- Dormant Bitcoin provide fears reshape value outlook as markets reprice future circulation danger from previous wallets.

- Energetic Bitcoin provide stagnation exhibits falling engagement and rising emotional fatigue amongst buyers.

- Quick-term holders face historic losses whereas massive redistribution avoids a full structural market crash.

Bitcoin is having a tough stretch. Since This fall 2025, BTC has underperformed each main asset class. Analysts at the moment are pointing to 2 key issues driving that lag: quantum computing dangers and dormant coin provide.

In the meantime, at press time, CoinGecko value knowledge exhibits Bitcoin buying and selling at $66,828.19, down 2.04% over the past 24 hours. The sell-off has many asking what is absolutely weighing available on the market.

Thousands and thousands of Misplaced Bitcoin Are Again within the Dialog

Analyst Ash Crypto lately flagged a priority that markets are quietly pricing in.

Roughly 3.5 to 4 million BTC mined in Bitcoin’s early years are thought of misplaced or completely dormant at this time. That determine represents almost 18% of Bitcoin’s whole provide. The key phrase, although, is “thought of.”

🚨ANOTHER REASON WHY BITCOIN IS DUMPING NON STOP.

Since This fall 2025, BTC has underperformed each main asset class. This has lots to do with quantum computing issues and misplaced cash.

Roughly 3.5–4 million BTC mined in Bitcoin’s early years are thought of misplaced or completely… pic.twitter.com/wVRLzl9HYG

— Ash Crypto (@AshCrypto) February 18, 2026

With quantum computing advancing, older wallets are getting contemporary consideration. Many early wallets have uncovered public keys, making them a theoretical goal. If even a portion of that dormant provide returned to circulation, ahead provide expectations would shift.

Ash Crypto famous that markets might already be discounting that danger at this time, which places downward stress on value.

Institutional Accumulation Has Not Been Sufficient

Right here is the place the numbers get fascinating. Since 2020, establishments, ETFs, and corporates have amassed between 2.5 and three million BTC. That vary sits proper alongside the dormant provide determine. Establishments have absorbed an enormous quantity of provide. But the overhang concern nonetheless lingers.

Ash Crypto identified that 13 to 14 million BTC have already moved throughout this cycle. That’s the largest on-chain redistribution ever recorded.

Regardless of that giant sell-side liquidity, Bitcoin didn’t crash structurally. So the market could also be overreacting to a theoretical future provide shock which will by no means really materialize.

On-Chain Exercise Is Slowing Down Quick

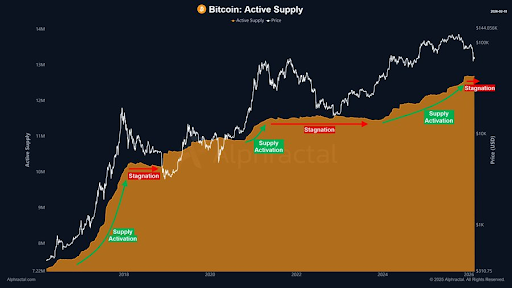

The provision concern is just not the one sign value watching. Alphractal, a crypto analytics account, famous that Bitcoin’s lively provide has stopped rising. Fewer cash are transferring. Community exercise has slowed noticeably.

Alphractal described it as social demotivation mirrored on-chain. Holders will not be transferring cash. Contributors are stepping again. The community is getting quieter.

Based on Alphractal, habits shifts earlier than narratives do. That silence on-chain could also be an early signal of deeper emotional fatigue throughout the market.

Quick-Time period Holders Are Sitting on Heavy Losses

On-chain analyst account OnChainMind added one other layer to the image.

Quick-term holders, those that have held Bitcoin for lower than 5 months, are sitting on deep unrealized losses. New investor profitability is close to a few of the lowest ranges in Bitcoin’s historical past.

OnChainMind famous that ache is excessive and capitulation might nonetheless come. Nonetheless, the analyst views this as a long-term accumulation alternative relatively than a purpose to exit.

The Bitcoin market is below critical stress.

Quick-term holders (<5 months) are in deep unrealised losses, with new investor profitability at a few of the lowest ranges of its whole historical past.

Ache is excessive, capitulation might come, however that is additionally the place my long-term… pic.twitter.com/LYmtnsRdh5

— On-Chain Thoughts (@OnChainMind) February 18, 2026

The broader takeaway throughout all three analysts is identical. Bitcoin is navigating a tough second the place theoretical dangers, weak sentiment, and holder losses are all compressing value on the identical time.