Close to.AI co-founder Illia Polosukhin loves OpenClaw, the AI agent that has gone viral for its talents as an autonomous assistant, however thinks it’s a complete safety black gap.

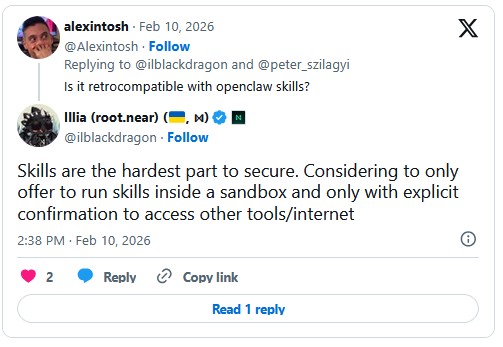

So he’s engaged on recreating OpenClaw in Rust, with all of the completely different instruments sandboxed in remoted WebAssembly environments in order that if one goes rogue, it doesn’t have an effect on anything. The system additionally treats immediate injections as safety dangers and protects in opposition to credential theft.

Polymarket merchants have been experimenting with OpenClaw to seek out worthwhile bets, however a viral submit this week reported that it could actually nonetheless reveal personal keys regardless of express directions to not.

Polosukhin says the answer with IronClaw is “to not let the LLM contact secrets and techniques in any respect.” Secrets and techniques are reportedly saved in an encrypted vault, with the big language mannequin granted permission to make use of them just for particular websites.

“Persons are dropping their funds and credentials utilizing OpenClaw,” Polosukhin defined this week. “Quite a few folks have stopped utilizing it as [they’re] afraid it should leak all of their info. We began engaged on security-focused model — IronClaw.”

George Xian Zeng, normal supervisor of Close to.AI, tells Journal that when Polosukhin will get impressed, he works quick.

“He constructed the premise of it in a single night,” explains Zeng. “He was feeding his child and constructing IronClaw on the similar time.”

OpenClaw was initially referred to as Clawdbot and was briefly generally known as Moltbot. Polosukhin has already made an unlimited contribution by developing with a approach cooler identify.

Why is OpenClaw such a safety threat?

Clawdbot went viral within the first place as a result of it’s a harness that controls a bunch of brokers, instruments and integrations working collectively to do helpful stuff. The system remembers your dialog at the same time as you turn between Telegram and Slack, and might carry out actions in your laptop and in your browser.

However with nice energy comes nice safety dangers. Giving it terminal entry, together with all of your credentials and crypto pockets, is an exploit ready to occur. It makes use of JavaScript, which has a big assault floor, however Rust eliminates total lessons of memory-safety bugs. Plus, it’s not very fashionable, so few hackers know the best way to use it.

Polushkin has made 74 GitHub commits prior to now week, and Zeng expects IronClaw to be completed and accessible on Close to.AI in a matter of weeks.

Within the meantime, Close to.AI Cloud lets anybody spin up an OpenClaw within the cloud in round half an hour (it’s in beta, so it’s important to apply for entry proper now). It runs in a Trusted Execution Atmosphere, so every little thing is encrypted and no person, together with Close to, can entry your information.

If you wish to have a non-public chat with DeepSeek for authorized recommendation, you don’t have to fret about incriminating chat logs showing in discovery. (Which is a big threat as Journal highlighted in January.) Close to’s OpenClaw additionally anonymizes requests to industrial fashions corresponding to Gemini and ChatGPT 5.2.

One drawback but to be solved is the quantity of threat concerned in downloading abilities from ClawHub. Slowmist this week reported that 341 of the accessible abilities comprise malicious code to gather passwords or information.

“The cool factor … is that anybody can construct a talent. However the harmful factor concerning the present market is that anybody can construct a talent,” says Zeng.

“How do you make a market that’s protected and efficient, proper? We’re nonetheless going via how precisely do you make that work? I believe it’s affordable to think about perhaps, like, a curated market.”

Close to has additionally launched a crypto-based market enabling AI brokers to rent one another or for people to rent brokers. At current, most of the 1,900 accessible jobs contain constructing for Close to itself, however constructing or shopping for abilities may emerge as an fascinating use case.

“Consider it as your guardian angel within the digital house”

Illia Polosukhin explains IronClaw’s evolution, from OpenClaw in safe environments to AI you may really belief to be in your facet. pic.twitter.com/2dzuusKbwD

— The Rollup (@therollupco) February 9, 2026

Amazon’s AI surveillance state

Amazon’s Tremendous Bowl industrial for its Ring doorbell sparked a swift privateness backlash. The advert showcased its AI-powered Search Occasion characteristic, which makes use of neighborhood cameras to discover a cute misplaced canine.

However it’s fairly apparent that the characteristic, which is switched on by default, may flip your neighborhood right into a surveillance state and observe your each transfer. My neighborhood WhatsApp group is already filled with doorbell digital camera footage of individuals stealing packages and letting down different folks’s tires.

Rival doorbell digital camera firm Wyze launched this very humorous take-down.

Factor of absolute magnificence. Give whoever made this video an enormous fats elevate, Wyze

pic.twitter.com/3uYktNfXsC— Enguerrand VII de Coucy (@ingelramdecoucy) February 11, 2026

Olas releases prediction market bots for Polymarket

Everybody instantly appears to be working AI brokers to try to uncover arbitrage methods on Polymarket to take advantage of information replace delays or market inefficiencies — corresponding to when Sure and No are each priced at 45c, which means in the event you purchase each, you may theoretically make a 10c revenue.

Olas has been engaged on the presumption that AI brokers would be the essential merchants on prediction markets sooner or later and affords the Omenstrat agent on its Pearl market. These brokers have collectively accounted for 13 million transactions on the Omen prediction platform on Gnosis. Rechristened Polystrat, the brokers are actually being unleashed on Polymarket.

“This was all the time a considerably area of interest utility,” says David Minarsch, co-founder of Olas and CEO of Valory. “Customers had been saying, OK, nicely, why doesn’t this factor run on Polymarket?”

These brokers don’t try and determine arbitrage; as a substitute, they use a spread of reports sources, public information, and different instruments to foretell outcomes in markets that resolve in beneath 4 days. Minarsch says they “are sufficiently highly effective to have above common efficiency over very long time horizons.”

“What we see with Omestrat is that over time they’ve a 55% to 65% success price relying on which fashions, instruments they use.”

In keeping with information shared with Journal, the win price is between 59.2% to 63.6% throughout classes like sustainability, science, enterprise and curiosities, however falls to 37.96% to 48.57% for bets on style, arts, animals and social. For sports activities, you may as nicely flip a coin (51.01%).

And naturally, these outcomes are from Omen, which is a a lot smaller market than Polymarket.

Learn additionally

Options

Australia’s world-leading crypto legal guidelines are on the crossroads: The within story

Options

Transfer to Portugal to turn into a crypto digital nomad — All people else is

You possibly can tailor your betting technique by chatting together with your Polystrat, and all important pockets and bet-related features are hardcoded to stop the agent from going rogue together with your funds.

“That’s a key architectural design choice, which actually restricts the potential of the agent,” Minarsh says. “So, our totally structured agent gained’t instantly turn into your private assistant. However it additionally means it’s safer.”

Olas takes a lower of charges paid to instruments, fashions and different brokers. You possibly can run it domestically, however utilizing it by way of the Pearl retailer requires staking OLAS. Minarsh says funding it with $100 will allow the agent to guess autonomously on sufficient markets to get a way of its strengths and weaknesses.

All Killer, No Filler AI Information

— That viral story in The New York Instances a couple of author who churned out 200 books with AI might need simply been an advert for an AI guide era course.

— Polymarket has partnered with Kaito AI to launch “consideration” markets, the place you may place bets on how viral one thing is and whether or not it’s being acquired in a constructive or destructive approach.

— The Tremendous Bowl was plastered with adverts for AI from 16 tech corporations. There’s a principle that any tech sector that dominates Tremendous Bowl adverts crashes quickly after; internet corporations dominated in 2000, and crypto corporations had been in all places in 2022.

— Everybody’s speaking about how the text-to-video AI era instrument Seedance 2.0 will remodel films, however a brand new McKinsey report says AI instruments are already reworking the manufacturing course of by turning screenplays into storyboards, and producing lists of places, props and different necessities.

This one-minute video was apparently created by Seedance with only one picture and one immediate:

Seedance 2.0 kinda makes it laborious for businesses and manufacturing homes to disregard AI now.pic.twitter.com/20QMJTJl00

— Dinda Prasetyo (@heydin_ai) February 11, 2026

Subscribe

Probably the most partaking reads in blockchain. Delivered as soon as a

week.

Andrew Fenton

Andrew Fenton is a author and editor at Cointelegraph with greater than 25 years of expertise in journalism and has been overlaying cryptocurrency since 2018. He spent a decade working for Information Corp Australia, first as a movie journalist with The Advertiser in Adelaide, then as deputy editor and leisure author in Melbourne for the nationally syndicated leisure lift-outs Hit and Switched On, revealed within the Herald Solar, Day by day Telegraph and Courier Mail. He interviewed stars together with Leonardo DiCaprio, Cameron Diaz, Jackie Chan, Robin Williams, Gerard Butler, Metallica and Pearl Jam. Previous to that, he labored as a journalist with Melbourne Weekly Journal and The Melbourne Instances, the place he gained FCN Greatest Function Story twice. His freelance work has been revealed by CNN Worldwide, Unbiased Reserve, Escape and Journey.com, and he has labored for 3AW and Triple J. He holds a level in Journalism from RMIT College and a Bachelor of Letters from the College of Melbourne. Andrew holds ETH, BTC, VET, SNX, LINK, AAVE, UNI, AUCTION, SKY, TRAC, RUNE, ATOM, OP, NEAR and FET above Cointelegraph’s disclosure threshold of $1,000.

Learn additionally

Options

Actual AI use instances in crypto, No. 2: AIs can run DAOs

Andrew Fenton

5 min

November 28, 2023

Real, no bullsh*t, hype-free use instances for AI in crypto: How AIs may help run DAOs and make them genuinely autonomous.

Learn extra

Hodler’s Digest

FTX EU opens withdrawal, Elon Musk requires AI halt, and Binance information: Hodler’s Digest, March 26–April 1

Editorial Employees

6 min

April 1, 2023

FTX Europe opens withdrawal for European clients, a petition seeks to halt AI growth, and Binance is sued by U.S. authorities.

Learn extra