- XRP dropped 9% to round $1.50, with restoration momentum slowing as hypothesis rises.

- Lengthy-term fundamentals stay robust, with XRP holders hitting a brand new all-time excessive of 507,110 and SBI reaffirming its Ripple stake.

- Perpetual shorts dominate near-term motion, with $13.5M in bull liquidations and key ranges at $1.67 upside and $1.11 draw back.

XRP simply posted one of many sharpest drops among the many prime 5 cryptocurrencies, sliding roughly 9% up to now 24 hours. On the time of writing, the token is buying and selling close to $1.50, and the temper round it feels a bit of uneasy. Not as a result of XRP’s story is out of the blue damaged, however as a result of the short-term market is leaning closely towards hypothesis, and the momentum that might assist a clear restoration is beginning to gradual.

It’s the form of setup the place fundamentals look regular, however value nonetheless will get pushed round by leverage. And proper now, leverage is doing a lot of the speaking.

Fundamentals Nonetheless Look Strong, Even With the Value Injury

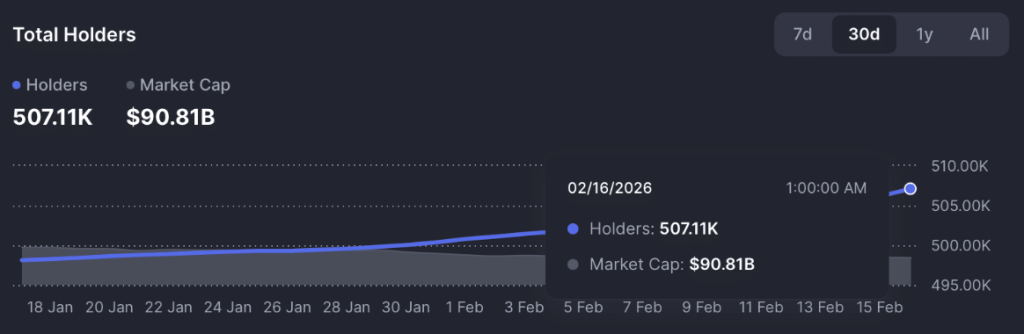

For all of the weak point on the chart, XRP’s fundamentals haven’t collapsed. If something, the on-chain holder knowledge paints a surprisingly constructive image. In line with CoinMarketCap, the full variety of XRP holders reached 507,110 on February 16, marking a brand new all-time excessive.

That’s not what you anticipate to see if confidence is actually evaporating.

Over the previous seven months, XRP continues to be down about 58.9% from its all-time excessive of $3.66. But the holder base retains rising, which suggests long-term buyers are nonetheless stepping in, even whereas short-term merchants are getting chopped up. This sort of regular accumulation throughout fragile market situations tends to construct a stronger base beneath value, particularly as soon as broader sentiment stabilizes.

It’s not a assure of an instantaneous rebound, nevertheless it does sign that XRP nonetheless has dedicated consumers. Quiet ones.

SBI’s Ripple Stake Reinforces Institutional Confidence

Institutional assist hasn’t disappeared both. In a put up on X, the chairman and president of SBI Holdings Inc., one in all Japan’s main monetary conglomerates, reaffirmed that SBI maintains a 9% stake in Ripple Labs, the corporate behind XRP.

He went additional than that, too. He emphasised that Ripple’s complete valuation, together with the ecosystem Ripple has constructed, can be “monumental,” and identified that SBI owns greater than 9% of that.

That form of assertion issues as a result of it indicators long-term conviction from a critical establishment. This isn’t retail hopium. It’s a strategic stake being held by means of volatility, which reinforces the concept XRP nonetheless has deep-pocketed believers behind the scenes.

Perpetual Merchants Are the Actual Cause XRP Is Bleeding

So if fundamentals look robust, why is XRP getting hit this tough?

The reply is fairly easy: derivatives.

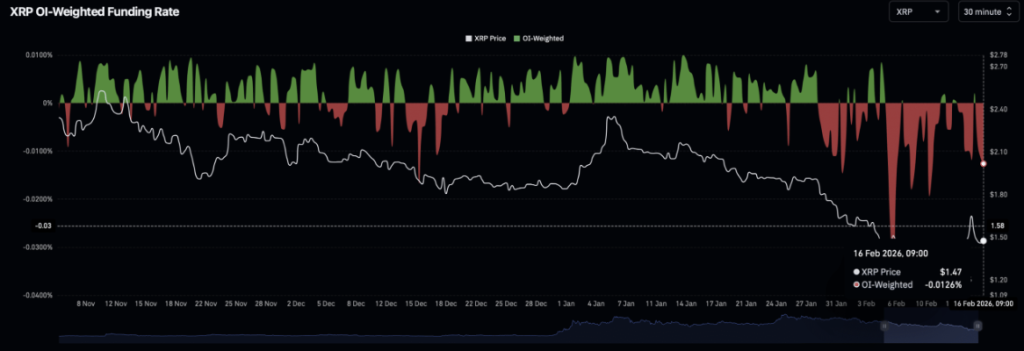

XRP’s underperformance seems to be pushed primarily by perpetual market exercise, the place brief sellers have been aggressively positioning for draw back. As value dropped, that brief strain triggered roughly $13.5 million in liquidations amongst bullish merchants, in response to CoinGlass. That liquidation wave provides gasoline to the draw back, as a result of pressured closes flip into market sells, and the cycle feeds itself.

CoinGlass knowledge additionally exhibits a pointy contraction in capital. XRP’s perpetual market noticed about $245.7 million go away as value declined, with Open Curiosity now sitting close to $2.6 billion. That drop suggests merchants are both decreasing danger or getting pressured out, whereas brief positioning continues to construct.

The Open Curiosity-weighted funding charge fell to round 0.0101%, which signifies bearish positions are at present dominating. And when perpetual merchants dominate the move, spot value usually follows, even when long-term buyers are nonetheless accumulating within the background.

XRP’s Subsequent Transfer Comes Right down to a Few Key Ranges

From a chart perspective, XRP isn’t giving a clear bullish or bearish affirmation but. It’s in that awkward center zone the place the subsequent transfer goes to outline the course.

If bearish strain stays energetic, XRP may drift down to check the decrease demand zone proven on the chart earlier than making an attempt any transfer towards the descending resistance line. If consumers regain momentum, the primary upside goal is the latest wick low round $1.67, which fashioned on February 15 and now acts as a near-term restoration marker.

But when promoting continues and XRP breaks beneath the descending channel, the draw back opens towards $1.11. That will seemingly shift sentiment sharply and will set off one other spherical of leverage unwinds.

On the larger image, XRP stays caught inside a descending channel. That does replicate ongoing promoting strain, nevertheless it’s value noting that descending channels are sometimes considered as bullish reversal buildings as soon as value breaks above the higher resistance. Till that breakout occurs, although, the market stays susceptible to leverage-driven swings.

Proper now, XRP is mainly caught between two forces. Lengthy-term accumulation continues to be constructing. However short-term derivatives merchants are controlling the tape, they usually’re leaning bearish.

Disclaimer: BlockNews gives impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.