- Ethereum is buying and selling close to $2,087 after reclaiming $2,000 however lacks sustained upside momentum.

- Whales bought 1.3M ETH, then rapidly purchased again 1.25M ETH, creating churn with out course.

- Lengthy-term holders have shifted from regular accumulation to modest distribution, signaling uncertainty.

Ethereum is attempting to stabilize, nevertheless it doesn’t look absolutely satisfied.

ETH is buying and selling round $2,087 after reclaiming the $2,000 stage, which on paper sounds constructive. However the follow-through simply isn’t there. Each try and construct upside momentum appears to stall earlier than it actually will get going, and that hesitation isn’t nearly resistance ranges. It’s about who’s shopping for — and who isn’t.

Whales Promote Massive… Then Reverse Simply as Quick

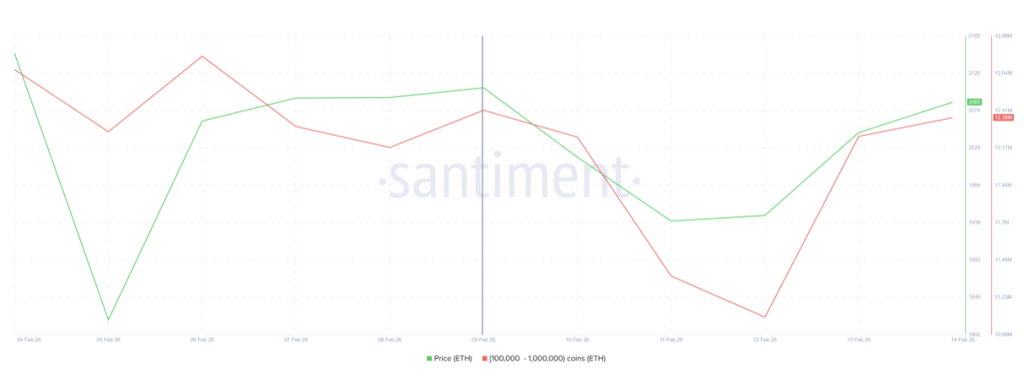

Whales, particularly these holding between 100,000 and 1 million ETH, are likely to form the tone of the market. And not too long ago, they’ve been something however constant.

Between February 9 and February 12, this cohort offloaded roughly 1.3 million ETH, which interprets to round $2.7 billion in worth. That’s not small. Strikes of that measurement shift liquidity and sentiment nearly immediately.

However then, throughout the subsequent 48 hours, the identical group reportedly purchased again about 1.25 million ETH. Almost $2.6 billion in recent shopping for. So the online impact? An enormous churn of capital, however and not using a clear course.

That form of back-and-forth creates liquidity. It creates volatility. What it doesn’t create is development.

And that’s precisely the place Ethereum is caught — transferring, however not progressing.

Lengthy-Time period Holders Are Shedding Conviction

If whale exercise seems to be indecisive, the long-term holders aren’t precisely providing readability both.

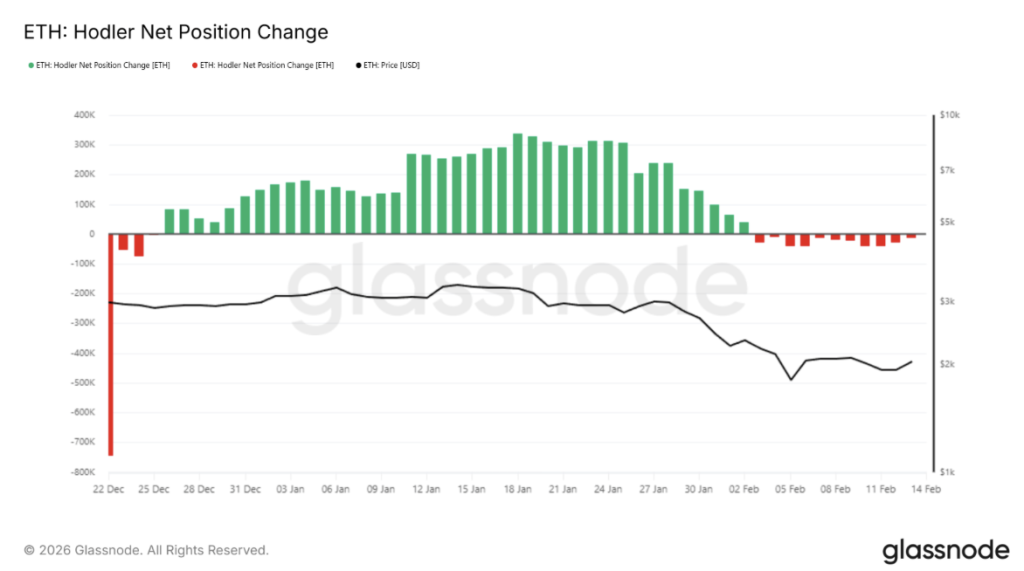

The HODLer web place change metric reveals that since late December 2025, long-term holders had been steadily accumulating ETH. That regular accumulation normally acts like a quiet ground underneath worth. It’s not flashy, nevertheless it’s stabilizing.

Then February hit, and one thing shifted.

Accumulation slowed. Then modest distribution started. Not aggressive dumping — nothing dramatic — however sufficient to counsel conviction is softening. When long-term holders begin trimming as a substitute of stacking, it sends a refined sign: uncertainty is creeping in.

And markets don’t rally cleanly when conviction fades.

Ethereum Is Holding $2,000… Barely

Technically, reclaiming $2,000 issues. It’s a psychological and structural stage, and Ethereum is presently holding above it.

However the subsequent key resistance sits round $2,241. To push by way of that zone convincingly, ETH would wish clear, sustained accumulation from whales and long-term holders. Proper now, that alignment simply isn’t there.

So consolidation turns into the default situation.

Ethereum could proceed hovering round $2,000, defending assist close to $1,902 whereas failing to decisively break upward. Sideways motion can last more than most merchants count on, particularly when each consumers and sellers appear uncertain.

It’s not bearish collapse. It’s indecision. And indecision could be exhausting.

What Would Flip the Script?

For Ethereum to interrupt out meaningfully, the dominant cohorts have to lean in the identical course.

If whales return to regular accumulation and long-term holders resume web optimistic positioning, ETH might push by way of $2,241 and intention for $2,395. Past that, $2,500 turns into the true inflection level. Clearing $2,500 with power would invalidate the present bearish hesitation and make sure a stronger restoration development.

Till then, Ethereum stays caught in a liquidity churn zone.

It’s not breaking down. Nevertheless it’s not breaking out both. And when the most important gamers can’t determine, worth normally drifts… proper within the center.

Disclaimer: BlockNews gives unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.