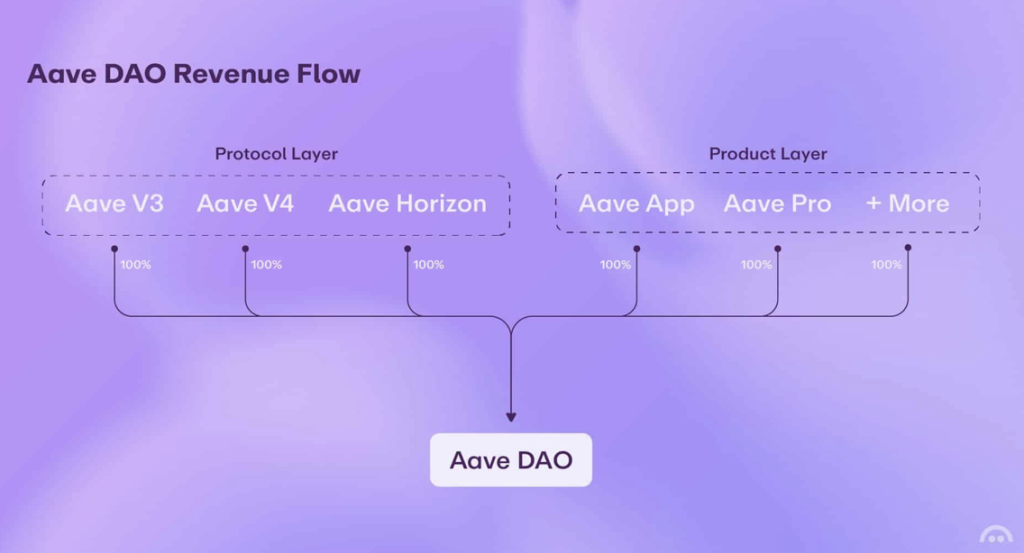

- Aave Labs proposed directing 100% of product income to the DAO below a brand new framework.

- In return, it requested $50M and 75,000 AAVE tokens to fund improvement.

- DAO members raised considerations about transparency and potential extraction, signaling governance tensions stay unresolved.

The uneasy truce between Aave Labs and the Aave DAO is beginning to really feel… fragile once more.

Again in January, either side agreed to chill issues off after a bruising governance struggle. Now Aave Labs has launched what it calls the “Aave will win” framework, a proposal that might direct 100% of product income from Aave-branded platforms straight to the DAO. On paper, that feels like alignment. In apply, it’s stirring up stress yet again.

100% Income to the DAO — With Situations

Underneath the proposal, each greenback generated from Aave-branded merchandise — Aave.com, the Aave cellular app, Aave Card, Aave Horizon (the tokenization platform), and different initiatives — would movement on to the DAO.

Stani Kulechov, Aave Labs CEO and founder, framed the transfer as a long-term structural shift. In response to him, the framework formalizes Aave Labs’ function as a long-term contributor working below a token-centric mannequin, with all product income benefiting the DAO. As DeFi and TradFi more and more blur collectively, he argues this construction positions Aave to seize development over the following decade.

That’s the imaginative and prescient. Huge, forward-looking, virtually company in tone.

However there’s a catch.

In trade for redirecting these income streams, Aave Labs is requesting $50 million from the DAO, together with 75,000 AAVE tokens, to fund continued improvement. The logic is that since their present earnings would now go on to the DAO, they want various funding to maintain constructing.

It’s not a small ask.

The Basis Proposal and Governance Tensions

Aave Labs additionally proposed forming a Basis to handle Aave’s manufacturers. The reasoning is that the DAO, being a decentralized governance physique and never a authorized entity, can’t successfully deal with model possession or authorized duties.

Structurally, that makes some sense. However politically? It’s difficult.

For context, the DAO represents tokenholders and controls ecosystem funding selections. Tensions escalated sharply in late 2025 when accusations surfaced that Aave Labs had diverted DAO income and sidestepped governance oversight concerning model management. The dispute rattled the market. AAVE’s worth fell from round $200 to just about $140 in the course of the peak of the battle.

January’s ceasefire introduced some aid, with Aave Labs promising a proposal aligned with tokenholder pursuits. This new framework is supposed to be that answer.

But not everyone seems to be satisfied.

DAO Pushback: “Extraction” Considerations

Marc Zeller, a vocal DAO member, responded critically to the proposal.

Whereas acknowledging that the framework may gain advantage the DAO, Zeller argued that the $50 million funding request seems like a one-sided negotiation. He described the state of affairs as Aave Labs presenting an answer “for the nice of the DAO” with out prior coordination with delegates or service suppliers. His concern? That the incentives may lean extra towards extraction than alignment.

He additionally referred to as for better transparency, together with clarification and a possible audit of Aave Labs’ earnings streams to confirm the declare that 100% of product income would certainly movement to the DAO.

In different phrases, belief stays skinny. And in DAO politics, notion issues virtually as a lot because the numbers.

Market Response and What Comes Subsequent

Apparently, AAVE’s worth rose about 7% following the announcement. Merchants, at the least initially, appear to view the framework as constructive. A cleaner income mannequin tied on to the DAO may strengthen token worth over time — if it really works.

However the market has seen this film earlier than.

If the governance dispute escalates once more, volatility may return shortly. Analysts warn that in a renewed disaster situation, AAVE may fall towards $79 or decrease. Governance threat, particularly in DeFi, tends to reprice property quick.

For now, the state of affairs sits in a grey zone. The proposal aligns income with tokenholders, which is optimistic. But the funding request and structural management questions reopen outdated wounds.

The ceasefire isn’t damaged. However it’s being examined. And whether or not this turns into a long-term alignment shift or one other chapter in Aave’s governance saga is determined by what occurs subsequent — and the way a lot belief either side are prepared to rebuild.

Disclaimer: BlockNews supplies unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.