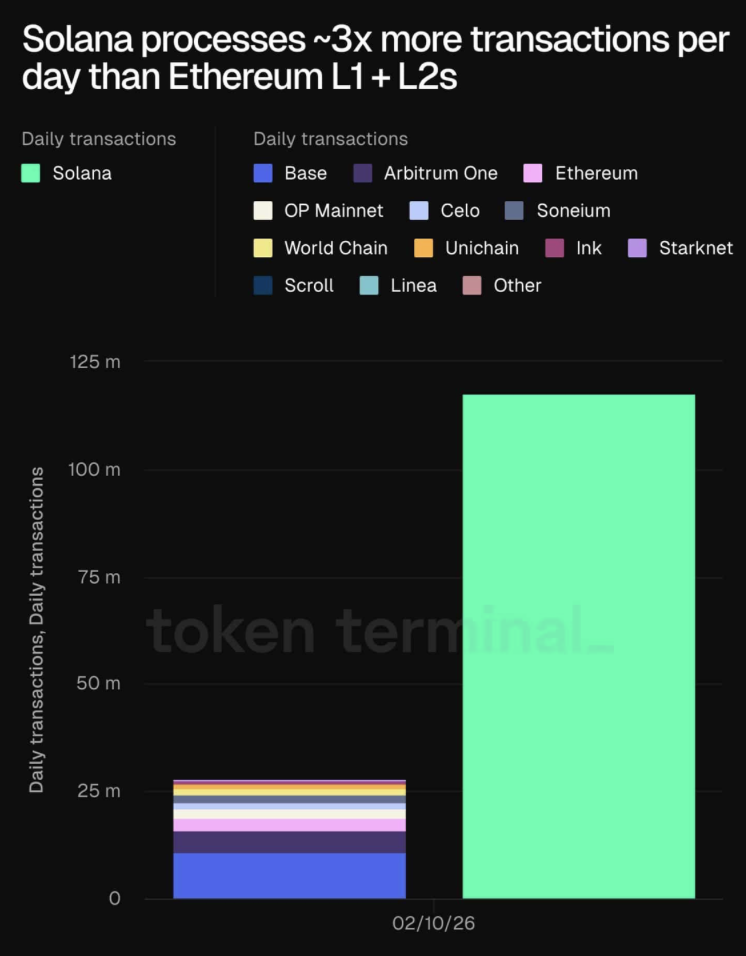

Whereas merchants maintain debating the place SOL is heading subsequent, the community itself is doing one thing fairly wild: it’s processing extra each day transactions than nearly all the pieces else in crypto put collectively. In accordance with TokenTerminal information, Solana is dealing with roughly thrice extra each day transactions than Ethereum’s Layer 1 plus all of its Layer 2 networks mixed. That’s not a small lead. That’s Solana mainly planting a flag and saying, “that is what high-throughput seems like.”

Solana Is Profitable on Uncooked Throughput, Not Hype

The numbers clarify why the Solana narrative retains surviving, even by drawdowns.

Solana is sitting round 285 million each day transactions, with reported throughput round 3,300 transactions per second. That’s the sort of scale Ethereum nonetheless can’t contact on L1. And it’s made attainable by the identical two issues Solana has at all times leaned on: quick execution and ultra-low charges.

That construction naturally attracts exercise. You possibly can commerce, swap, mint, and transfer funds round with out considering too exhausting about value. Consequently, person engagement has climbed too, with round 2.6 million lively addresses. That stage of participation retains Solana enticing for DeFi buying and selling, payment-style use circumstances, and something high-frequency the place pace issues.

However the catch is that not all transactions are equal. A bit of Solana’s quantity comes from vote transactions, which inflate totals. Actual “person TPS” is decrease than the headline quantity. And the community nonetheless has reliability questions, with success charges typically hovering round 40–50% in congested intervals, partly due to bot exercise.

So sure, Solana leads on throughput. However the community nonetheless has to show it could possibly maintain that pace whereas staying constant, as a result of reliability is what turns a quick chain right into a long-term settlement layer.

Solana’s Utilization Doesn’t Totally Convert Into Worth

Right here’s the place the story will get extra difficult.

Regardless that Solana dominates in transactions, it doesn’t seize worth the way in which you would possibly count on. The chain processes round 86 million non-vote transactions per day, but solely generates roughly $622,000 in chain charges. That’s a bizarre hole if you happen to’re considering in conventional network-effect phrases.

Evaluate that to Tron. Tron reportedly generates round $948,000 each day in charges, regardless of far decrease general exercise, as a result of stablecoin transfers drive steadier charge technology. Solana’s charges are nearly too low cost. Transactions averaging round $0.003–$0.007 make it extremely scalable, however in addition they suppress how a lot worth the bottom protocol captures.

In different phrases, Solana is constructed for quantity, not toll assortment.

The worth, as an alternative, shifts upward into the appliance layer. Solana data about $7.57 million in complete charges paid, together with roughly $6.66 million from apps. That’s the place the true financial exercise is displaying up.

Ethereum, although, nonetheless dominates in monetization. It generates round $18 million in complete charges and $11.7 million in app income, and it captures extra protocol-level worth by burns and MEV. That structural distinction issues, as a result of it highlights the core tradeoff: Solana can execute extra, however Ethereum extracts extra.

Solana is profitable the pace race. Ethereum is profitable the worth seize race. That’s the cleanest method to body it.

Whale Exercise Is Including a New Layer of Strain

Even with execution dominance, financial weaknesses can nonetheless translate into volatility. And proper now, whale habits just isn’t precisely calming anybody down.

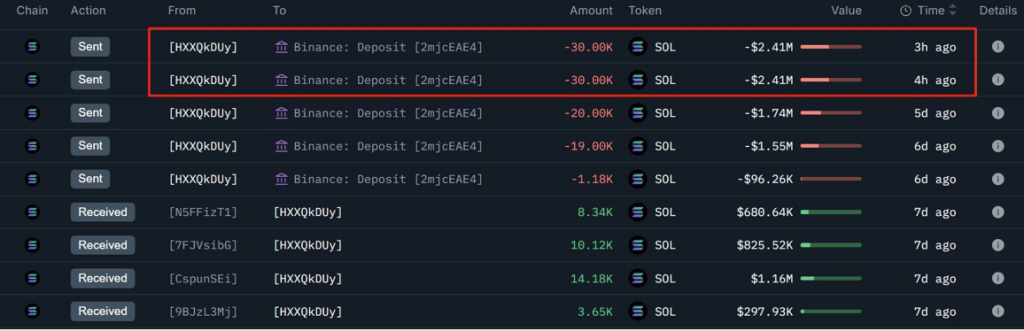

One pockets not too long ago deposited 60,000 SOL (value roughly $4.42 million) into Binance by staged transfers. Two deposits of 30,000 SOL alone totaled about $4.82 million inside hours. Earlier than that, smaller tranches — 20,000 SOL, 19,900 SOL, and 1,180 SOL — pushed cumulative change inflows above 100,000 SOL.

This issues as a result of the deposits adopted an earlier withdrawal of 111,945 SOL, initially valued round $17.16 million, which had been allotted for staking. The return movement realized roughly $9.78 million, locking in a lack of about $7.38 million, or round 43%.

That sort of gradual, phased depositing sample is commonly finished to cut back slippage throughout liquidation. It doesn’t routinely imply a full sell-off is going on, nevertheless it does recommend the pockets is de-risking.

And when whales are prepared to understand losses at that scale, it tends to bolster defensive sentiment out there, particularly whereas SOL continues to be buying and selling close to post-drawdown ranges.

Last Ideas

Solana’s dominance is actual, nevertheless it’s additionally messy.

On one hand, the chain is processing mind-blowing transaction quantity and pulling in thousands and thousands of lively customers. That sort of throughput accelerates ecosystem adoption, boosts liquidity velocity, and retains Solana positioned because the “execution layer” narrative chief.

Then again, the community nonetheless has reliability friction, and the economics aren’t as clear because the transaction counts recommend. Charges are so low that protocol worth seize lags behind chains like Ethereum, and even Tron exhibits stronger monetization in sure classes.

Solana is proving it could possibly transfer quick. The subsequent section is proving it could possibly do it reliably, and profitably, with out breaking when demand spikes.

Disclaimer: BlockNews supplies impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.