It’s Friday, Feb. 13, and in right this moment’s prime tales XRP positive aspects stronger trade depth with a brand new Binance itemizing, Bitcoin Money extends its dominance among the many prime 10 tokens amid a revived “Bitcoin with out Saylor” narrative and Charles Hoskinson outlines values-based standards as Cardano’s privateness chain, Midnight, enters the ultimate launch stage.

TL;DR

- Binance opens XRP/U spot buying and selling, including the United Stables liquidity layer.

- Bitcoin Money holds a $10.55 billion market cap and sustains its prime 10 rating.

- Hoskinson requires ethics-driven blockchain growth as Cardano ecosystem prepares Midnight launch.

Binance expands stablecoin choices for XRP with XRP/U pair itemizing

Based on a brand new X put up, Binance launched a brand new XRP/U buying and selling pair, introducing United Stables (U) as a brand new liquidity layer for XRP.

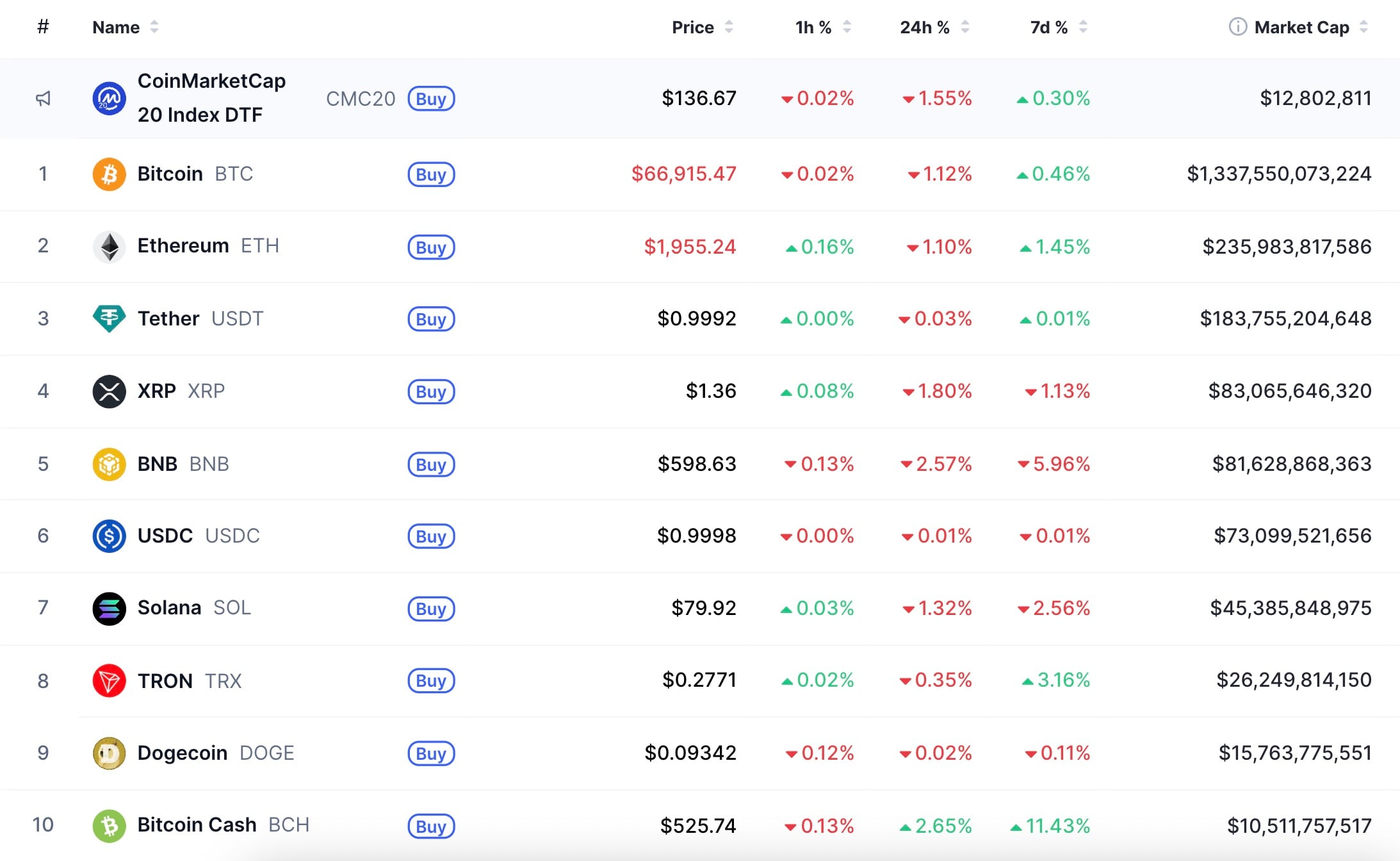

Crypto Market Overview: XRP Consolidates Amid Low Volatility, DOGE Struggles at $0.10, Is Shiba Inu (SHIB) Testing Key Help?

U.Right now Crypto Digest: Shiba Inu Worth Rebounds, Ex-Ripple CTO Calls Bitcoin ‘Useless Finish’, Goldman Sachs Owns 14% of XRP ETF

Binance stays one of many largest spot markets for XRP, in line with CoinMarketCap knowledge, with the XRP/USDT pair producing $154,548,191 in current 24-hour quantity. Even the USDC pair there value $52,776,085 in every day quantity is greater than most different exchanges have in principal USDT or USD pairs.

It’s an attention-grabbing element that Korean crypto exchanges like Upbit and Bithumb have the equal of $185,369,440 and $154,892,350, respectively, for XRP/KRW pairs.”

United Stables (U), listed on Binance in January 2026, is a meta-stablecoin backed by a reserve mannequin accepting USDT, USDC and USD1. As the primary native stablecoin on BNB Chain utilizing a multiasset reserve construction, it goals to standardize settlement and liquidity flows throughout DeFi, CEXes and funds rails.

XRP’s integration into the U buying and selling pair lineup displays rising deal with stablecoin-agnostic buying and selling and cross-reserve fungibility.

Bitcoin Money solidifies prime 10 standing as “Bitcoin with out Saylor” narrative positive aspects steam

Whereas Binance continues to broaden the market share for XRP and U, Bitcoin Money, in its personal lane, is holding a place within the prime 10 cryptocurrencies by market cap on CoinMarketCap, with a determine of $10,553,475,202 on the time of writing. After a breakthrough earlier this yr and dethroning Cardano (ADA), BCH’s presence within the prime 10 has drawn renewed consideration to this once-forgotten Bitcoin fork.

Now that its prime 10 standing seems sustainable, public figures like “thedefivillain” have labeled it “Bitcoin with out Saylor” in an try to border its relative power inside a broader narrative.

If that’s an expression of the opinion that Saylor and the Bitcoin Normal he carried out at Technique are poisonous to Bitcoin, or an try to elucidate why Bitcoin Money could also be superior to its authentic counterpart is open for debate. One might say that each of those explanations have a proper to life. The very fact is, the crypto neighborhood appears open to discovering an concept inside the digital belongings area that won’t have such a heavy entity tied to it.

It’s no shock actually, contemplating that Bitcoin’s success was principally attributed to the disappearance of its creator, often known as Satoshi Nakamoto, and with Saylor absorbing 3.4% provide of the cryptocurrency and being the primary subject of just about all discussions round BTC, this may occasionally spoil the attraction for some.

All issues thought of, some could attribute the resilience of Bitcoin Money to its huge presence within the on-line on line casino and gaming sectors. Others could argue that its power comes from mining being extra worthwhile than Bitcoin. One other group of individuals could name it “Bitcoin with out Saylor.” The reality, one could argue, lies within the worth chart, whereas narratives and information are usually constructed afterward.

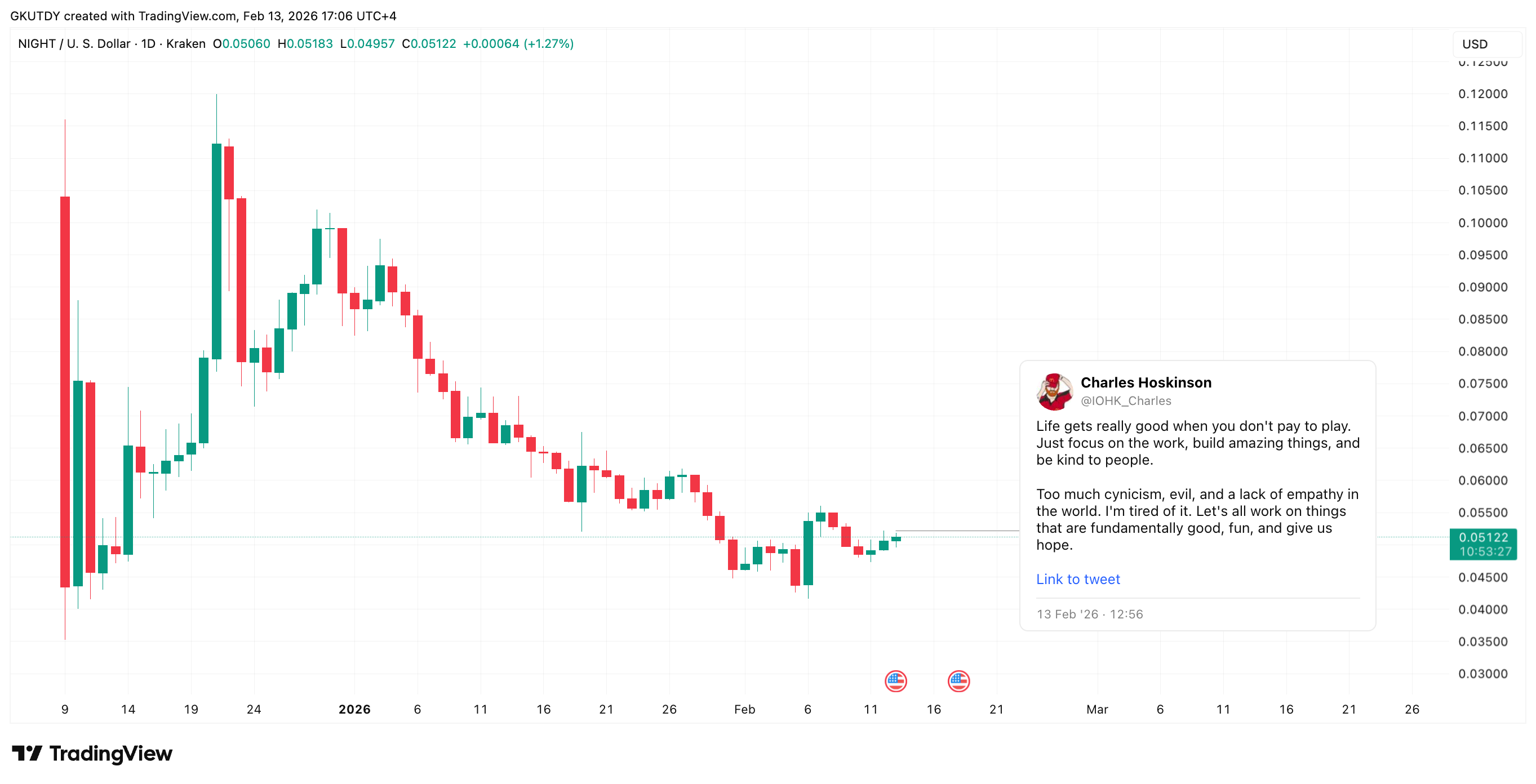

Hoskinson defines “anti-cynicism” standards as Cardano’s Midnight prepares March launch

XRP and BCH tales apart, Charles Hoskinson used social media this Friday to speak a few values-driven framework for growth because the Cardano creator appears to be bored with “pay to play.” For him, significant work mustn’t depend on such buildings and will deal with constructing essentially good and hopeful programs. These ideas of Hoskinson’s look like a response to a “lot of cynicism” and an absence of empathy within the crypto trade.

Past all of the speak, there are actual steps being taken to make that occur. Beforehand this week, Hoskinson confirmed that Midnight, a blockchain centered on privateness and constructed on Cardano, will launch within the final week of March 2026.

Midnight’s structure is all about ensuring transactions are non-public by default, and it solely discloses the data it must by one thing referred to as zero-knowledge proofs. The purpose is to discover a center floor between privateness and compliance, avoiding the straightforward selection of privateness vs. compliance.

So, the “anti-cynicism” method strains up with real-world motion, like privateness infrastructure, simulation instruments, cross-chain growth and ecosystem integration. Whether or not this method will result in capital inflows will depend on how effectively it’s adopted after launch, not simply on the general Cardano ecosystem’s place on the matter.

Crypto market outlook: Key ranges to look at for BTC, ADA, XRP

This week’s worth motion was pushed principally by macro knowledge, with NFP and CPI releases setting the tone throughout danger belongings, and digital ones particularly. Crypto responded with brutal sell-offs, random pumps, excessive worry and extra uncertainty.

Although the infrastructure and atmosphere across the digital belongings market continues to evolve, with new CFTC assembling 35 key figures of the marketplace for a brand new advisory panel.

Key ranges to look at:

-

Bitcoin (BTC): BTC is buying and selling close to $67,069 after rebounding from a washout to $60,000. Fast resistance now sits round $72,000. On the draw back, $64,000 acts as short-term assist, whereas a lack of that stage would reopen draw back danger towards the $60,000 liquidity pocket.

-

XRP: XRP is at present buying and selling close to $1.365 on the every day timeframe. After the early February capitulation wick towards the $1.10-$1.15 zone, the worth rebounded however remained structurally beneath prior consolidation ranges. Fast resistance is now positioned at $1.50. On the draw back, $1.30-$1.32 serves as short-term assist. A lack of that space reopens danger towards the February low close to $1.10.

-

Cardano (ADA): ADA is at present buying and selling close to $0.2627 after extended draw back stress. Fast resistance is positioned at $0.30, adopted by a broader provide zone close to $0.35. On the draw back, $0.25 is the important thing structural assist. A decisive reclamation of $0.30 would sign short-term restoration potential forward of the late-March Midnight launch, whereas continued compression beneath that threshold retains momentum impartial to weak.

Total, Bitcoin stays the directional anchor. So long as BTC holds above $64,000, altcoin stabilization stays doable. A breakdown beneath that stage would possible stress the ADA and XRP assist zones in tandem.