The digital property market, and Bitcoin particularly, enter Thursday’s session, Feb. 12, with threat positioning recalibrating forward of Friday’s U.S. CPI launch. This report’s three huge tales eloquently element what is going on on in crypto proper now as XRP has turned constructive on the day close to $1.39, Binance confirms completion of its $1 billion SAFU fund with 15,000 BTC already in revenue and Solana’s Mert Mumtaz outlines three huge upgrades for February 2026.

Fast abstract

- XRP reclaims $1.39 zone forward of CPI launch on Feb. 13.

- Binance’s $1B SAFU Fund now holds 15,000 BTC and is already up $1.89 million in revenue.

- Helius CEO Mert Mumtaz confirms upcoming Solana rollouts this February: Privateness, predictions, perpetual futures and one “huge shock.”

XRP turns “inexperienced” forward of Friday CPI

XRP has turned constructive into the Thursday buying and selling session, up almost 2% to $1.3978, as per TradingView knowledge. After holding assist simply 10% above the Oct. 10 capitulation zone round $1, the native construction now reveals the value consolidating beneath the $1.48 resistance zone, a breakdown space from early February.

Crypto Market Assessment: XRP Consolidates Amid Low Volatility, DOGE Struggles at $0.10, Is Shiba Inu (SHIB) Testing Key Assist?

U.At the moment Crypto Digest: Shiba Inu Value Rebounds, Ex-Ripple CTO Calls Bitcoin ‘Useless Finish’, Goldman Sachs Owns 14% of XRP ETF

As seen on the every day chart, XRP is now inside a large $1.20 and $1.48 vary, with the decrease boundary serving as reclaimed assist after a deep flush final week. Reversal alerts haven’t been confirmed, however the U.S. macro calendar may present a catalyst.

The subsequent U.S. Shopper Value Index (CPI) report is scheduled for Friday, Feb. 13, per the Bureau of Labor Statistics. That is the ultimate main inflation print earlier than the Federal Reserve’s March 4 rate of interest determination.

The earlier CPI report in January got here barely softer than anticipated at 2.6% — a minimal in 4 years. If February’s determine reveals additional disinflation, risk-on property, together with crypto, might lengthen the restoration.

For XRP, extremely delicate to macro shifts not solely as a consequence of its institutional narrative and ETF flows however as a longtime cryptocurrency strongly tied to the U.S. greenback, the present setup is as follows: a break above $1.48 opens the trail to $1.60-1.80, whereas the lack of the $1.20 zone makes retesting $1 the primary precedence.

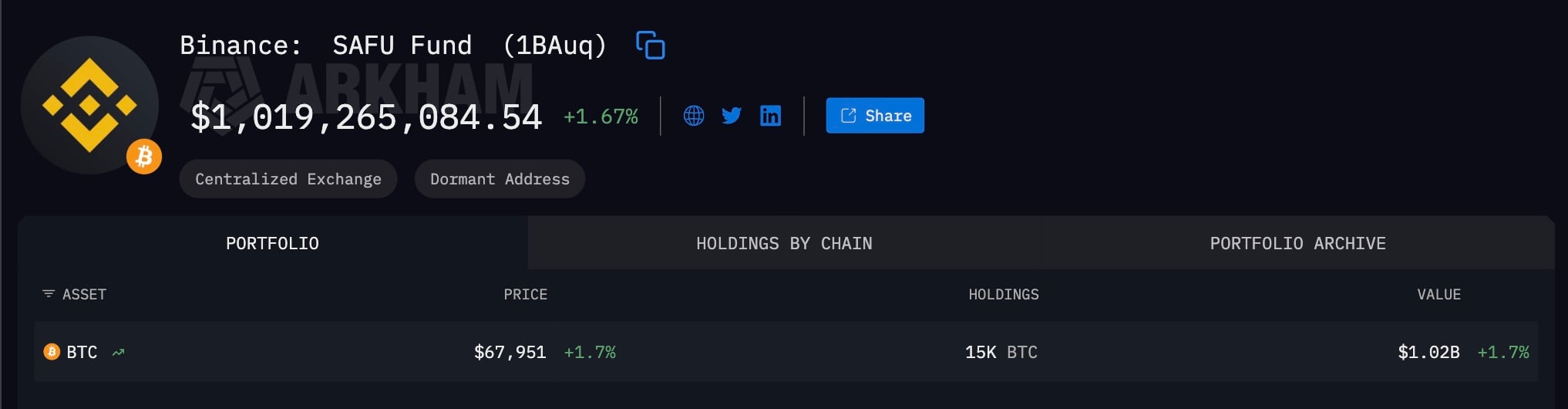

Binance finalizes SAFU Fund completion with 15,000 BTC already producing revenue

Based on the official announcement on X, Binance has finalized the total transition of its SAFU user-protection reserve from stablecoins into Bitcoin, finishing a $1 billion conversion program with the final tranche of 4,545 BTC as we speak. The whole SAFU fund of the world’s largest crypto change now holds 15,000 BTC.

After as we speak’s acquisition, the common buy-in value for the BTC reserve stands at roughly $67,000, in accordance with the corporate. At a spot value of $67,933, this places the fund’s present notional worth at round $1.018 billion, yielding an unrealized achieve of round 1.39%, or $1.89 million already, as per Arkham.

For many who missed the information, beforehand, on the finish of January, Binance introduced its intent to maneuver all SAFU holdings into BTC to enhance transparency and mitigate stablecoin devaluation dangers. The fund, which is used as an emergency insurance coverage mechanism for customers in case of essential failures, was beforehand denominated in BUSD and TUSD.

One main element is that If Bitcoin holds above this degree, Binance will proceed to replicate mark-to-market revenue. Extra to the purpose, if the BTC worth drops and the fund falls beneath $800 million, Binance promised to inject extra capital to return it to the $1 billion threshold.

This introduces a quasi-mechanical purchase mechanism. If BTC experiences a extreme drawdown and the fund’s valuation dips underneath $800 million, Binance would step in to replenish the reserve again to $1 billion, successfully accumulating extra BTC.

On the broader chart, Bitcoin is presently buying and selling close to $67,930 after rebounding from sub-$60,000 lows earlier this month. Main resistance sits round $74,000 and $92,000, whereas structural assist is concentrated close to $60,000.

Solana prepares three key releases in subsequent two weeks of February

Mert Mumtaz, CEO of Solana-based infrastructure agency Helius, has confirmed that three main Solana protocol releases are scheduled to launch over the subsequent two weeks in February.

In a brand new submit on X, Mumtaz detailed what to anticipate, with privateness, predictions and perpetual futures as areas the rollouts will contact. Apparently, the Helius CEO additionally hinted at “one small shock.”

Referred to solely as a “small shock,” the teaser might relate to the Web Capital Markets pattern that gained traction on Solana final yr, significantly with Consider, beforehand generally known as Launchcoin, on the forefront. That narrative facilities on tokenized fundraising and on-chain capital formation native to Solana’s ecosystem.

This roadmap comes amid a surge in Solana ecosystem developer exercise and builds on earlier expectations from Delphi Digital, which labeled 2026 as a breakout yr for Solana.

The three main initiatives driving the ecosystem embody:

- Alpenglow: A whole consensus overhaul introducing Votor and Rotor, Solana’s most vital protocol improve to this point.

- Firedancer: A performance-enhancing validator shopper by Bounce, designed to course of hundreds of thousands of transactions per second with deterministic latency.

- DoubleZero: A high-speed fiber-optic validator community impressed by conventional monetary change infrastructure.

SOL itself has struggled to carry the $100 mark in early 2026 however continues to be considered because the main layer-1 blockchain play outdoors Ethereum as a consequence of its rising DePIN and DeFi sectors.

What to anticipate: XRP, BTC value outlook

The subsequent 48 hours are outlined by macro with CPI on the forefront. A lower-than-expected inflation print would seemingly revive threat urge for food and reintroduce upside makes an attempt throughout majors like Bitcoin and XRP. The next studying may reinforce the repricing of price cuts towards the second half of the yr and stress altcoins testing resistance.

Key ranges to look at:

- Bitcoin: $60,000 structural assist, $74,000 near-term resistance.

- XRP: $1.2 short-term assist, $1.48 essential resistance.

The March 4 Fed determination, with 3.75% anticipated to carry, stays a secondary however vital marker. Based on UBS, easing inflation ought to preserve the Consumed observe for 2 cuts later in 2026, doubtlessly in June and September. Markets presently value the primary transfer in July.

For now, crypto sits in anticipation mode. XRP is trying to reclaim misplaced floor forward of resistance, Binance has formalized a $1 billion Bitcoin reserve with an embedded rebalance rule and Solana’s ecosystem prepares tangible protocol upgrades.

Friday’s CPI will decide whether or not these tales evolve into renewed upside enlargement or resolve into one other defensive rotation.