- $60K is a key Bitcoin help strengthened by the 200-week shifting common and heavy choices positioning.

- $1.24B in put choices sit under $60K, with the following main cluster close to $50K.

- Rising open curiosity and macro uncertainty make the present construction fragile for bulls.

Bitcoin is hovering close to a degree that feels much less like help and extra like a stress plate.

Volatility hasn’t gone away. If something, it’s been simmering simply beneath the floor, weighing on sentiment and making merchants further delicate to each pink candle. Proper now, all eyes are locked on one quantity: $60,000. Bulls actually can’t afford to lose it. As a result of if that degree cracks, the liquidity sitting beneath may get swept quick — and restoration makes an attempt would immediately look loads more durable.

Why $60K Is the Line within the Sand

Analysts are calling $60K a possible liquidation set off zone. It’s not simply psychological. There’s actual construction behind it.

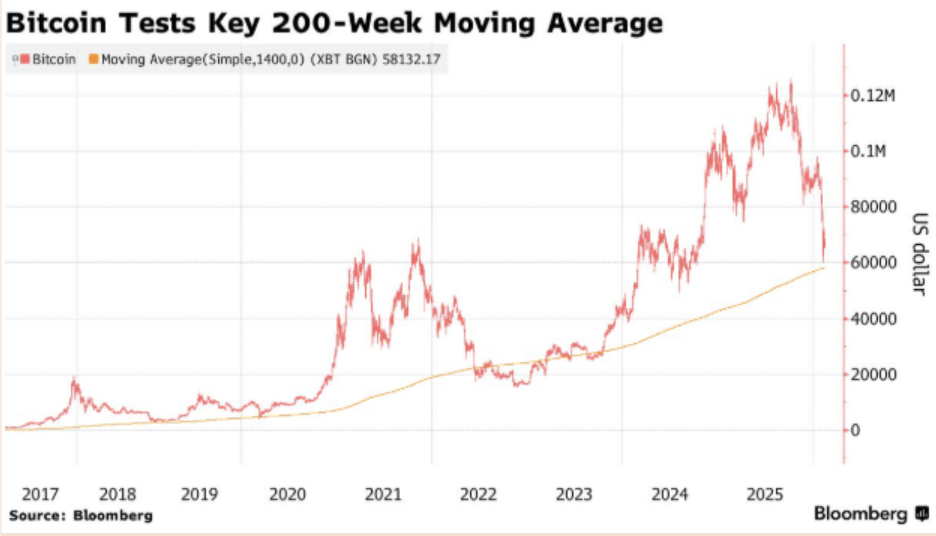

From a technical standpoint, Bitcoin’s 200-week shifting common is hovering close to that space. Traditionally, when BTC holds above the 200-week MA, the broader uptrend stays intact. Lose it, and the tone shifts. Not immediately catastrophic, however sufficient to shake confidence. Bulls begin second-guessing.

And the derivatives knowledge provides one other layer.

Deribit exhibits the most important focus of put choices sitting under $60K, totaling roughly $1.24 billion. Meaning an enormous variety of merchants are positioned for a break decrease. If BTC slices by way of $60K cleanly, the following main put cluster sits nearer to $50K. That’s not a small hole.

So structurally, $60K isn’t simply help. It’s a cliff edge with lots of leverage hanging off it.

Choices Stacking and Open Curiosity Are Elevating the Stakes

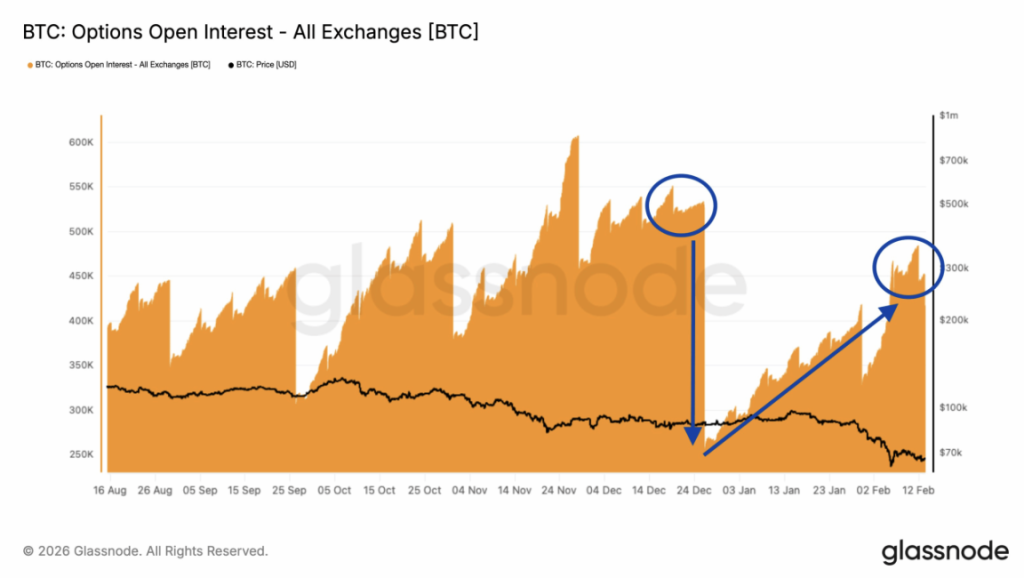

Glassnode knowledge reveals Bitcoin choices open curiosity has surged again towards late This autumn 2025 highs. It now sits round 452,000 BTC, up from 255,000 BTC. That’s a 77% improve in positioning.

When open curiosity rises like that, it tells you merchants are loading up. The issue is, they’re not all leaning the identical path. And when positioning will get crowded close to a key degree, volatility tends to spike.

Proper now, market-implied likelihood suggests solely about 15% confidence that BTC will maintain above $60K. Meaning 85% of merchants are leaning towards a breakdown situation. Whether or not that’s sensible positioning or herd mentality… we’ll discover out quickly sufficient.

However when expectations get this lopsided, even a small transfer can set off a series response.

Macro Uncertainty Isn’t Serving to

As if the choices stress wasn’t sufficient, macro uncertainty is creeping again in.

The U.S. Supreme Court docket is about to rule on February 20 relating to President Donald Trump’s tariff case, and merchants don’t like not realizing. Coverage shifts tied to commerce or tariffs can ripple into equities, greenback power, yields — and finally crypto. It doesn’t even should be dramatic. Simply unsure.

In the meantime, sentiment throughout crypto stays heavy. It’s the sort of surroundings the place small drops really feel greater than they’re. Liquidity is thinner. Conviction is weaker. One sharp transfer may shortly snowball into capitulation.

Fragile Construction, Binary Consequence

Put all of it collectively and the setup appears to be like fragile.

Large put positioning under $60K. Elevated open curiosity. A key long-term shifting common sitting proper on the edge. And macro FUD quietly constructing within the background.

If Bitcoin holds $60K and patrons step in aggressively, it may lure lots of bearish bets and gas a pointy aid rally. But when it breaks — decisively, with quantity — the trail towards $50K may open shortly, as a result of that’s the place the following liquidity pocket sits.

Proper now, the market is leaning bearish. The 85% likelihood crowd thinks the extent gained’t maintain.

However in crypto, crowded expectations typically create the alternative end result.

Both method, $60K isn’t simply one other quantity on the chart. It’s the extent that decides whether or not that is consolidation… or the beginning of one thing deeper.

Disclaimer: BlockNews gives unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.