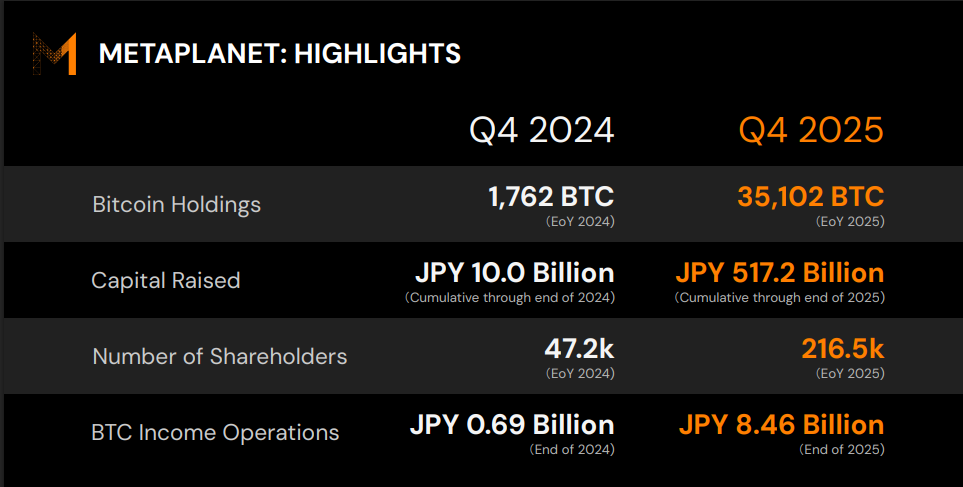

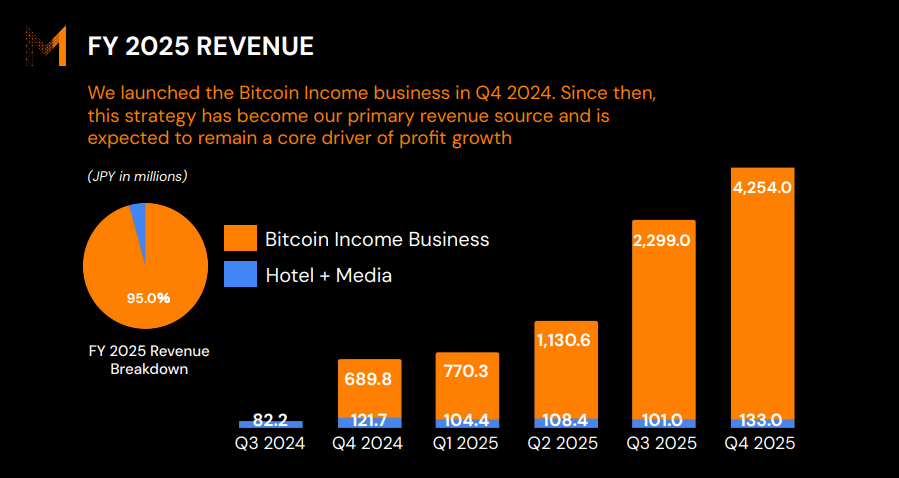

Metaplanet posted a dramatic swing in its newest outcomes after shifting a lot of its enterprise towards Bitcoin. Income surged by over 700% year-on-year to shut to ¥9 billion (about $58 million), a soar the corporate ties to revenue from BTC choices and associated providers. The change was fast — the agency solely launched its Bitcoin revenue operations late in 2024 — and now these actions make up nearly the whole high line.

Income And Enterprise Shift

In response to the fiscal 2025 submitting, roughly 95% of income was tied to Bitcoin-related operations. Premiums from choices writing and charges from buying and selling merchandise accounted for the majority of that money movement.

おはプラネット。最近の株価動向を踏まえ、株主の皆さまにとって厳しい状況が続いていることは、私たちも十分に認識しています。しかしながら、メタプラネットの戦略に変更はありません。私たちは引き続き、ビットコインの積み上げ、収益の拡大、そして次の成長フェーズに向けた準備を、着実に進めてい…

— Simon Gerovich (@gerovich) February 6, 2026

Conventional strains reminiscent of resort and media work had been changed by the crypto arm. That transfer translated rapidly into gross sales, nevertheless it additionally concentrated the corporate’s fortunes round one risky asset.

CEO Reaffirms Lengthy-Time period Treasury Plan

Simon Gerovich has reiterated that their technique will stay in place regardless of the current market stoop. He posted that there shall be no change in course, and that accumulation will proceed. That public dedication issues for continuity, nevertheless it doesn’t take away the accounting and market dangers.

Supply: Metaplanet

The Numbers Behind The Headlines

Metaplanet’s working revenue was constructive, at about ¥6.28 billion (near $40 million). Reviews word the corporate nonetheless recorded a web loss almost $620 million after a valuation hit on its Bitcoin holdings.

A drop in market worth of greater than $660 million worn out many of the working acquire when fair-value accounting was utilized. Capital markets had been tapped closely: the agency has raised over $3 billion since switching to the treasury mannequin.

Supply: Metaplanet

Accounting Losses Versus Working Power

That hole between working revenue and web loss is a transparent instance of how accounting guidelines work together with risky belongings. Features from choice premiums had been earned and reported. On the identical time, unrealized losses on the coin stash needed to be proven on the steadiness sheet, pushing the underside line into the purple.

Bitcoin Worth Motion

In the midst of this story sits the market itself. Bitcoin’s swings have pushed a lot of Metaplanet’s 12 months. Costs fell sharply in the course of the broader selloff and checked the corporate’s valuation, whereas intervals of calmer buying and selling allowed the choice enterprise to generate regular revenue.

Merchants pointed to headline danger and total risk-off strikes when the market slid, and that stress fed into the corporate’s monetary statements.

Holdings And Technique

Reviews say holdings rose from about 1,762 BTC on the finish of 2024 to roughly 35,102 BTC by the shut of 2025, making Metaplanet certainly one of Japan’s largest company Bitcoin holders.

The corporate describes the plan as a long-term treasury strategy: purchase and hold Bitcoin to protect towards fiat dilution and to seize potential long-term appreciation. That’s an express wager on future returns offset by short-term volatility.

Featured picture from Unsplash, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our workforce of high expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.