- The Fed is shopping for $16B in Treasury payments by means of two operations

- Contemporary reserves ease funding situations even when coverage stays “tight”

- Liquidity shifts usually ripple into equities and crypto markets

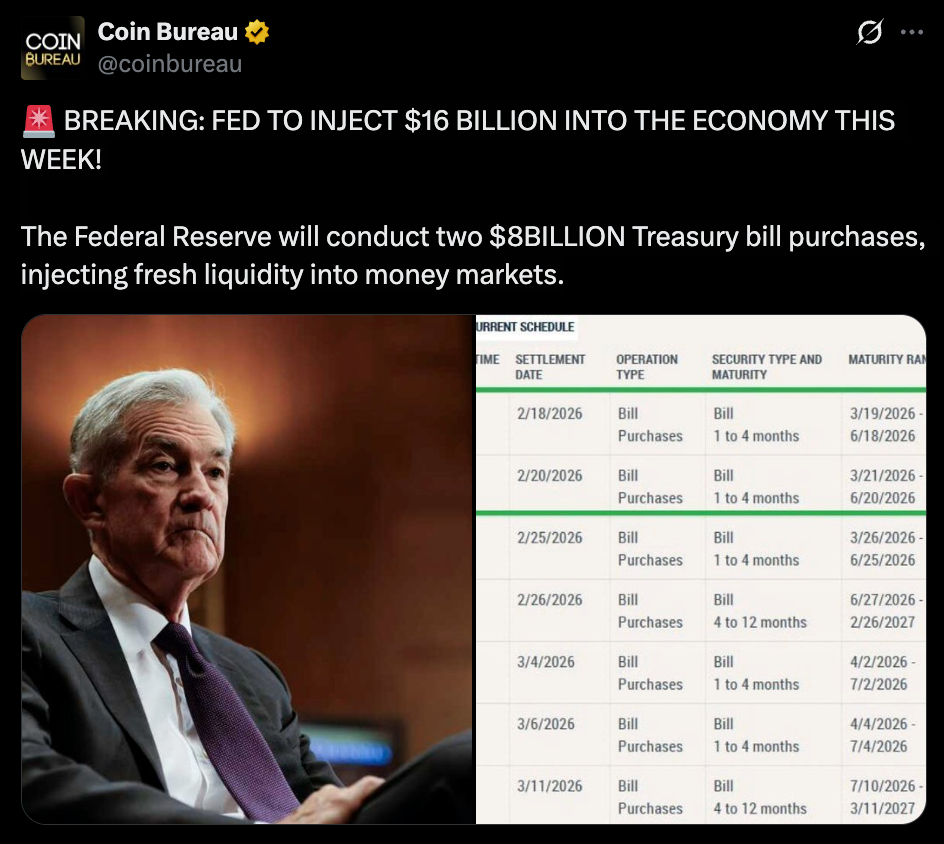

When the Federal Reserve steps in with $16 billion in Treasury invoice purchases, describing it as routine misses what truly issues. Two separate $8 billion operations imply actual {dollars} getting into the system this week. Not ahead steerage. Not projections on a dot plot. Precise liquidity transferring into cash markets in actual time.

In an atmosphere the place officers hold repeating that monetary situations stay restrictive, this sort of motion feels contradictory. You possibly can body it as commonplace steadiness sheet administration, positive, however reserves nonetheless enhance. And when reserves enhance, the system feels it.

How Treasury Invoice Purchases Change the Plumbing

Treasury invoice shopping for is without doubt one of the cleanest instruments the Fed has to affect liquidity. The central financial institution purchases short-term authorities paper, financial institution reserves rise, and strain in funding markets tends to ease. Repo charges soften. Quick-term borrowing will get a bit extra comfy. The pipes unclog, even when solely barely.

You possibly can debate the Fed’s intention all day lengthy. Was it technical? Was it seasonal? Was it precautionary? However the mechanical impact stays the identical. Extra reserves within the system imply much less quick funding stress, and merchants have a tendency to note that earlier than economists do.

Why Crypto and Threat Property Care About Circulate

Liquidity strikes first. Threat property often reply after. When extra money builds within the system, it doesn’t simply sit idle eternally. It appears to be like for yield, momentum, or alternative. Typically which means equities. Typically it’s credit score. And more and more, it’s crypto.

This doesn’t imply Bitcoin or altcoins all of the sudden explode increased the following morning. Markets not often transfer in straight traces. However rising liquidity usually reduces draw back strain and offers rallies gasoline as an alternative of friction. Circulate issues greater than speeches, and markets commerce on stream.

The Sample Markets Hold Seeing

Officers proceed to emphasize that coverage stays tight and that inflation dangers are nonetheless being managed. But small injections like this hold showing. Quiet invoice purchases right here. Refined steadiness sheet changes there. Individually they might look minor. Collectively, they begin to inform a unique story.

Sixteen billion {dollars} just isn’t trivial. It’s a reminder that liquidity nonetheless underpins the system, even when rhetoric suggests restraint. You possibly can ignore that if you would like. Markets virtually by no means do.

Disclaimer: BlockNews offers unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.