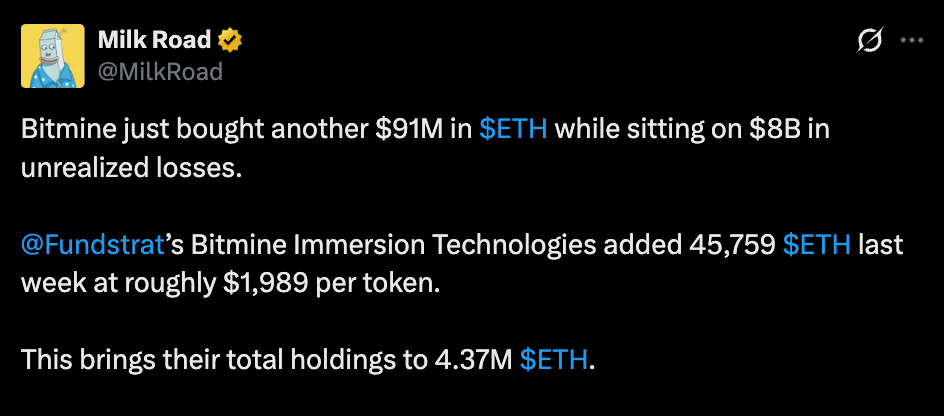

- BitMine holds 4.37M ETH and stakes over 3.04M of it for yield

- Annualized staking income is ~$176M, with a path towards ~$252M through MAVAN

- The technique is much less about ETH value and extra about crypto infrastructure money move

Holding 4.37 million ETH is already aggressive by any company commonplace. However staking greater than 3 million of that stack pushes BitMine Immersion Applied sciences into a very totally different class. This isn’t an organization sitting on tokens and praying for a rebound. It’s a agency actively treating Ethereum like a steadiness sheet engine, the type that quietly produces income whereas everybody else argues about charts.

At present charges, BitMine is already producing roughly $176 million yearly in staking income. And in line with its personal projections, that determine may climb towards $252 million per 12 months as soon as MAVAN is absolutely deployed. That’s not theoretical yield farming. That’s institutional-scale staking income, even with ETH nonetheless down arduous on the 12 months.

Ethereum Seems Much less Like a Commerce and Extra Like Productive Crypto Infrastructure

A lot of the market nonetheless talks about ETH as if it’s a tech inventory proxy, a high-beta commerce that rises and falls with sentiment. BitMine is treating it like infrastructure. Validators earn. Networks safe themselves. And money move exhibits up within the background, nearly boringly, whereas the headlines keep obsessive about value ranges.

Even with Ethereum down greater than 30% on the 12 months, the staking math retains working. That disconnect issues as a result of it forces a unique dialog. If ETH can generate significant income whereas value is weak, then ETH stops being only a speculative asset. It begins wanting like a productive one, and that adjustments how treasuries behave.

Volatility Isn’t a Bug, It’s A part of the Technique

Chairman Tom Lee is true about one factor: steadiness sheet swings are usually not a flaw right here, they’re constructed into the mannequin. BitMine is successfully working long-duration publicity to Ethereum’s relevance, whereas staking income cushions the trip. That could be a very totally different posture than merely shopping for ETH and hoping for upside.

Volatility turns into one thing the corporate absorbs reasonably than one thing it fears. Unrealized losses might look ugly in a drawdown, positive, however staking income retains compounding within the background. And when markets ultimately shift, the treasury doesn’t simply rebound on value. It rebounds with a bigger, yield-producing base.

Company Crypto Is Beginning to Look Like a Actual Asset Class

BitMine is not working like a miner within the conventional sense. Between ETH holdings, staking infrastructure, money positioning, and strategic fairness publicity, it’s working nearer to a digital asset holding firm. That is what company crypto appears like when it stops apologizing and begins appearing like an allocator.

The market continues to be adjusting to this idea. Bitcoin treasuries have been the primary wave. Ethereum treasuries is likely to be the following, and staking is what makes them structurally totally different. A BTC treasury is a shortage guess. An ETH treasury is shortage plus yield, and that combo hits otherwise.

BitMine Is Constructing Yield Whereas Markets Fixate on Drawdowns

Whereas merchants deal with ETH’s drawdowns and macro uncertainty, BitMine is constructing one thing extra sturdy. 4 million ETH producing actual income shouldn’t be a story. It’s a press release. Ethereum is not simply one thing you commerce when sentiment is scorching.

For some steadiness sheets, it already works, even within the chilly.

Disclaimer: BlockNews supplies impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.