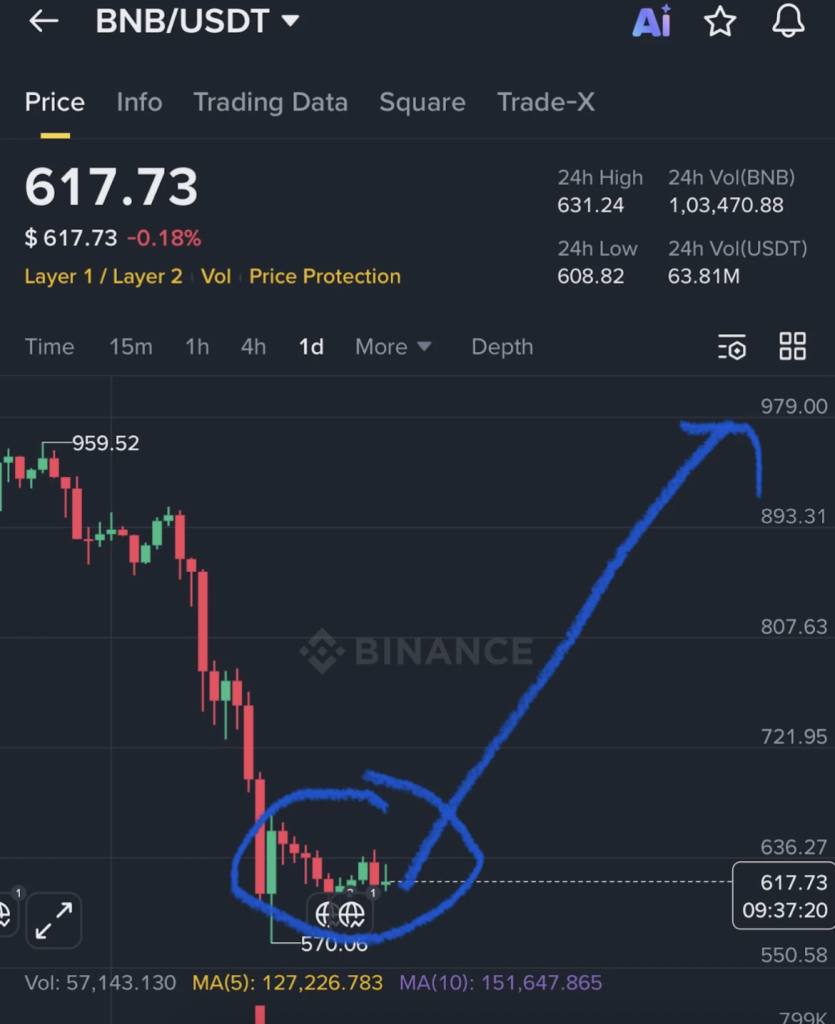

- BNB is stabilizing inside a key $550–$650 help band that analysts view as a possible reversal zone.

- Worth dropped from $750 to $587 and is now consolidating close to the $608–$598 Fibonacci help pocket.

- MACD and RSI stay mildly bearish, however weakening histogram strain suggests sellers could also be dropping momentum.

BNB is perhaps getting near a type of turning factors merchants love to identify early, the type the place value stops bleeding and begins constructing a base. On Monday, February 16, crypto analyst Crypto GVR urged that Binance’s native token may very well be discovering robust help within the $550 to $650 area, a zone that will find yourself appearing like a reversal flooring if consumers hold defending it.

The bullish argument isn’t solely technical both. Supporters level to constructive community developments, rising adoption, and bettering sentiment as causes BNB may regain energy over the approaching months. Nonetheless, it’s crypto, so nothing comes with ensures. The chart wants to verify the story, not simply trace at it.

BNB Bulls Are Watching the $550–$650 Assist Band

In line with Crypto GVR’s view, if BNB holds this help vary, the token may finally rally towards $1,200 to $1,500 inside a 3 to six month window. That’s an aggressive projection, and it’s clearly primarily based on the idea that the broader market stabilizes and BNB regains development energy.

For merchants, this setup turns into much less about “calling the highest” and extra about watching affirmation alerts. Quantity, key resistance breaks, and momentum indicators will matter excess of a single tweet or goal vary.

As a result of in a market this risky, the one factor worse than lacking a rally is getting chopped up within the fakeout earlier than it.

BNB Is Consolidating After a Sharp Drop From $750

TradingView knowledge exhibits BNB fell quickly from round $750 right down to roughly $587 earlier than bouncing again into the $610 to $630 zone. That type of drop often leaves behind a messy chart, the place value has to digest the transfer earlier than any actual development can rebuild.

Fibonacci retracement ranges spotlight a number of key zones merchants are monitoring:

- 0.236 close to $629

- 0.382 close to $621

- 0.618 close to $608

- 0.786 close to $598

Proper now, the 0.618 to 0.786 vary is appearing as a vital help pocket after the bounce. It’s principally the realm the place bulls want to carry the road if the rebound goes to stay credible.

If value loses that area, the chart begins opening up draw back extension ranges. Fibonacci extensions counsel potential targets round $553, $498, $443, and even $410 if help absolutely breaks. These are usually not predictions, however they’re the “map” merchants use when momentum turns bearish once more.

On the upside, the realm round $629 has already proven resistance, with value struggling to push by cleanly. That degree is now a near-term barrier bulls have to reclaim.

Momentum Indicators Counsel Promoting Strain Is Easing

Momentum indicators aren’t absolutely bullish but, however they’re beginning to soften. The MACD nonetheless exhibits the blue MACD line under the orange sign line, and each stay underneath the zero degree. That confirms bearish momentum continues to be technically dominant.

Nevertheless, the histogram bars have been printing smaller, which often means the promoting strain is fading. It’s not a reversal sign by itself, however it’s usually what occurs earlier than the market flips. The truth that each strains are converging close to the zero degree suggests a crossover may type quickly if shopping for continues.

The RSI is sitting round 43.50, nonetheless under the impartial 50 threshold. That factors to gentle bearish circumstances, however it’s not deeply oversold both. Mixed with the slight bounce in value, it hints that sellers are dropping management, even when bulls haven’t absolutely taken over but.

BNB Is in a “Watch for Affirmation” Section

Proper now, BNB appears to be like prefer it’s consolidating after a heavy drawdown, with merchants watching the 0.618 to 0.786 retracement zone for indicators of stability. If that help holds and value can reclaim resistance close to $629, the bullish reversal narrative begins to strengthen.

If it fails, draw back extension ranges come again into play shortly.

BNB shouldn’t be in breakout mode but. But it surely’s additionally not in freefall anymore, and that’s often step one towards an actual development shift. The subsequent few periods will probably resolve whether or not that is the beginning of a bigger restoration, or simply one other pause earlier than the market assessments decrease help.

Disclaimer: BlockNews gives unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.