As greenback dominance is questioned, Arch sees Bitcoin aligned with a multipolar financial shift.

World leaders are starting to query the monetary system that has existed for the previous eighty years. Distinguished investor Ray Dalio stated the post-war world order has damaged down. And this displays broader concern in international markets, based on the investor. An Arch report argues that Bitcoin holders could not be early to a fringe concept however positioned for structural change.

International Energy Shift Brings Bitcoin Again Into Focus, Arch Report Says

U.S. Secretary of State Marco Rubio spoke at Munich with a firmer tone on international politics. He famous that the U.S. desires allies with a assured id and shared pursuits. In the meantime, investor Ray Dalio stated the post-1945 world order has come to an finish.

We don’t need allies shackled by guilt and disgrace.

We would like allies who’re pleased with their tradition and heritage and are prepared to assist us defend it. pic.twitter.com/IOKg9n1UNM

— Secretary Marco Rubio (@SecRubio) February 14, 2026

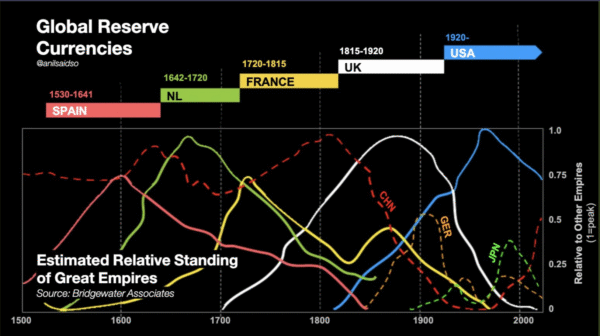

Arch frames these statements as affirmation of a deeper shift already in movement. Financial techniques, it argues, don’t final without end. Gold requirements gave strategy to Bretton Woods. Bretton Woods gave strategy to the petrodollar period. Every shift appeared chaotic in actual time and apparent in hindsight.

Rising deficits are pressuring main economies, whereas central banks have little room left after years of low charges and bond shopping for. Extra so, coverage instruments as soon as seen as dependable carry unwanted side effects and shrinking influence. On the similar time, forex techniques are getting used as strategic instruments in international disputes.

In opposition to that backdrop, Arch focuses on Bitcoin’s design as a substitute of its value. Bitcoin runs exterior any single nation or alliance. No central financial institution can enhance its provide, and no international authorities can shut down its community. Whereas these options as soon as sounded ideological, they now seem sensible.

Arch argues {that a} new financial section favors property with particular traits:

- Portability throughout borders with out reliance on banks.

- Mounted provide that can not be altered by coverage choices.

- Direct settlement between events with out intermediaries.

- Political neutrality not tied to at least one nation’s agenda.

Gold Faces Digital Limits as Bitcoin Positive aspects Lengthy-Time period Enchantment

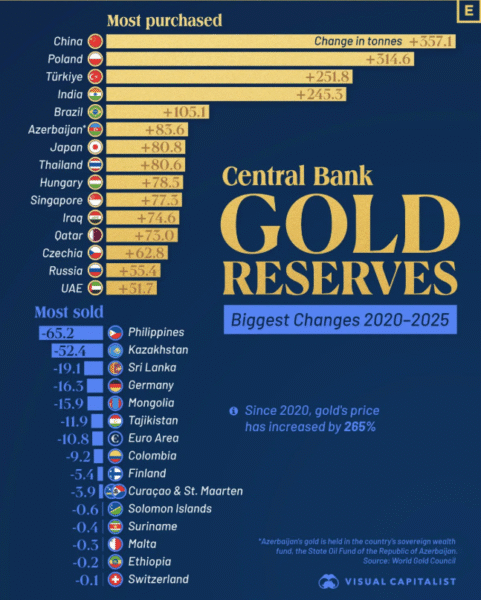

Gold nonetheless performs a task in occasions like this, and central financial institution shopping for has elevated in recent times. Notably, China and Poland are among the many lively consumers of the metallic. That development exhibits a shift away from relying solely on greenback reserves.

Picture Supply: X/Mining

Nevertheless, gold has limits in a digital financial system. Shifting giant quantities is expensive and sluggish, verifying purity takes time, and it can’t be despatched throughout continents in seconds.

In distinction, Bitcoin can transfer globally inside minutes. Much more, community guidelines implement shortage via code relatively than political promise. Holders can retailer worth with out counting on a single custodian.

For long-term traders, the query shifts away from short-term value targets. Focus turns to the place worth can sit past political attain.

Arch Says Financial System Faces Lengthy-Time period Pressure Regardless of Crypto Volatility

Bitcoin stays a risky asset, with costs susceptible to sharp swings as regulation shifts and market sentiment modifications. The truth is, intervals of geopolitical change have a tendency to extend that instability.

Nevertheless, Arch attracts a transparent line between short-term value volatility and deeper systemic danger. Whereas Bitcoin’s value can fluctuate extensively, the present financial system is going through longer-term structural stress.

The U.S. greenback was as soon as seen because the clear and lasting international reserve forex. Nevertheless, that view is now being questioned. Nations are treating alliances extra like strategic offers than long-term partnerships.

Picture Supply: X/Arch

As well as, monetary techniques are additionally getting used extra usually as instruments of international coverage. These shifts level to a extra divided international system with competing financial blocs.

Arch famous {that a} altering world order doesn’t assure Bitcoin will succeed. Different applied sciences, regulation, and market cycles will affect what occurs subsequent. Nevertheless, Arch argues that an asset not managed by any single counterparty is best suited to a multipolar world.