The cryptocurrency market is booming, and its progress reveals no indicators of slowing down. Despite the fact that there may be a whole lot of pleasure, many individuals are nonetheless questioning about the perfect time to get entangled, one of the best ways to method it and how one can put together. Richard Teng, a CEO at Binance, has shared his ideas, providing a unique tackle the hype.

Lengthy story quick, Teng is satisfied it’s higher to plan forward than to behave on impulse proper now. His suggestion is straightforward: do your homework earlier than you leap in. He says you will need to perceive the market’s particulars and to assume long run if you end up contemplating investing. If you’re tempted by fast good points, he suggests you proceed with warning and cautious planning.

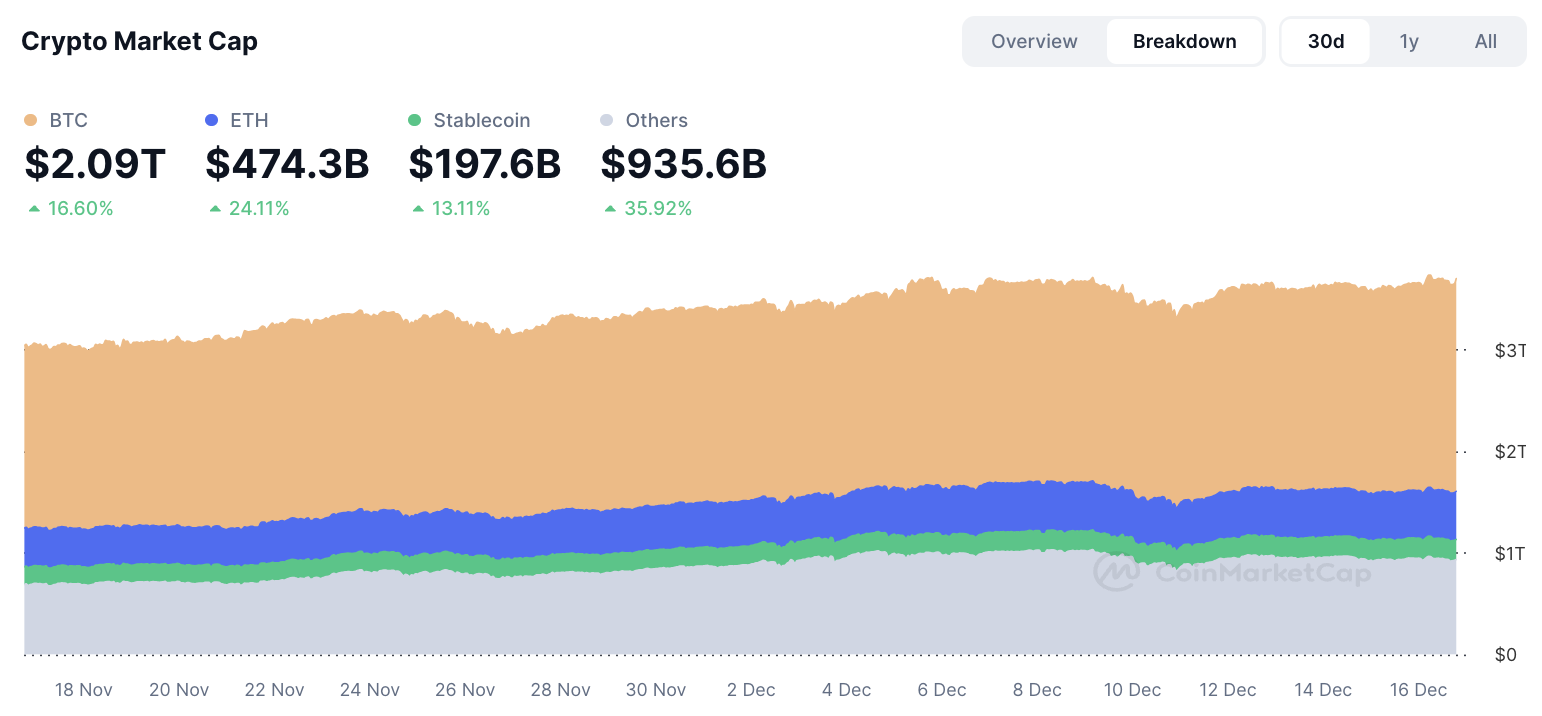

The numbers inform a fairly spectacular story. In simply two months, the cryptocurrency market cap — measured by the TOTAL index — has seen a 58% surge, reaching an all-time excessive of $3.68 trillion.

Altcoins, which exclude Bitcoin (BTC) and Ethereum (ETH), have performed particularly effectively, with their mixed market cap rising 92.41% to $1.16 trillion. Even Bitcoin itself not too long ago reached an unprecedented $106,648. These figures present how shortly the sector is rising and the way engaging it’s to traders, each new and skilled.

Binance working numbers as FOMO kicks in

Binance performs a completely essential position on this ecosystem. As the primary crypto change to surpass $100 trillion in lifetime buying and selling volumes earlier this yr, it’s clear that it has a major affect. With practically 250 million customers, $182 billion in complete belongings and $26.6 million in day by day buying and selling quantity, the platform has an enormous attain.

These achievements present not solely how huge Binance is by way of operations but additionally that increasingly individuals all over the world are inquisitive about digital belongings.

Teng’s insights are reminder that speedy market progress and rising valuations include their very own dangers. His recommendation to assume forward, not simply react to market developments, displays a broader philosophy of taking a thought-about method.